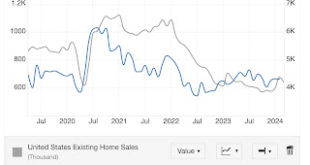

– by New Deal democrat Let me tie this morning’s report on April existing home sales into my two last posts (Part 1 and Part 2), which concerned the huge role that shelter prices, and the underlying shortfall in housing capacity, have in the continued elevation in overall consumer prices. So let’s start by looking at the last 10 year history of existing home inventories [note: all graphs in this article are from the site Trading Economics,...

Read More »A closer look at inflation (Part 2 of 2): how the Fed’s rate hikes actually *exacerbate* inflation in shelter

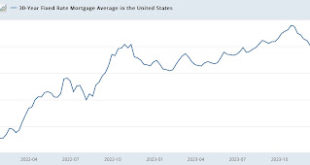

– by New Deal democrat Yesterday I discussed how virtually the entire issue of inflation remaining above the Fed’s target was the housing sector. Let me start today’s post where I left off yesterday: namely, that the net level of divergence between total headline inflation and shelter inflation of 1.15% is one of the highest such divergences in history, and the longest such big divergence. Here again is the graph: Today I want to discuss...

Read More »Canada’s 2024 federal budget: What’s in it for rental housing and homelessness?

I’ve written a blog post titled “Canada’s 2024 federal budget: What’s in it for rental housing and homelessness?” The English version is here: https://nickfalvo.ca/canadas-2024-federal-budget-whats-in-it-for-rental-housing-and-homelessness/ The French version is here: https://nickfalvo.ca/le-budget-federal-2024-quels-sont-les-avantages-our-le-logement-locatif-et-litinerance/

Read More »Women’s homelessness

I’ve just published Chapter 8 of my open access textbook. This new chapter focuses on women’s homelessness. An English summary of the new chapter can be found here: https://nickfalvo.ca/womens-homelessness/ A French summary of the new chapter is here: https://nickfalvo.ca/litinerance-chez-les-femmes/ All material related to the textbook can be found here: https://nickfalvo.ca/book/

Read More »The bifurcation of the new vs. existing home markets continues

– by New Deal democrat The Bonddad Blog The bifurcation of the new vs. existing home markets continued in March, per the report on existing home sales and prices yesterday. Remember that, unlike existing homeowners, house builders can vary square footage, amenities, lot sizes, and offer price and/or mortgage incentives to counteract the effect of interest rate hikes.On a seasonally adjusted basis, existing home sales declined from 438,000 to...

Read More »The economy is actually doing great — unless you want to make a change in your life.

Liking your present situation right now? Your job, your house, your car, you can keep it and you may have to do so. Buying a new car, house, or getting a different job may be more costly and not pay off. Even if you are not so satisfied, chances maybe you having to manage your pennies and stay put. Making a major economic change today involving costly upgrades, may not be advantageous, right now. Getting far out on a limb in a new job or with...

Read More »Housing construction rebounds in February, as permits and starts are stable and rebounding

– by New Deal democrat The Bonddad Blog Yesterday I wrote of how Fed rate hikes had not translated into a decline in the amount of housing under construction, and without that I did not see how a recession could occur. And in reaction to January’s housing construction report I concluded, “To signify a likely recession, units under construction would have to decline at least -10%, and needless to say, we’re not there. With permits having...

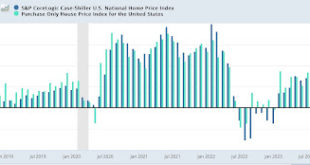

Read More »Repeat sales house price indexes continue to increases on par with past expansions

Repeat sales house price indexes continue to increases on par with past expansions – by New Deal democrat House prices lag home sales, which in turn lag mortgage rates. Yesterday we got the final January reading on sales. This morning, we got the final monthly (for December) read on prices, for repeat sales of existing homes. The FHFA purchase only price index rose 0.1% on a seasonally adjusted basis, and is up 6.6% YoY. Meanwhile the Case...

Read More »Housing construction essentially stable in January

Housing construction essentially stable in January – by New Deal democrat I’m on the road, so I need to keep this brief, but fortunately I can give you the essence of this most important housing report with little difficulty. Mortgage rates have declined about 1% from their peak during the autumn, and are about equal to where they were one year ago: As a result, we should expect some improvement in the housing market from its worst...

Read More »Homelessness in Yellowknife

[unable to retrieve full-text content]Here’s a ‘top 7’ summary of my recent book chapter on homelessness in Yellowknife: Responding to homelessness in Yellowknife: Pushing the ocean back with a spoon

Read More » Heterodox

Heterodox