Share the post "A Larger Deficit Won’t Cause Hyperinflation" We’re now 7 years out of the grand monetary experiment and there’s still no inflation on the horizon. In fact, we seem to be coming to an increasing consensus that monetary policy and QE just hasn’t done much. These are all things I expected from the start of QE – it wouldn’t cause high inflation, wouldn’t cause rising interest rates, wouldn’t really do much of anything. If you worked through the accounting and the scenario...

Read More »The Appropriate Portfolio vs the Optimal Portfolio

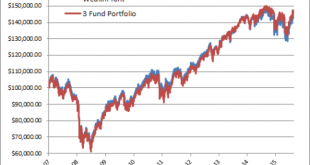

Share the post "The Appropriate Portfolio vs the Optimal Portfolio" “Perfect is the enemy of the good” – Adapted Italian Proverb We all want the perfect portfolio, the portfolio that achieves the highest amount of return for the lowest degree of risk. But one of the inconveniences of a system as dynamic as a financial market is that it’s impossible to consistently maintain the perfect portfolio. This pursuit, unfortunately, causes more damage than good since it leads to increased...

Read More »Trump is Wrong on the National Debt

Share the post "Trump is Wrong on the National Debt" Donald Trump made some controversial comments the other day regarding the national debt. First, he said: “We’re paying a very low interest rate — what happens if that interest rate goes up 2, 3, 4 points?” he said. “We don’t have a country. We have tremendous debt, tremendous.” Second, he said: “I’ve borrowed knowing that you can pay back with discounts….Now we’re in a different situation with the country, but I would borrow knowing...

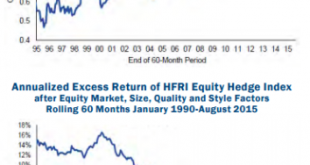

Read More »Why Does Indexing Shrink Alpha?

Share the post "Why Does Indexing Shrink Alpha?" Jesse over at Philosophical Economics has written a couple of really fantastic posts (see here and here) on indexing and market efficiency. His basic conclusions: The trend in passive investing is sustainable. The rise of passive indexing improves market efficiency. I’ve made the same points in a series of posts in recent months including: Although I’ve written a good deal on this I didn’t explain why indexing has made life so much harder...

Read More »Financial Market Forecasts are Essential to good Financial Planning

Share the post "Financial Market Forecasts are Essential to good Financial Planning" McKinsey released a very good report last week discussing the high probability of lower returns in the future. The piece was, predictably, met with great ire from efficient market proponents saying that forecasts are stupid and that no one can accurately predict the future. But these critics are missing the very important point that one should conclude here: not that we can correctly predict the future,...

Read More »Robo Advisors Won’t Die as Fast as High Fee Human Advisors

Share the post "Robo Advisors Won’t Die as Fast as High Fee Human Advisors" Michael Kitces has a very good post up discussing some of the big trends in the Robo Advisor space. Michael notes that the robo growth is falling off fast and that this could be a sign that the trend here is beginning to dry up. He ultimately concludes that the biggest winners here are the companies augmenting human advisory services with the benefits of the robo technology: “advisor platforms are quickly seeking...

Read More »How Scared Should we be About Future Returns?

Share the post "How Scared Should we be About Future Returns?" McKinsey had a really nice piece this week on the future of financial market returns. The basic conclusion – lower your expectations and hunker down for some lean years in the financial markets. McKinsey’s says that equities have benefited from unusually favorable conditions in the last 30 years such as low valuations, falling inflation, falling interest rates, strong demographic growth, high productivity gains and strong...

Read More »Three Things I Think I Think – Thinking Edition

[unable to retrieve full-text content]Please don’t kill me for the lack of creativity in that title. I was trying my best….Anyhow, here are some things I think I am thinking about: 1) Asset allocation and stock activism. 2) Endowment fund spending and portfolios. 3) Safe assets....

Read More »The Coming Catatrophe for High Fee Active Managers

Share the post "The Coming Catatrophe for High Fee Active Managers" Back in 2009 I wrote a very critical piece on mutual funds basically calling them antiquated products that do the American public a disservice.¹ My general message wasn’t to bash active management. After all, I agree with Rick Ferri here – there’s no such thing as passive investing. There are only degrees of active investing. But there are smart ways to be active and very silly ways to be active. Mutual funds are usually a...

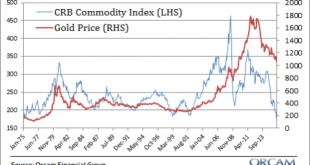

Read More »“There are no Good Gold Analysts”

Share the post "“There are no Good Gold Analysts”" Joe Weisenthal recently asked for a recommendation for a good gold analyst to interview on Bloomberg. I said: @TheStalwart There are no good gold analysts. — Cullen Roche (@cullenroche) April 21, 2016 I was sort of kidding, but let me explain. Gold is one of the most interesting assets because it is viewed by many people and even central banks as a form of “money”. As a result of this it tends to have a uniquely special place in the...

Read More » Heterodox

Heterodox