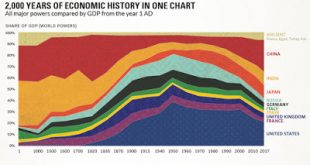

A graph that shows, for a longer span, essentially the same information presented in Robert Allen's graph of manufacturing production, and discussed before here. It is evident that the rise of China (India is not quite yet visible, even if its share did increase) represents a certain rebalancing, which is inevitable as the income per capita grows in that country, even if it does not scape what mainstream economists refer to as the middle income trap. Source here, and the data is, as...

Read More »Tariffs, trade and money illusion

In the past few days, I have read three pieces from Economists for Brexit - now renamed "Economists for Free Trade" - extolling the virtues of "hard" (or "clean") Brexit and calling for the UK to drop all external tariffs to zero unilaterally after Brexit. Two are written by professors of finance (Kent Matthews and Kevin Dowd). The third is from the veteran economist Patrick Minford.All three of these pieces wax lyrical about the benefits to GDP and welfare from unilaterally reducing...

Read More »Brexit, trade and echoes of the past

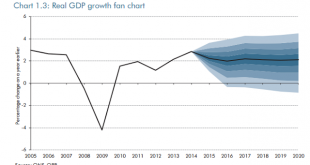

Brexit supporters have been severely critical of the OBR for its grim outlook for the UK post Brexit. The OBR is by no means the most negative of the professional forecasting bodies, and historically its forecasts have tended to err on the side of optimism, as Duncan Weldon observes. But it struggles to find anything good to say about post-Brexit Britain. In particular, it is distinctly negative about the future for Britain's external trade.Brexit is above all a shock to trade, since its...

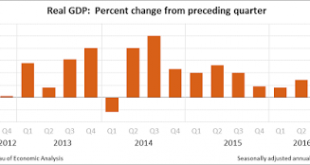

Read More »GDP recovers a bit in the third quarter

According to the BEA, the advance estimate of GDP growth in the third quarter is 2.9%, which is a significant improvement on the second quarter (1.4%). So maybe there is no recession in the near future (Neil Irwin might be right about that), which does not mean Yellen should hike the Fed rate in December anyway.

Read More »Slovenia and the banks

I bet you've never heard of Slovenia. It's the northernmost Balkan state, squeezed between Austria, Italy and Croatia on the Adriatic coast. It's small, peaceful (by Balkan standards) and prosperous compared to the rest of the Balkans, though that isn't saying much. It is also stunningly beautiful, in a mountains-and-lakes sort of way. It is in many ways rather like Austria.But at the moment, Slovenia is famous not for its lovely scenery, or its important history, or its rich culture. No,...

Read More »The unaffordable George

On March 16th, George Osborne unveiled his shiny new Budget. Full of populist tax giveaways to help "hard working people", it was the sort of budget that we might expect from a Chancellor riding the crest of an economic recovery. UK plc is growing well, profits are rising and the Board can afford to increase the dividend.But this is not the current economic situation. Far from an economic recovery gathering pace, the latest figures from the OBR show that UK plc is slowing. In its March 2016...

Read More »Mtg prch apps, CPI, Housing starts, Industrial production

Working their way a bit higher but still seriously depressed:With the year over year CPI increase now only 1% the Fed can only wait and see if headline will catch up to core and ‘justify’ their tightening bias. Consumer Price IndexHighlightsThe CPI core is showing pressure for a second month, up a higher-than-expected 0.3 percent in February with the year-on-year rate up 1 tenth to plus 2.3 percent and further above the Federal Reserve’s 2 percent line.Gains are once again led by health...

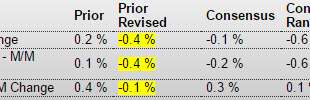

Read More »Retail sales, Redbook retail sales, Housing index, Business inventories and sales, Empire manufacturing, MEW, Atlanta Fed

Just plain bad. Including last month’s downward revision. And, again, sales = income, and lower income means less to spend in the next period: Retail SalesHighlightsConsumer spending did not get off to a good start after all in 2016 as big downward revisions to January retail sales badly upstage respectable strength in February. January retail sales are now at minus 0.4 percent vs an initial gain of 0.2 percent. The two major sub-readings also show major downward revisions with ex-auto...

Read More »Wholesale trade

As previously discussed, GDP was only as high as it was due to increases in unsold inventory- not good! Wholesale TradeHighlightsWholesalers had been keeping their inventories down as sales have slowed but they got behind in January. Inventories rose 0.3 percent in the month which isn’t alarming in itself but relative to sales, which fell 1.3 percent, inventories look heavy. The stock-to-sales ratio rose two notches to 1.35 from 1.33 for the highest reading of the recovery, since April...

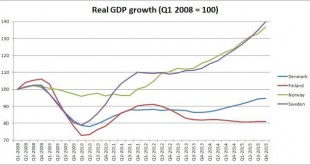

Read More »The Great Scandinavian Divergence

From @MineforNothing on Twitter comes this chart: Now, we know Finland is in a bit of a mess. A series of nasty supply-side shocks has devastated the economy. When Nokia collapsed in the wake of the 2007-8 financial crisis, ripping a huge hole in the country's GDP, the government responded with substantial fiscal support. This wrecked its formerly virtuous fiscal position: it switched from a 6% budget surplus to a 4% deficit in one year, and although its deficit has improved slightly since,...

Read More » Heterodox

Heterodox