Share the post "You’re Doing it Wrong – Deficit Edition"If I showed you the chart below and asked you where you should buy stocks and where you should sell stocks the answer would be obvious, right? You buy low and you sell high. Everyone knows that. Of course, it’s easier said than done, but we still know the right answer. And the reason why this is the right answer is because your risk adjusted returns are likely to be better when you buy low than when you buy high. Again, that’s...

Read More »Let’s Talk About Taxes and the Fed

Share the post "Let’s Talk About Taxes and the Fed"At the risk of inflaming a sensitive political environment I am going to try to talk objectively about the economics of our political environment. I have my flame retardant suit on so let’s get started.Jerome Powell is the new Fed ChiefTrump’s appointment of Jerome Powell is kind of strange in my view. Powell is totally status quo. He doesn’t have many beliefs that veer too far from the Yellen Fed. I suspect that Trump didn’t want to be...

Read More »Vegas Presentation – The State of the Markets

Share the post "Vegas Presentation – The State of the Markets"Here’s my talk in Vegas from earlier this month. It’s only 30 minutes but I think I covered a good bit of ground including:The passive investing craze.The importance of diversification in global asset allocation.Navigating high equity valuations.Why the aggregate bond index is imperfect.Why you should extend your duration in a bond portfolio.Why the Fed’s balance sheet reduction is overblown.This was a fun talk and I think people...

Read More »Beware of Extremist Bond Calls

Share the post "Beware of Extremist Bond Calls"I’ve spent way too much of my career cautioning investors about extremist positions. No, there wasn’t a bond bubble in 2010. No, the stock market wasn’t a bubble back in 2013. No, the USA wasn’t going bankrupt in 2012. No, QE wasn’t going to cause hyperinflation. You get the point. I try to be objective and pragmatic and a big part of that involves empirically sound and operationally consistent analysis so we can make relatively high...

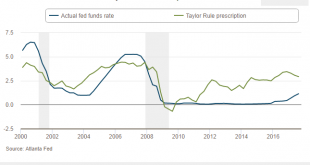

Read More »Is a Taylor Tantrum on the Horizon?

Share the post "Is a Taylor Tantrum on the Horizon?"Back in 2013 bond markets were jolted by the potential that the Fed would unwind its balance sheet more quickly than previously believed. The basic thinking was that QE puts downward pressure on interest rates so unwinding QE will put upward pressure on interest rates. That isn’t quite what happened, but markets are gonna market.Fast forward to 2017 and interest rates are only a bit higher than they were before the Taper Tantrum. I’ve been...

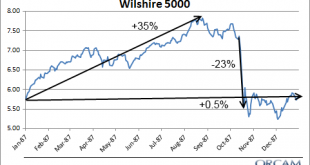

Read More »This Sucker’s Going Down

Share the post "This Sucker’s Going Down"30 years ago the market crashed 23% in one day. It’s everyone’s worst nightmare – seeing their savings get cut in a quarter overnight. This is obviously traumatic so it’s rational to worry about such an event. There are important lessons in big traumatic events like this so let’s dive deeper.I have a simple recurring theme about life and markets on this website – life is mostly just a boring trend of similarly monotonous stuff that gets jarred loose...

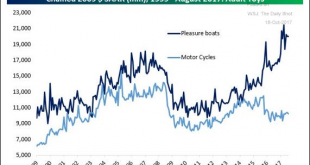

Read More »Financial Wisdom Part Three – Funny Money

Share the post "Financial Wisdom Part Three – Funny Money"Here is part three of the Abnormal Returns blogger wisdom:Question: What is one thing you do with your money (spending and/or investing) that you would never recommend to a client, family or friend?My answer:About 10 years ago I bought a boat. Or, as boat owners say, BOAT – Bring Over Another Thousand. This was, by far, the worst financial decision I ever made in my life. Although it was enjoyable the cost of upkeep and maintenance...

Read More »Financial Wisdom Part Deux – Factor Investing

Share the post "Financial Wisdom Part Deux – Factor Investing"Here is question two from the Abnormal Returns blogger wisdom series:Question: Assume you have discovered an equity return factor that is both previously unknown and uncorrelated with other factors. What would you do to monetize that insight? (Answers in no particular order.)My answer:Well, I’ve been pretty negative about factor investing so it would be pretty damn hypocritical of me to start a factor fund. I am deeply skeptical...

Read More »Cryptocurrencies are Non-Financial Collective Equity

Share the post "Cryptocurrencies are Non-Financial Collective Equity"One of the troubles with understanding the cryptocurrency boom is that the existing definitions aren’t consistent. We call all of these things “currencies”, but that implies that they are all money which is incorrect. For instance, Filecoin is basically a decentralized version of Dropbox. It isn’t a currency at all. It has an exchange value, but it isn’t a “currency” in the traditional sense of the word. This space is so...

Read More »Moneyness, Utility & Network Effects

Share the post "Moneyness, Utility & Network Effects"Eric Lonergan has been cranking out some good stuff on money and language in the last few weeks which got me thinking again about “moneyness” and the network effect of a money system. I wrote a piece on Moneyness back in 2012 that I think describes a realistic operational scale of the utility of money. In short, we use the most credible form of money that has the most utility accessing the payment system.Now, this concept is rather...

Read More » Heterodox

Heterodox