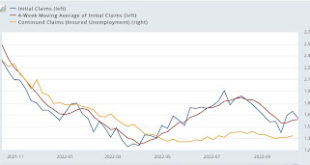

Jobless claims flat for the moment – by New Deal democrat There’s no big news in the jobless claims release this week. Initial claims fell -12,000 to 214,000, but the 4 week average increased 1,250 to 212,250. Continuing claims, which lag somewhat, increased 21,000 to 1,385,000: To the extent there is any discernible trend, I would call it sideways in the past few weeks. I had expected gas prices to continue to rise following OPEC’s...

Read More »New Deal democrat’s Weekly Indicators for October 10 – 14

Weekly Indicators for October 10 – 14 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. Just about everything looks awful. And one bright spot, consumer spending as measured by Redbook, just got dimmer. Needless to say, if consumer spending rolls over, that’s pretty much the ball game.. You can be brought up to the virtual moment in the ugliness by clicking over and reading, and it will reward...

Read More »September real retail sales lay another egg

September real retail sales lay another egg – by New Deal democrat One of my favorite indicators, retail sales, was reported for September this morning, and it came in unchanged. Which means that after factoring in +0.4% inflation in September, real retail sales were down -0.4%. Which is not good, because real retail sales have gone nowhere in 18 months, and have been down every single month since April with the exception of August, and are...

Read More »As the economy slows, so has producer price growth

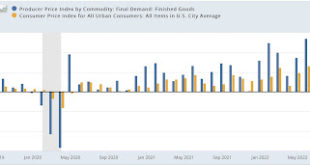

As the economy slows, so has producer price growth – by New Deal democrat Consumer prices for September will be released tomorrow. This morning the upstream producer prices were released. Total PPI rose by 0.4%, after two straight months of decline; but excluding those and December 2021, the lowest monthly increase since November 2020. Here are the monthly changes compared with CPI: YoY producer prices increased at the lowest rate in a...

Read More »Scenes from the September jobs report

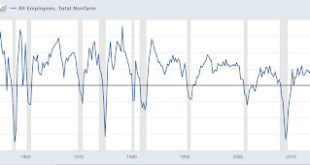

Scenes from the September jobs report by New Deal democrat No important economic news this week until Wednesday. I was going to put up a book review for Indigenous Peoples’ Day, but it got too long and involved, so maybe tomorrow. Instead, here’s a look at some of the more important metrics I was tracking for last Friday’s employment report. Historically, month over month growth in jobs tends to peak near the middle of an expansion (averaged...

Read More »NDd’s Weekly Indicators for October 3 – 7

Weekly Indicators for October 3 – 7 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. This week’s headline was easy, because OPEC’s (and in particular Russia and Saudi Arabia’s) geopolitical decision – aimed directly at the November elections in the US as well as Western support for Ukraine – to cut back production has already caused gas and oil prices to increase sharply. As usual, clicking over...

Read More »Signs and portents of an employment slowdown and a near-term recession

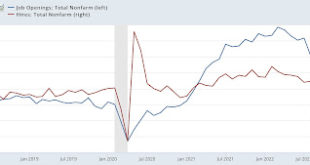

Signs and portents of an employment slowdown and a near-term recession – by New Deal democrat I continue to believe that a recession – possibly a deep if relatively brief one – is likely to start early next year. As I’ve mentioned before, this isn’t just an academic exercise; recessions by definition feature jobs and income losses, which is my primary interest. With that introduction, let’s look at one overall metric, and several which will...

Read More »August JOLTS report: the game of reverse musical chairs in the jobs market is ending

August JOLTS report: the game of reverse musical chairs in the jobs market is ending – by New Deal democrat Since early this year I’ve been making the point that, because of the pandemic, there have been several million fewer persons looking for work, leaving a huge number of unfilled job vacancies, particularly in the face of a roughly 10% higher jump in demand. This has given employees the upper hand, as there are almost always higher...

Read More »September manufacturing new orders and August construction spending both turn down

September manufacturing new orders and August construction spending both turn down – by New Deal democrat As usual, we begin another month and another quarter with important manufacturing and construction data. The ISM manufacturing index has a very long and reliable history. Going back almost 75 years, the new orders index has always fallen below 50 within 6 months before a recession, and in three cases did not actually cross the line...

Read More »Weekly Indicators for September 19 – 23

Weekly Indicators for September 19 – 23 at Seeking Alpha – by New Deal democrat My Weekly Indicators column is up at Seeking Alpha. For the third week in a row, interest rates increased, and gas prices, along with the prices of other commodities, tumbled. While the decline in gas prices is good, the downturn in other commodity prices is a sign of weakening global demand. Once the decline in gas prices stops, I suspect the economic...

Read More » Heterodox

Heterodox