from Lars Syll We live in a world permeated by unmeasurable uncertainty — not quantifiable stochastic risk — which often forces us to make decisions based on anything but ‘rational expectations.’ Our expectations are most often based on the confidence or ‘weight’ we put on different events and alternatives, and the ‘degrees of belief’ on which we weigh probabilities often have preciously little to do with the kind of stochastic probabilistic calculations made by the rational agents as...

Read More »Weekly Indicators for January 3 – 7 at Seeking Alpha

by New Deal democrat Weekly Indicators for January 3 – 7 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. Surprisingly, Omicron has not had any wide impact on the coincident data – at least not yet. On the other hand, the long leading forecast has become weaker, as interest rates have moved in the wrong direction. As usual, clicking over and reading will bring you up to the virtual moment on where the economy is...

Read More »A Better World

from Dean Baker Okay, I’m a bit slow for a New Year’s piece, but what the hell, we can always use a bit of optimism. Anyhow, I thought I would spout a few things about what the world might look like if we didn’t rig the market to give all the money to rich people. Not much new here for regular readers, I just thought I would spell it on paper, since it is a nice backdrop for many of our battles. Before I go through my favorite unriggings, let me start by making a general point, which some...

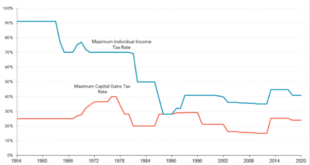

Read More »Maximum USA capital gains and individual tax rates 1954 to 2020

Euro Area inflation: Putin wins. If we let him. By commuting too much.

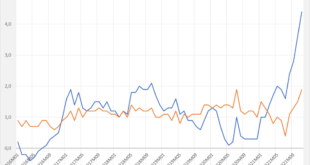

About one month ago I wroute about Euro Area inflation: “troubling but transitory“. One month more of data are in. It is even more troublesome but also more transitory. The increase of the consumer price index is dominated even more by energy prices than one month ago. As the Euro Area is a net importer of energy (among other items: natural gas from Russia.). This particular kind of inflation is, to use confusing terminology, highly deflationary… (for the non-energy sectors)....

Read More »In defence of presentism

I was planning a post with this title, but after some preliminary discussion, a commenter on Twitter pointed me to this piece by David Armitage, which not only has the title I planned to use[1], but a much more complete and nuanced presentation of the argument, as you might expect from the chair of the Harvard history department. I won’t recapitulate his points, except to make an observation about disciplinary differences. The dominant view in history described by Armitage as...

Read More »How could the 1970s stagflation have been avoided?

from Philip George How could the 1970s stagflation have been avoided? The stagflation of the 1970s is widely believed to have heralded the eclipse of Keynesian economics and the rise of monetarism. In a previous post (https://rwer.wordpress.com/2021/08/14/weekend-read-what-caused-the-stagflation-of-the-1970s-answer-monetarism/) I had argued that this was not the case and that the stagflation was directly caused by the monetarist policies of the time. But there is an even more important...

Read More »Open thread Jan. 7, 2022

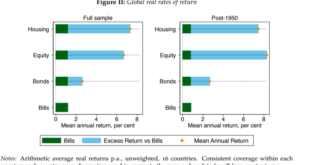

A golden age of macro economic statistics 5. Rates of return.

It still has to feed into the management of pension funds or global wealth funds. Or, does it? It seems that Black Rock is already investing more in real estate… Look here and here. It might well be that this happens because because the smarties at Black Rock read the work of Jorda, Knoll, Kuvshinov, Schularick and Taylor, who gathered data on ‘‘The Rate of Return on Everything, 1870–2015”, including the rate of return on ‘houses’ (better: the rate of return on ‘land underlying...

Read More »Causal identification

from Lars Syll Causal identification requires nonstatistical information in addition to information encoded as data or their probability distributions … This need raises questions of to what extent can inference be codified or automated (which is to say, formalized) in ways that do more good than harm. In this setting, formal models – whether labeled ‘‘causal’’ or ‘‘statistical’’ – serve a crucial but limited role in providing hypothetical scenarios that establish what would be the case...

Read More » Heterodox

Heterodox