Share the post "2016 – More Like 1998 Than 2008"Last year when China was causing flash crashes and constant market fear I said that this environment looked a heckuvalot like 1998. And I said that there would be a huge cost to selling stocks into that environment. My basic thinking was:China is a risk, but it won’t derail the US economy.From a macro perspective, many of the scares in 2015 looked eerily similar to 1998.After a brief decline in stocks in 1998 the markets realized that these...

Read More »What is Gold?

Share the post "What is Gold?"Jason Zweig has a couple of good pieces in the WSJ today on gold (see here and here). Jason is not a big fan of owning gold in a portfolio and I generally agree with him. However, I don’t completely agree with the description of gold as a “pet rock” and I think it detracts from the point he’s trying to make. So let me see if I can make a similar point from a more empirical perspective.I like to work from what I think is a form of rigorous empiricism. I tend to...

Read More »How a Foreign Recession Could Cause US Stock & Real Estate Bubbles

Share the post "How a Foreign Recession Could Cause US Stock & Real Estate Bubbles"The greatest bull market in the history of markets just keeps on chugging as long-term bond yields continue their perpetual slide. As of this morning the yield on the 10 year T-Bond is 1.35%.(Source: Bloomberg)This is a bit confusing for some people because the US economy seems to be in relatively good shape. Q2 GDP is expected to print at 2.4%, wages are growing at 3.4%, the ISM non-manufacturing number...

Read More »Short-Termism Gets Brexecuted

Share the post "Short-Termism Gets Brexecuted"The S&P 500 is fast approaching all-time highs again after the brief Brexit scare. I guess that was the fastest panic and recovery during the current bull market. Of course, this has been a repeat theme over the last 7 years. Investors were so badly scarred after the 2008 crisis that every little hiccup in the financial markets has been called the “next 2008”. Brexit was just the latest case of this. I was very quick to downplay the impact of...

Read More »Failure to Predict the Financial Crisis Does Not Discredit Economists

Share the post "Failure to Predict the Financial Crisis Does Not Discredit Economists"One of the criticisms that has emerged during the Brexit event is the criticism of experts and economists specifically. One claim that has been thrown around by many people during this event and for many years is the idea that economists are useless because they didn’t predict the financial crisis. This is a rather unfair view in my opinion.¹For the most part, economists hold relatively boring and...

Read More »Brexit, Bregret and Bredo?

Share the post "Brexit, Bregret and Bredo?"I reluctantly dive into the topic of the day….Brexit.The morning after the Brexit vote a large number of people were apparently regretting their vote. A combination of misinformation and misunderstanding appears to have led many people to vote in a manner that they didn’t really believe in. Here’s some of the reports:The most Googled items in the UK after the vote were “What is the EU? and “What does it mean to leave the EU?”The UKIP party admitted...

Read More »Brexit and the Failure of Democracy

Share the post "Brexit and the Failure of Democracy"I want to go off topic here today because the recent Brexit vote exposed the extraordinary failure and danger of pure democracy. People in the USA often refer to the USA as a “democracy”. But this is wrong. The Founding Fathers were terrified of a pure democracy. They intentionally designed the United States so that it wasn’t a pure democracy. Referendums such as the Brexit are a glaring example of how dangerous and flawed the idea of a...

Read More »Brexit is Here – Bremain Brational

Share the post "Brexit is Here – Bremain Brational"The UK has decided to leave the EU. It’s a strange vote given how little support there was from reputable economic experts. The estimates of the economic impact of Brexit were virtually all negative. This makes sense given that leaving the EU only makes trade more difficult, labor less mobile and most things more costly. It’s actually hard to come up with reasonable long-term positive outcomes here. As Oxford and the London School of...

Read More »Confessions of a Recovering Alpha Junky

Share the post "Confessions of a Recovering Alpha Junky"For most of the last 20 years I’ve been an alpha junky. That means I was obsessed with trying to “beat the market” and generate excess return. And I was pretty good at it. At one point I was on a 10 year streak with no negative calendar year returns. Between 2005-2012 I ran an event driven stock picking strategy that averaged almost 14% per year during a period when the S&P 500 annualized 2.5%. Not bad for a young punk who knew a...

Read More »Is Secular Stagnation Really a Thing?

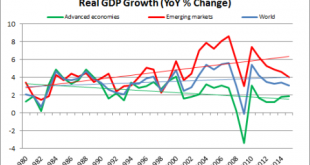

Share the post "Is Secular Stagnation Really a Thing?"Did you know that world growth rates have actually picked up since 1980? Did you know that emerging market growth rates have averaged 4.5% since 1980? You might not know it from the media’s coverage of “secular stagnation”, but global growth isn’t slowing. Secular stagnation is only a thing in the advanced economies of the world where growth has slowed. As you can see in the following chart the trend-line growth for global real GDP has...

Read More » Heterodox

Heterodox