Share the post "2 Concerns About the US Government’s Debt" The comedy website Mises.org had some responses to the recent uproar over the TIME magazine article referring to the US government as insolvent. The two big concerns were in fact funny which is good because comedy websites are supposed to be…funny. Specifically, they said: The US government can’t afford the interest on the national debt. Foreign governments might sell US government bonds crashing the US bond market. The first one...

Read More »The Myth of Declining American Living Standards

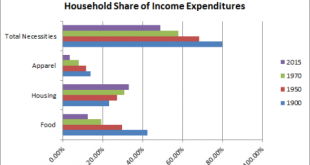

Share the post "The Myth of Declining American Living Standards" One of the running themes of this website over the last 6 years is the idea that the US economy is not doing nearly as well as it should be, however, that it’s also not doing nearly as bad as some people would have us believe. Unfortunately, whenever I publish something like the recent post on the solvency of the USA I get a lot of pushback from people arguing that American living standards are in some sort of terminal...

Read More »Thinking About the Great Normalization

Share the post "Thinking About the Great Normalization" There’s a lot of talk these days about how bad the economy is and how we seem to be in a state of permanently low growth. But it’s amazing what a macro view of the world will do for you because it shows us that a lot of this could just be recency bias at work. While many other people have referred to this period as the “new normal” or “secular stagnation”, I’ve referred to it as the “Great Normalization”. What I mean by this is that...

Read More »Say America’s Bankrupt One More Time!

Share the post "Say America’s Bankrupt One More Time!" I am beginning to get worried that my future on this planet will consist of something roughly like this: TIME magazine is out with a cover piece saying “Make America Solvent Again”. Here’s the cover for your viewing (dis)pleasure: Regulars know I’ve been over this message too many times in the last, oh, almost decade. Fear sells and I have no doubt this magazine will sell well. But it’s also totally wrong. I’ve spent a few minutes...

Read More »Janet Yellen (Might Have) Nailed It*

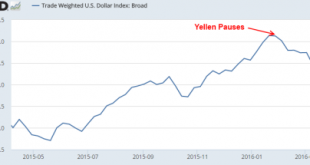

Share the post "Janet Yellen (Might Have) Nailed It*" Coming into 2016 it looked like there was an increasingly high chance that the weakness in emerging markets posed a serious threat to the US economy. I repeatedly said that the Fed would be irrational to raise rates based on the following: The risk with rate hikes is creating an extreme divergence in global policy approaches where the US Central Bank, the world’s most important central bank, is tightening policy into a global slowdown....

Read More »Three Things I Think I Think – Fixing Stuff Edition

Share the post "Three Things I Think I Think – Fixing Stuff Edition" The weekend is right around the corner. I’ll be in Las Vegas with a group of crazy overworked men from New York most likely riding bikes and reading poetry. I don’t particularly like poetry (or rather, I’m no good at it) so my odds of survival are relatively low. If this is our last interaction I don’t doubt that you’ll find it disappointing. 1 – Fix the Financial Advisers! Here’s a nice piece from Jason Zweig about...

Read More »Is Your Adviser a Fiduciary?

Share the post "Is Your Adviser a Fiduciary?" The new fiduciary standard rule has been all the rage this week on Wall Street. This new rule set out guidelines by which financial advisers must act in the best interest of their clients. Unfortunately, the new rule looks more like a lot of talk and little effective action. The main problem with giving financial advice is that your compensation is often structured according to the products you sell. When I used to work for big financial firms...

Read More »Three Things I Think I Think – Hump Day Edition

Share the post "Three Things I Think I Think – Hump Day Edition" Okay people. Just 2.5 more days and we’re there. You can make it….In the meantime, here are some things I think I am thinking about: 1 – Why Bull Markets are Hated. Here’s a great piece from Josh Brown about bull markets and why they’re so hated. The sad reality of the financial markets is that all financial assets are always held by someone. By definition, we can’t all participate in bull markets because some of us hold...

Read More »My “Wisdom” on the Being an Optimist About the Future

Share the post "My “Wisdom” on the Being an Optimist About the Future" Tadas ends his blogger wisdom series asking what we’re excited about that no one else is talking about. I said: I am excited about how great the future is going to be. We live on a rock spinning 1,000 mph through space in a universe where we might be the only creatures fully aware of it. The whole human existence is a miracle that should have us all waking up in the morning screaming “holy crap, this is amazing”. ...

Read More »My “Wisdom” on Changing my Mind

Share the post "My “Wisdom” on Changing my Mind" Tadas continues with the financial blogger wisdom series today asking: Think back to the last edition of this series a couple of years ago. Have you changed your mind about something (big or small) over that time period? If so, what and why? My answer alluded to a rather substantial change of opinion: Ben Bernanke would beat Paul Krugman in an arm wrestling competition. I used to think differently, but based purely on beard strength,...

Read More » Heterodox

Heterodox