Share the post "Quick Twitted" I post a lot of things on Twitter these days and tend to leave the website for long form stuff, but I know many of you aren’t Twitter users so I think I will start cross posting some of my tweets here so readers don’t miss out on some of the good stuff. Twitter is great because it’s short form and I know my long form content can put people to sleep so maybe posting some of the short form Twitter content will be a nice way to mix things up. The June Mutual...

Read More »Is There a Bubble in Low Volatility Funds?

Share the post "Is There a Bubble in Low Volatility Funds?" Investors have been pouring money into low volaility funds at a record pace so far in 2016. According to Bloomberg low vol funds have seen higher fund flows than any other ETFs which has prompted some people to wonder if there’s a bubble in low vol funds. Low volatility funds try to capture what’s called the low volatility anomaly which shows that some stocks with lower than average volatility tend to outperform the market.¹...

Read More »Big Confusion on “Passive” Investing

Share the post "Big Confusion on “Passive” Investing" Here’s a new fund filing which is both hilarious and sad. The ticker symbol is BIGD, which stands for Big Data. The fund will be comprised of big data firms. I am tempted to short such a fund, however, I feel uncomfortable being anything less than long a ticker such as BIGD.¹ In all seriousness, what I love about this filing is this part: The Fund uses a “passive” or indexing approach to try to achieve its investment objective. Unlike...

Read More »Why Is the S&P 500 Approaching All-Time Highs?

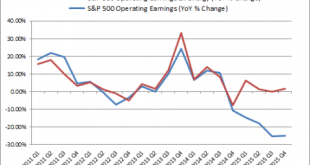

Share the post "Why Is the S&P 500 Approaching All-Time Highs?" Greece is back in the news. There’s a devastating recession in oil. Emerging market turmoil is widespread. The Fed is worried about global growth so much that they won’t raise rates. Earnings are declining. According to our Presidential candidates the economy stinks and America needs a restart. And…the S&P 500 is approaching a new all-time high? What. The. Hell. Is. Going. On? My view in the last couple of years has...

Read More »Three Things I Think I Think – Confirmation Bias Edition

Share the post "Three Things I Think I Think – Confirmation Bias Edition" Here are some things I think I am thinking about: confirmation bias, robo advisors and rate hikes! 1 – Constructive Criticism is a Core Value of the Internet. Some people insist on using the Internet as a confirmation bias tool. Twitter is particularly bad in this respect as people will tend to follow only those who they agree with. This way you create a stream of commentary that you agree with. I think this is...

Read More »How to Ensure You’re not Gambling When You’re Allocating Assets

Share the post "How to Ensure You’re not Gambling When You’re Allocating Assets" A smart reader asks how investing isn’t gambling after reading my last post. He/she says: “While I agree with your premise that true investing is current spending for future cash flow, the only time this happens in the public markets is at an IPO. And even then, my money is still exposed to several risks of loss in ways that are similar to gambling. How do I know this company isn’t the next Enron? How do I...

Read More »Investing is not the Same as Gambling

Share the post "Investing is not the Same as Gambling" It’s the Monday following the second leg of the Triple Crown and a whole bunch of people lost money betting on the Preakness. Like the stock market, the allure of gambling is strong because many people think that having more money will solve most of their problems. And while there are some similarities between investing and gambling we should be clear that they are not nearly as similar as some people might believe. First, some...

Read More »Why Helicopter Drops Would Work

Share the post "Why Helicopter Drops Would Work" Here’s John Kay in the FT arguing that helicopter drops don’t work. He says: “even if the lucky recipients of the helicopter drop went straight down to the pub to celebrate their good fortune, the publican would return the cash to the banking system by the end of the day, and the notes would end up back in the vaults of the central bank. The helicopter drop does not give households reason to hold additional notes in their wallets, shops to...

Read More »Would Donald Trump Crash the Stock Market?

Share the post "Would Donald Trump Crash the Stock Market?" Mark Cuban says a Donald Trump victory would cause a huge stock market correction: “I can say with 100% certainty that there is a really good chance we could see a huge, huge correction,” Hmmm. “really good chance” doesn’t mesh with “100% certainty”, but let’s think this through a bit more. First of all, Trump is running at about 29% odds of winning according to PredictWise so this doesn’t seem like the likely outcome, but we do...

Read More »Hedge Funds – Misunderstood, but Still North Worth it

Share the post "Hedge Funds – Misunderstood, but Still North Worth it" Cliff Asness has a wonderful new piece on Bloomberg View discussing hedge funds. He basically argues that: Hedge fund criticism has been unfair largely due to false benchmarking. Hedge funds should hedge more. Hedge funds should charge lower fees. These are fair and balanced statements. And they’re worth exploring a bit more. The first point is dead on. The media loves to compare everything to the S&P 500 which is...

Read More » Heterodox

Heterodox