Read More »

GDP forecast, Philly Fed, Euro area headlines

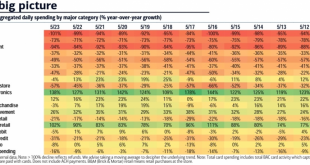

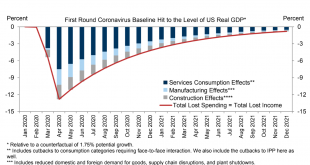

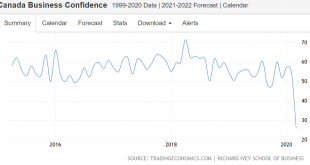

Income is what supports and ’causes’ sales. When income falls, sales in the first instance need deficit spending- spending that exceeds income- to grow employment/output from prior levels. The GDP forecasts include income/sales from public deficit spending as well as private sector deficit spending. The risk I see is private sector deficit spending falling short of the (implied) forecasts: The euro area is also at risk that total deficit spending will be insufficient....

Read More »Headlines, Chicago Fed, Gasoline consumption

Nothing good Friday’s headlines:

Read More »Home sales, PMI, Fed surveys, Claims, Hotels, Household incomes, GDP

Now that more data is out, looks like GDP will be down by over 1/3 for the quarter, as the negative labor supply shock continues. While fiscal policy works to support incomes and spending (GDP) obviously spending is still falling short, and with it private sector income (GDP=sales=income). This story doesn’t change much until people start returning to work which restores incomes, output, and spending. Until then business has to make due with that much less total spending....

Read More »Rig count, Mtg purchase index

Oil related capital expenditure has collapsed, and likely won’t come back until investors have confidence prices will stay high enough long enough: Mortgage applications for home purchases have bounced back a bit but remain depressed, even with ultra low mortgage rates:

Read More »ADP, Earnings, Vaccine odds

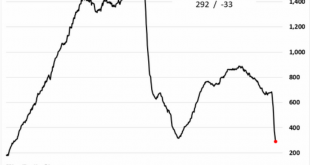

Down 50% and only about one month was due to the virus:

Read More »Unemployment Claims

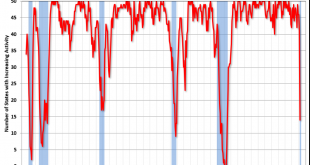

Unemployment claims had been historically low for quite a while because they had been made harder to get: The EPI survey estimated between 8.9 million and 13.9 million more Americans would have filed for claims over the past five weeks had the process been easier. “These findings on the millions of frustrated filers and the UI (unemployment insurance) system’s low payment rate highlight the need for policies to improve rather than hinder the UI application process,” the...

Read More »Philly Fed

More of same, won’t bore you with the rest:

Read More »Rails, oil

The stats continue to be all like this, or worse, so I won’t bore you with them: Like most other indicators, oil investment had been decelerating well before the virus hit:

Read More »Various charts

I haven’t been posting because all the charts look pretty much like this: h

Read More » Heterodox

Heterodox