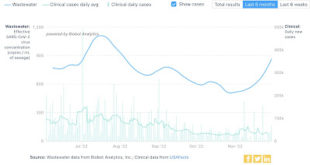

Coronavirus dashboard for December 7: the first winter wave of endemicity begins – by New Deal democrat COVID is well on its way to becoming endemic, with a significant background level similar to what we have experienced in the last 8 months, and a surge during the winter months when people spend more time socializing together indoors. In that vein, it is apparent that, as expected, Thanksgiving get-togethers have triggered a new wave of...

Read More »November jobs report: decidedly mixed signals

November jobs report: decidedly mixed signals, most consistent with a still-growing but decidedly weakening economy – by New Deal democrat Since early this year I have expected employment to follow the halt in consumption growth, decelerating over time to a stall. This has only intensified given the major decline in growth in payroll withholding tax payments, which are near recessionary. This expectation was partially met today in...

Read More »October Manufacturing (near record low) and Construction Decline

November manufacturing and October construction both decline, the former almost at recessionary levels – by New Deal democrat As usual, we begin the new month’s data with the ISM manufacturing index. This index has a very long and reliable history. Going back almost 75 years, the new orders index has always fallen below 50 within 6 months before a recession. Recessions have typically started once the overall index falls below 50, and usually...

Read More »Strong personal income and spending – near record low in saving

Strong personal income and spending contrast with near record low in saving – by New Deal democrat Like retail sales earlier in November, personal income and spending both rose smartly, as shown in the below graph of real retail sales compared with real personal spending: Real personal income was up 0.4%, and real personal spending increased 0.5%: Nominally each increased 0.3% more; i.e., the PCE deflator was 0.3%. Each metric only had...

Read More »Jobless claims get closer to signaling recession

Initial jobless claims get closer to signaling recession – by New Deal democrat Today is one of those data-palooza days, so I’ll put up separate posts on personal income and spending, and the ISM manufacturing report and construction spending reports later. But let’s start with weekly jobless claims, and the news here is OK for the week, but the trend is troublesome. Initial claims declined -16,000 from last week’s 3 month high to...

Read More »Oct JOLTS report: Job Market deceleration and Job Opening Gap

October JOLTS report shows continued deceleration in jobs market, with continuing gap in job openings filled – by New Deal democrat For the past year, I have likened the jobs market to a game of reverse musical chairs, where there are more chairs than players. Some chairs are always left empty. The chairs are jobs, and the players are job seekers. Since the lowest paying jobs have always been left empty, there is tremendous pressure to raise...

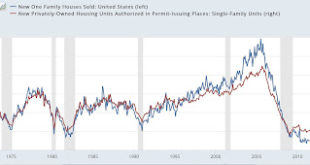

Read More »Have new home sales made a bottom?

Have new home sales made a bottom? – by New Deal democrat Hopefully you are recovering from your turkey coma today. Here’s a little late commentary on Wednesday’s new home sales report. New home sales are noisy, and heavily revised, which is why I prefer housing permits, and especially single family housing permits, as a source of information. But . . . on the other hand, new home sales tend to be the very first housing metric that...

Read More »More on deteriorating tax withholding receipts and jobs reports

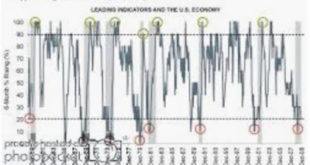

More on deteriorating tax withholding receipts and jobs reports – by New Deal democrat I have a new post up at Seeking Alpha, laying out all of the short leading indicators, and concluding conditions have now been met for a recession to begin at any point in the next 6 months. There’s one graph I intended to use which didn’t make it through to the final published piece. Here it is: Typically recessions have only begun when 8 of the 10...

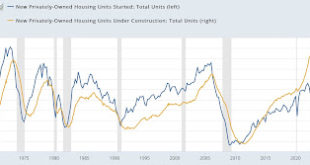

Read More »When will housing construction turn down? A fuller consideration

When will housing construction turn down? A fuller consideration – by New Deal democrat No important economic news today. Also I am traveling this week, so there might be some light posting, as in, I might skip a day or two. But I very much want to see what is happening with house prices, which will be updated tomorrow in the FHFA and Case Shiller indexes, and Wednesday as part of the new home sales release. In the meantime, after I posted...

Read More »September existing home sales and prices decline

September existing home sales and prices decline – by New Deal democrat With the exception of their big impact on prices, I do not particularly pay attention to existing home sales. Their economic impact is small compared with the construction of new homes; at best they add confirmation to a trend in new home sales, permits, and starts. In September, existing home sales did continue to decline, by 2%, to 4.71 million units annualized (Note:...

Read More » Heterodox

Heterodox