Share the post "What Does it Mean to be a “Low Fee” Investment Advisor?" I pride myself on being a truly low fee investment advisor, financial planner & portfolio manager. With fees ranging from 0.1%-0.35% my firm offers one of the most competitive fee structures in the entire investment business. We could probably charge the standard 1% annual fee, but I made a conscious decision when I started my retail asset management business last year that I was going to get way ahead of the...

Read More »My “Wisdom” on Diversity in Finance

Share the post "My “Wisdom” on Diversity in Finance" The blogger wisdom series continued today with a question about diversity in finance. Tadas asks: It does not escape me that the entire distribution list on this “Blogger Wisdom” e-mail chain is entirely male. I have written extensively on why this is an issue for the investment industry. What, if anything, can be done to make the investment industry more inclusive? My answer was stupid and not nearly as funny as I wanted it to be:...

Read More »My “Wisdom” on Index Funds

Share the post "My “Wisdom” on Index Funds" Tadas Viskanta continues his series on “finance blogger wisdom” today discussing index funds. Specifically, he asks: Should we care that the percentage of assets in indexes is on the rise, or should we just sit back and enjoy the (low cost) ride? My answer was, um, not very thorough (again): Indexing requires active management in order to maintain the “passive” allocation held by the indexers. The rise of indexing is good for both the...

Read More »My “Wisdom” on Smart Beta & Factor Investing

Share the post "My “Wisdom” on Smart Beta & Factor Investing" The latest installment from Tadas Viskantas’s series on “financial blogger wisdom” (is that an oxymoron?) asked a bunch of smart people (and also me) about smart beta. I was short: Smart beta and factor investing are the newest versions of high(er) fee active management promising the fairy tale of “market beating” returns in exchange for higher fees and usually delivering lower returns (after taxes and fees). Regulars know...

Read More »My “Wisdom” on Robo Advisors

Share the post "My “Wisdom” on Robo Advisors" Tadas Viskanta has put together a nice collection of opinions regarding the new “Robo Advisor” trend. Here’s my general view: “Robo “advisors” aren’t really advisors. They’re robo asset allocators. The robotic allocations are susceptible to flawed risk profiling and inefficient portfolio management for most people with a sophisticated financial plan. The business of asset allocation is too personal and customized to ever become fully...

Read More »How to Avoid the Problem of Short-Termism

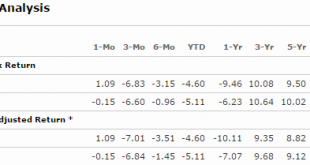

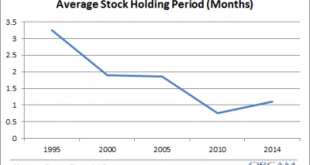

Share the post "How to Avoid the Problem of Short-Termism" If I had to pinpoint the biggest problem for most asset allocators I would probably say short-termism. Short-termism is the tendency to judge financial markets in periods that are so short that it results in higher fees, higher taxes and lower average performance. We’ve become accustomed to judging the financial markets in quarterly or annual periods which contributes to this short-termism, but some context will show that this...

Read More »The Investor Podcast – Macro Thoughts

Share the post "The Investor Podcast – Macro Thoughts" I was on The Investor Podcast this past weekend with the very awesome Stig Brodersen and Preston Psyh. We covered a lot of ground in this one including: The implication of negative interest rates for banks and bank customers Why quantitative easing doesn’t work in the current environment Why focus should be fiscal policy rather than monetary policy Why central banks works as a clearing house with the intention to avoid bank runs How a...

Read More »Understanding Flow of Funds Accounting

Share the post "Understanding Flow of Funds Accounting" After the post a few weeks ago where I showed that Post-Keynesian Stock Flow Consistent modeling has become very popular on Wall Street I got a ton of emails asking for more details on this approach. So, here’s a short description and a few good links for you to explore if you’d like. Stock flow consistent modeling is a form of economic modeling that involves a comprehensive macro framework for understanding the integration of the...

Read More »Opinion: The Rise (and Fall) of Donald Trump

Share the post "Opinion: The Rise (and Fall) of Donald Trump" A bit off topic here, but since it’s the weekend and this is basically all anyone in the world talks about anymore, I figured I’d chime in with an update on Donald Trump. If you recall my 10 “Useless” 2016 predictions, I said: Donald Trump will be the next President of the United States. The American electorate will reluctantly vote for Donald Trump as he seizes on a world of instability and literally scares the American...

Read More »Economics Can’t be Tested in a Vacuum

Share the post "Economics Can’t be Tested in a Vacuum" The economy is one of the most complex systems that exists in the world. Perhaps even the most complex system. I like to think of the monetary system like a car. There are very specific institutional structures that act as certain parts of this system and in a vacuum that car or system will do certain things. For instance, when someone borrows money from a bank to finance investment in a productive innovation it is much like pouring...

Read More » Heterodox

Heterodox