Share the post "Three Things I Think I Think – Video Edition"I spoke at the Stansberry Investment Conference this past Tuesday. Hopefully we’ll get the full presentation out at some point since I covered a lot of useful ground in 30 minutes. Here’s a short interview I did afterwards. We touched on a number of topics including:1) The difficulty of navigating the bond market these days and why actively selecting where you get exposure is wise.2) Thoughts on stock market valuations and why you...

Read More »Value Investing is Dead, Long Live Value Investing!

Share the post "Value Investing is Dead, Long Live Value Investing!"Here’s a great piece by Wes Gray discussing the viability of value investing. Here’s the money shot showing the relative performance of value investing strategies versus the S&P 500. We’re in the middle of one of the longest droughts on record for the value guys:I’ve made myself pretty clear on factor strategies – they usually sell alpha (market beating hopes) at greater than the cost of beta (a low cost index fund) and...

Read More »Let’s Throw Some “Keynesian” Bombs

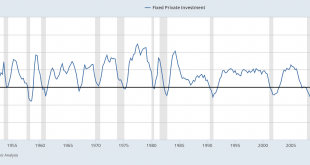

Share the post "Let’s Throw Some “Keynesian” Bombs"People really like to throw bombs at “Keynesian” economics because it’s become synonymous with big government and unfettered spending. The really common (and incorrect) understanding of Keynesian economics is that people shouldn’t save and should just consume until they are so fat that the economy is at full employment. The other (slightly less incorrect) version is that the government should help these people get as fat as possible by...

Read More »There’s No Such Thing as a “Sin Stock”

Share the post "There’s No Such Thing as a “Sin Stock”"This post will at first appear like a discussion about morality, but I hope it will end as a post about objective reasons for market cap weighted equity indexing. So hang tight even if your head starts to explode a little.Here’s a good piece by Felix Salmon on why we should avoid “sin stocks”. In it, he disagrees with a piece by Cliff Asness and Matt Levine. The basic gist of the disagreement is that Matt and Cliff say that avoiding sin...

Read More »Screaming into a Hole About Government Debt

Share the post "Screaming into a Hole About Government Debt"I’ve written 10,817 posts in the last 10 years. About 25% of those posts were about the operational nature of the US monetary system with the intent to explore and explain how the monetary system works. My goal was simple – to explain the monetary system in such a way that people could navigate the ocean of bullshit narratives out there without succumbing to the many biases that plague so many investors. But after 10 years I think...

Read More »Let the Ball Come to You

Share the post "Let the Ball Come to You"I sucked at baseball when I was younger. It wasn’t because I was physically incapable of playing baseball.¹ It was mainly because I was undisciplined and tried to do too much. For instance, I was a decent right handed hitter, but I spent half my time practicing left handed. I had this infatuation with being a switch hitter because I grew up watching Bernie Williams and was obsessed with Mickey Mantle. And after having played hockey left handed for...

Read More »Yes, Getting Rid of the Debt Ceiling is Smart

Share the post "Yes, Getting Rid of the Debt Ceiling is Smart"There are reports going around this morning that Trump wants to eliminate the debt ceiling. Here’s what I said about this 5 years ago:As a fully autonomous currency issuer the US government has no legitimate limit in its ability to finance its own spending. There is no such thing as the USA not being able to make a debt payment (see here if you’re already confused) due to a lack of funding since it can tap its own Central Bank for...

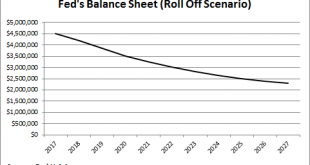

Read More »Let’s Talk About Shrinkage (Again)

Share the post "Let’s Talk About Shrinkage (Again)"I’ve got shrinkage on the mind again. Maybe I’ve spent too much time in cold water this summer or maybe it’s just me getting old? I don’t know, but I do know that it’s becoming an increasingly important discussion as the Fed discusses its future policy options. I’ve talked about how the Fed will unwind its balance sheet in the past and how this isn’t a big deal. I was one of a handful of people at the time of QE’s initiation explaining that...

Read More »Three Things I Think I Think – Disaster Edition

Share the post "Three Things I Think I Think – Disaster Edition"Here are some things I think I am thinking about:1. Floyd Mayweather – Maybe not such a financial disaster? Floyd Mayweather didn’t follow my financial advice. He was, predictably, MUCH better than Conor McGregor at boxing. Actually, I’d say Conor surpassed expectations. But Floyd is Floyd. He’s the best ever. And he proved it again on Saturday night when he beat a much younger and bigger man.What was most interesting to me...

Read More »Financial Planning for Floyd Mayweather

Share the post "Financial Planning for Floyd Mayweather"There’s this big fight this weekend between undefeated boxer Floyd Mayweather and MMA Champ Conor McGregor. They’re reportedly earning a combined $175 million +. It’s the biggest fight ever. On paper it looks like a no-brainer. Mayweather is the best fighter maybe ever. If you’ve watched him fight before it is breathtaking. The guy will go 12 rounds ducking, weaving and striking and he will look as good in the 12th round as he did in...

Read More » Heterodox

Heterodox