from Dean Baker Before anyone starts jumping off buildings, let me give you a few items to think about. 1) The stock market is not the economy. It moves in mysterious ways that often have little or nothing to do with the economy. In October of 1987 it plunged more than 20 percent in a single day. GDP grew 4.2 percent in 1988 and 3.7 percent in 1989. The market did recover much of its value over this period, but we don’t know whether or not it will recover the ground lost in the last week...

Read More »We have the power….

Together with Jeremy Smith of Policy Research in Macroeconomics (PRIME), I wrote this for the website UnHerd.com, edited by Tim Montgomerie. The site’s aim is “to appeal to people who instinctively refuse to follow the herd and also want to investigate ‘unheard’ ideas, individuals and communities.” The piece begins with this quote from Alice Walker: “The most common way people give up their power is by thinking they don’t have any.” Today, the world is confronted by globe-spanning,...

Read More »Open thread Feb. 6, 2018

What goes up. . .

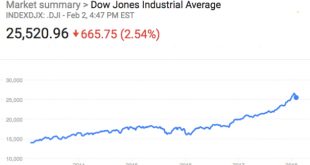

from David Ruccio Must come down. . . I’m not referring to karma or the application of Newton’s law of universal gravitation. No, it’s just the way capitalism works. Take the stock market, for example. Last Friday, the Dow Jones Industrial Average closed down 666 points, or 2.5 percent, its biggest percentage decline since the Brexit turmoil in June 2016 and the steepest point decline since the 2008 financial crisis. The large decline is really no surprise, since the U.S. stock market—a...

Read More »A pan-European living wage as a condition for authentic Freedom of Movement

From Yanis Varoufakis At the source a link to the UK House of Commons discussion where this idea was put forward can be found. Britain used to have wage councils that set the minimum wage per sector. Mrs Thatcher saw to it that they were abolished, together (effectively) with trades unions and council houses – thus yielding the present Precariat-Proletariat whose palpable anger and frustration is evident across the land. There is no doubt that we need to bring back a modernised for of...

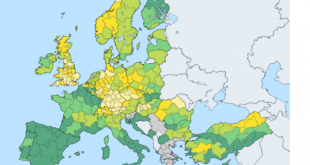

Read More »Low unemployment rates are here again (at least in parts of Europe). Surprise (not): productivity increases, too.

It seems that at this moment in time lower unemployment does not lead to higher inflation but to increasing wages, lower profits and increasing productivity. Since 2008, the (European) world has been characterized by high unemployment, a double dip (2008-2013), a historically unprecedented stalling of productivity and low interest rates. This situation seems to be changing. Since 2014, employment is increasing and unemployment is declining. New growth sectors (like ‘information and...

Read More »The stock market plunges, a major blow against inequality!

from Dean Baker The stock market tumbled by 2.0 percent on Friday. Given that the top 1.0 percent hold a grossly disproportionate share of stock wealth, this means they took a big hit. Are we more equal as a society now? Those who like to focus on wealth measures on inequality would have to say yes. And if the market continues to fall (not a prediction, but it certainly is possible that the correction will continue) then we will see further gain on the inequality front. Suppose it falls...

Read More »Modern economics — confusing models with reality

from Lars Syll What does concern me about my discipline … is that its current core — by which I mainly mean the so-called dynamic stochastic general equilibrium approach — has become so mesmerized with its own internal logic that it has begun to confuse the precision it has achieved about its own world with the precision that it has about the real one … While it often makes sense to assume rational expectations for a limited application to isolate a particular mechanism that is distinct...

Read More »Amazon business model

Via Naked Capitalism: In a scoop, Business Insider reports on how Amazon is creating massive turnover and pointless misery at Whole Food by imposing a reign of terror impossible and misguided productivity targets. Anyone who has paid the slightest attention to Amazon will see its abuse of out of Whole Foods workers as confirmation of an established pattern. And even more tellingly, despite Whole Foods supposedly being a retail business that Bezos would...

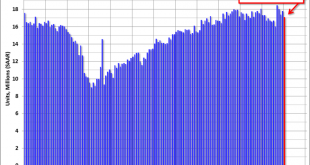

Read More »Vehicle sales, Construction spending, GDP comments, Comments on tax cuts, Comments on fed policy

Even lower than expected as weakness continues: U.S. Light Vehicle Sales decline to 17.1 million annual rate in January By Bill McBride Feb 1, (calculated Risk) — Based on a preliminary estimate from AutoData, light vehicle sales were at a 17.1 million SAAR in January. That is down 1.2% from January 2017, and down 3.8% from last month. Once again, prior month revised down, and current month higher than expected. In any case as the chart shows, construction growth remains...

Read More » Heterodox

Heterodox