We’re publishing some expert ideas about the future of the ECB and monetary policy. Three days ago some ideas of Willem Buiter were published, two days ago some ideas from Richard Werner and yesterday ideas from Thomas Mayer. Today some excerpts from a recent paper by Mike Konczal and Josh Mason. They are not part of the Handelsblatt Shadowcouncil but their ideas often tally with those already published: Pure ‘inflation targeting’ is (mortally?) compromised Hence, central banks are...

Read More »Keynote papers from WEA online conference – Economic Philosophy: Complexities in Economics

Strategies in relation to complexities: From neoclassical cost-benefit analysis to positional analysisPeter SöderbaumIn this essay neoclassical Cost-Benefit Analysis (CBA) is criticized as beinng too simplistic and also too specific in ideological terms. Positional Analysis (PA) is advocated as an alternative based on a definition of economics in terms of multidimensional analysis and … More 13 Comments A Cognitive Behavioral Modelling for Coping with Intractable Complex Phenomena...

Read More »Robert Lucas — nonsense on stilts

from Lars Syll In Michel De Vroey’s version of the history of macroeconomics, Robert Lucas’ declaration of the need for macroeconomics to be pursued only within ‘equilibrium discipline’ and declaring equilibrium to exist as a postulate, is hailed as a ‘Copernican revolution.’ Equilibrium is not to be considered something that characterises real economies, but rather ‘a property of the way we look at things.’ De Vroey — approvingly — notices that this — as well as Lucas’ banning of...

Read More »Thomas Mayer on the ideal European Central Bank

We’re publishing some expert ideas about the future of the ECB (and hence Euro money). Two days ago some ideas of Willem Buiter were published, yesterday we published some ideas from Richard Werner. Today some ideas by Thomas Mayer. Beware the last sentence. EMU is incomplete and dysfunctional The European Monetary Union (EMU) is incomplete and dysfunctional. First, it is incomplete, because the quality of book money created by banks through credit extension differs from country to...

Read More »DeLong and Krugman vs Mankiw

This has become a total mess and I moved my algebra over to my personal blog. The point is that the whole discussion depends on the difference in the long term effect of a cut in a tax on capital income on revenue collected from old capital and the effect ofa cut in a tax on capital on revenue collected from old capital. This is an extremely uninteresting issue.

Read More »How Uber money dominates and distorts economic research on ride-hailing platforms

from Norbert Häring Ride-hailing platform operator Uber is often accused of undermining labor market regulations and of overpricing in times of peak demand by “surge prcies”. Uber counters such accusations not only with high-profile lobbyists, but also with the help of top-notch economists, who cooperate in exchange for exclusive data and lucrative consultancy assignments. Even reputable journals publish such sponsored analyisis as if it was science. A recent paper by renowned MIT...

Read More »Open thread Dec. 8, 2017

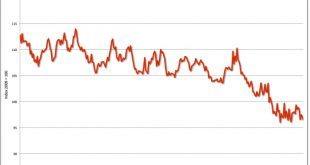

How low can it go?

from David Ruccio The United States is now more than eight years out from the end of the Great Recession and the one-side nature of the recovery is, or at least should be, clear for all to see. Even as unemployment has dipped below the so-called “natural rate,” workers are far from recovering all they’ve last in the past decade. According to the official data illustrated in the chart above, the labor share of national income remains just above the lowest level it reached in the entire...

Read More »Pakistan Today, Here Tomorrow

I cannot speak for the credibility of the Asian Human Rights Commission, nor about this story they published entitled Pakistan: The last nail in the coffin of democracy. However, it does ring true to me based on other material I have read in Western media. To quote liberally, if not to lift wholesale: The year 2017 in Pakistan has been marked by tussles between state institutions and the army. The chain of events that started with a seemingly whimsical...

Read More »Richard Werner on the Ideal ‘European’ Central Bank

As I stated yesterday we will publish some ideas about the future of the ECB. Yesterday some ideas of Willem Buiter were published. He wanted to abolish national central banks, to change the mandate, more transparency and an end to the prohibition of monetary financing. Today: Richard Werner. He warns us that it’s not just about the central bank but also about the ‘normal’ banks. More localism is needed. And the ‘tool’ credit guidance plus more localized banking may be more important...

Read More » Heterodox

Heterodox