from Jayati Ghosh The global financial media are always on the lookout for signs of an impending financial crisis in China – and the dark prognostications about the future made by several external observers relate to both internal and external financial flows. But there are reasons to believe that both concerns may be overplayed, and that what is occurring especially with respect to cross-border flows is a much more complex process reflecting a medium-term plan of the Chinese state, in...

Read More »Open thread Dec. 5, 2017

Two Stories on Cause and Effect

Cause and effect leaves little room for how people want the world to work. Here are two stories illustrating that. From Bloomberg: A Swiss maker of hamburger buns for McDonald’s Corp. said it’s struggling to run a Chicago bakery after it lost a third of its workers in a clampdown on 800 immigrants without sufficient documentation. About 35 percent of the workers at Cloverhill Bakery had to be replaced, according to Zurich-based Aryzta AG. The company,...

Read More »Factory orders, Cash bonuses, Oil prices

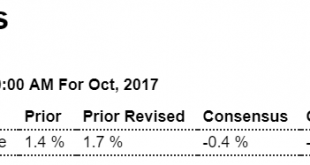

As the chart shows, year over year growth has gone to near 0 since the election, and the hurricane replacement effect has since dissipated: Highlights A big upward revision to core capital goods highlights today’s factory orders report which closes the book on what was a mixed October for manufacturing. The month’s 0.1 percent decline, which is better than expected and actually hits Econoday’s high estimate, reflects a 33 percent downswing for commercial aircraft orders that...

Read More »Lines

from David Ruccio How bad have things gotten in the United States? Nitin Nohria [ht: ja], the dean of Harvard Business School, is sounding the alarm that “class lines. . .have become far more distinct and visible in recent years.” Nohria published his essay at the end of the same week that the U.S. Senate passed its version of the “Tax Cuts and Jobs Act,” which is nothing more than an enormous boon to large corporations and wealthy individuals under the guise of trickledown economics, ...

Read More »Viewed as an element of scientific method, are tests for predictive power best seen as tests for the ability of a theory to predict?

from Adam Fforde Whilst it may superficially appear clear, an alleged ability of a theory to predict is easily shown to depend upon a host of tangled factors, so things are not clear at all. At an extreme, to start with, a theory that is right 51% of the time could feasibly be described as predictive, but is not likely to be. Yet if the point is to win bets placed very many times, then it could be thought of as predictive. Theories from physics, such a Newton’s laws of motion, are widely...

Read More »Denial of the public non-market system, and the consequences

from June Sekera The Denial Public non-market production makes up a quarter to a half or more of all economic activity among advanced democratic nation-states. Yet the public economy’s ability to function on behalf of the populace as a whole is seriously imperiled in many western democracies, and particularly jeopardized in the United States. The surging influence of mainstream economics has been a prime factor in the degradation of the public domain over the last several decades – a...

Read More »Why does capital flow from poor to rich countries? – The case of China

from Michael Joffe In 1978, not long after the death of Mao Zedong, economic reforms began to be implemented. The main changes were: (i) rural households were now allowed to keep their own surpluses (the “household-responsibility system”); (ii) Township and Village Enterprises were allowed to operate in a manner similar to capitalist firms; (iii) Special Economic Zones such as Shenzhen were set up, based on foreign capital and the export market; and (iv) State-Owned Enterprises were...

Read More »Trickledown economics—then and now

from David Ruccio Robert McElvaine, premier historian of the first Great Depression (whose books we have used to teach A Tale of Two Depressions), argues that Republicans today are repeating the same mistakes as the Republicans who were in charge during the 1920s, whose trickledown policies led to the spectacular crash of 1929. As a historian of the Great Depression, I can say: I’ve seen this show before. In 1926, Calvin Coolidge’s treasury secretary, Andrew Mellon, one of the world’s...

Read More »Construction spending, Rig count, Fed US leading index, Flynn news

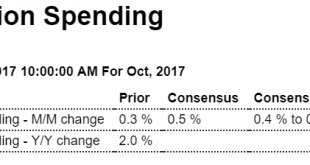

Up a bit this month but as per the chart it’s bumping along at recession type levels: Highlights It’s not housing that drove construction spending up a very sharp 1.4 percent in October but non-residential activity which had been lagging in this report. Spending on private non-residential construction jumped 0.9 percent in the month with strength centered in office construction and transportation construction. Despite the improvement, year-on-year spending on the...

Read More » Heterodox

Heterodox