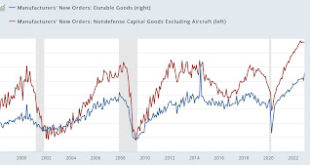

Durable goods orders come in mixed; leaving only employment indicators as short term positives for the economy – by New Deal democrat Manufacturers’ durable goods orders, and in particular “core” orders, which exclude defense and transportation (a/k/a Boeing), are (albeit noisy) a short leading indicator. I normally don’t pay too much attention to them because of that noise, and because they are less reliable than other indicators; but until...

Read More »How “FHFA-CPI” using house prices rather than OER shows a sharp deceleration in inflation

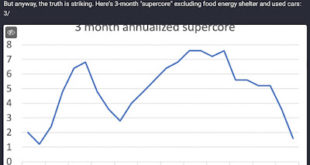

How “FHFA-CPI” using house prices rather than OER shows a sharp deceleration in inflation – by New Deal democrat Paul Krugman made another foray into the “inflation is mostly gone” genre over the weekend with a thread on Mastodon that largely relied on the following graph: concluding that “[A]t this point the burden of proof lies on anyone claiming that we had more than a, well, transitory inflation spike that’s mostly behind us.” I’m...

Read More »Jobless claims continue their string of good news

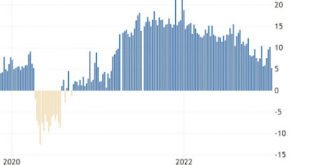

Jobless claims continue their string of good news – by New Deal democrat If yesterday’s economic data was bad, this morning’s was considerably better (I’ll post on housing construction later). Initial jobless claims declined 15,000 to 195,000, tied for their best number in almost 8 months. The 4 week moving average declined 6,500 to 206,000, the best number in over 6 months. Continuing claims, one week earlier, did increase by 17,000 to...

Read More »The important trend in retail sales that Redbook’s weekly report is telling us about

The important trend in retail sales that Redbook’s weekly report is telling us about – by New Deal democrat This is the first of hopefully two posts I will put up today. Tomorrow retail sales for December will be reported. In advance of that, I wanted to discuss their comparison with the weekly high-frequency data of Redbook consumer sales, which I have been paying heightened attention to in the past several months. Here is what Redbook...

Read More »New Deal democrat’s Weekly Indicators for January 9 – 13 2023

Weekly Indicators for January 9 – 13 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. One thing that comes with the territory of high frequency indicators is that they can be noisy. And at no time of the year can they be noisier as during and right after the Holiday season. That appears to be the case this week, as a number of coincident indicators in particular displayed volatility. This should...

Read More »Jobless claims start out 2023 where they left off in 2022

Jobless claims start out 2023 where they left off in 2022 – as positive – by New Deal democrat It took a little while for FRED to post this data today, but with that reason for a delay . . . Initial jobless claims started off 2023 where they left off in 2022, with another good print. Initial claims declined -1,000 to 205,000, while the more important 4 week average declined -1,750 to 212,500. Continuing claims also declined, down -63,000...

Read More »Consumer inflation remains dominated by gas prices (good) and shelter (bad)

Consumer inflation remains dominated by gas prices (good) and shelter (bad) – by New Deal democrat Declining gas prices continue to do wondrous things for the economy. In December they declined from roughly $3.50 to $3.10/gallon. Meanwhile the phantom menace of Owners’ Equivalent Rent continues to drag “core” inflation higher. Details below. Total inflation: -0.1%m/m , +6.4% YoY (12 month+ low), +0.9% since June, 1.8% annual rate Core...

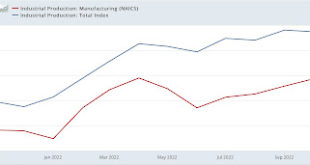

Read More »In-depth Look at Peaking Production and Sales

An in-depth look at production and sales: evidence of peaking in both – by New Deal democrat Yesterday I took an in-depth look at employment. Today let’s take a look at two other important coincident indicators that are looked at by the NBER for guidance as to whether or not the economy is expanding or in recession: production and sales. As I’ve mentioned several times in the past month, as of the latest readings it looks like industrial...

Read More »The main reason for the decline in inflation since June

In which I quibble with Prof. Alan Blinder about the main reason for the decline in inflation since June – by New Deal democrat Alan S. Blinder is getting traction for an opinion piece published in the WSJ concerning the big decline in inflation since June. He acknowledges that“ energy inflation played a meaningful role” but that “the rest of the stunning drop in inflation in 2022 [is] due … What did change dramatically was the supply...

Read More »New Deal democrats Weekly Indicators for January 2 – 6, 2023

Weekly Indicators for January 2 – 6 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. No big changes from the past month or so. The overall economic picture continues to be driven by the effects of the price of gas. As usual, clicking over and reading will bring you up to the virtual moment as to the trends in the economy, and reward me a little bit for my efforts. Weekly Indicators for December...

Read More » Heterodox

Heterodox