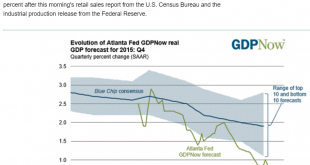

Revised up but for the worst reasons possible- unsold inventories were higher. Also, consumption expenditures were a bit lower, and note the deceleration of GDP growth on the chart. And in all likelihood Q1 GDP is now being reduced by inventory liquidation substituting for production: GDPHighlightsAn upward revision to inventory growth made for an upward revision to the second estimate of fourth-quarter GDP, to an annualized plus 1.0 percent rate for a 3 tenths increase from the initial...

Read More »Architectural Billings, JPM chart, GDP forecasts

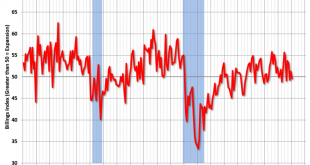

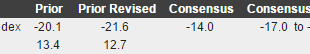

Down into contraction: From the AIA: Slight Contraction in Architecture Billings IndexFollowing a generally positive performance in 2015, the Architecture Billings Index has begun this year modestly dipping back into negative terrain. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the January ABI score was...

Read More »Philly Fed, leading indicators, jobless claims

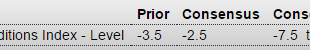

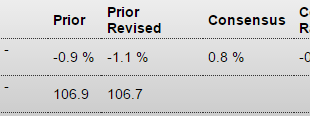

Another bad one, and supports the possibility of another downward revision to industrial production next month: Philadelphia Fed Business Outlook SurveyHighlightsThe Philly Fed report, much like Tuesday’s Empire State report, is pointing to continuing trouble for the nation’s factory sector. The general business conditions index came in at minus 2.8 to extend a long run of negative readings. New orders, at minus 5.3, have also been stuck in the minus column as have unfilled orders, at minus...

Read More »Personal income and spending, ISM manufacturing, construction spending

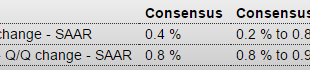

Spending still not good, and GDP *is* spending. Personal income growth remains low, but is higher than spending. I suspect this gets reconciled with downward revisions to income over time, perhaps due to downward revisions to employment. With GDP growth near flat employment growth implies more employees are being hired to produce the same levels of output, which sends up a red flag for downward revisions to employment. Personal Income and OutlaysHighlightsConsumers had a healthy December...

Read More »GDP, Saudi oil production, KC Fed, Chicago PMI, Shale Italy and Japan comments

As expected, the deceleration continues, and over the next couple of years it wouldn’t surprise me if the entire year gets revised down substantially: GDPHighlightsConsumer spending is the central driver of the economy but is slowing, at least it was during the fourth quarter when GDP rose only at a 0.7 percent annualized rate. Final demand rose 1.2 percent, which is the weakest since first quarter last year but is still 5 tenths above GDP.Spending on services, adding 0.9 percentage points,...

Read More »Economic Index, Storefronts, Fed statement, Pending home sales, Durable goods orders

Also tracing the weakness back to the oil capex collapse: Econintersect’s Economic Index declined and is barely positive – and still remains at the lowest value since the end of the Great Recession. The tracked sectors of the economy which showed growth were mostly offset by the sectors in contraction. Our economic index remains in a long term decline since late 2014. The Fed got this highlighted first part right: Information received since the Federal Open Market Committee met in...

Read More »Recession warnings, Dallas Fed

Reads like we are already in recession… Recession Warnings May Not Come to Pass Jan 24 (WSJ) — Every U.S. recession since World War II has been foretold by sharp declines in industrial production, corporate profits and the stock market. Industrial production has declined in 10 of the past 12 months, and is now off nearly 2% from its peak in December 2014. Corporate profits peaked around the summer of 2014 and were off by nearly 5% as of the third quarter of last year. The Dow Jones...

Read More »Holiday sales, Atlanta Fed, Freight transport index

Not long ago they blamed cold weather, now it was the warm weather. And this time not a word about the consumer not spending his gas savings…;) Holiday sales fall short of forecasts: NRF Jan 15 (CNBC) — The National Retail Federation said Friday that holiday sales increased 3 percent to $626.1 billion in November and December, falling short of the trade group’s forecast for 3.7 percent growth, as unseasonably warm weather and low prices weighed on results.The news came shortly after the...

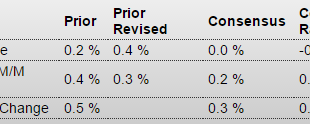

Read More »Fed comment, Retail sales, Empire State Manufacturing, Industrial production, Business inventories, Consumer sentiment

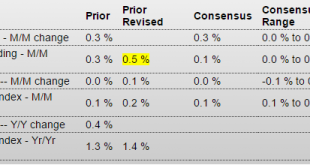

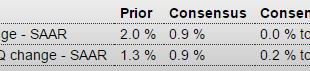

Looks like the Fed hiked during a recession. Should make for interesting Congressional testimony… Maybe the hundreds of $ millions they spend on economic research isn’t enough???;) Sales remain at recession levels: Retail SalesHighlightsRetail sales proved disappointing in December, down 0.1 percent in a headline that is not skewed by vehicles or even that much by gasoline. Ex-auto sales also fell 0.1 percent while the core ex-auto ex-gas reading came in unchanged which is well below both...

Read More »ECB comment, Retail Sales, Fed Atlanta, Oil comment

Seems there’s no wisdom on the topic of ‘money’ anywhere of consequence: No ‘plan B’ for ECB despite still low inflation: Praet Jan 6 (Reuters) — Executive Board member Peter Praet said various factors, notably low oil prices and less buoyant emerging economies, meant it was taking longer to reach the goal of inflation of close to but below 2 percent. “We need to be attentive that this shifting horizon does not damage the credibility of the ECB,” he added. “There is no plan B, there is just...

Read More » Heterodox

Heterodox