A whole score of Caribbean Islands seem to have been wiped out by a whole series of unusually strong hurricanes. These islands (Dominica, Puerto Rico, St-Maarten, Anguilla, …) need loads of outside help. But these societies have to be resilient, too. Which means that they need money suited to this task: cash. See below. There is however a powerful lobby which tries to get rid of cash (i.e. government money) and to replace this with electronic bank moneys. Sad. Aside – once government...

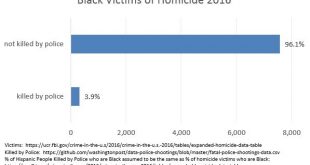

Read More »People Killed by Police, 2016

As a follow up to my post on homicides in 2016, I decided to combine homicide data from the FBI with figures from the police shooting database from the Washington Post. The only difficulty is that the FBI classifies people as being from Black, White, Other, or Unknown races, whereas the Washington Post breaks out other groups, such as Hispanic. Because Hispanic people can be Black, White, or Other (as per FBI classfication), it is necessary to assign...

Read More »From highway to master

from David Ruccio Adam Smith’s Wealth of Nations makes for uncomfortable reading these days. That’s because, as my students this semester have learned, the father of modern mainstream economics—who has become so closely (and mistakenly) identified with the invisible hand—held a narrow theory of money and advocated extensive regulation of the banking sector. This is contrast to the obscene growth of banking in recent decades, which Rana Foroohar reminds “isn’t serving us, we’re serving...

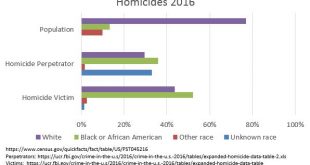

Read More »2016 Homicides

The FBI just released data on homicides for 2016. In light of the various protests by the BLM and now football players, I thought I’d provide a a graph. It breaks out population, homicide perpetrators and homicide victims by race. (click to embiggen) Note… the number of offenders exceeds the number of victims. This is a result of some homicides involving multiple perpetrators. This can happen, for example, if both the shooter and the getaway driver in a...

Read More »Neoliberal ‘ethics’

from Lars Syll As we all know, neoliberalism is nothing but a self-serving con endorsing pernicious moral cynicism. But it’s still sickening to read its gobsmacking trash, maintaining that unregulated capitalism is a ‘superlatively moral system’: The rich man may feast on caviar and champagne, while the poor woman starves at his gate. And she may not even take the crumbs from his table, if that would deprive him of his pleasure in feeding them to his birds. David Gauthier Morals by...

Read More »Ugly and Uglier

from Peter Radford One reason I have not been very communicative in the past two months is my disgust at the state of the nation. America is simply not the place I came to live in back in the late 1970’s. It is a tired, aging, and deeply unsettled country grappling with an identity crisis and its steady loss of economic energy. America as a myth was always built around the notion that it was a “land of opportunity”. That opportunity was open to as many interpretations as there were people...

Read More »Self-Driving Cars

Being a parent of a child under 16 means trying to figure out ways to get said child from here to there, say from school to home, and from home to after school activities, and then back. There is often a fair amount of juggling involved – one or more, er, “caregivers” are typically involved in the process To an economist, therefore, being able to put a child in a self-driving car means, potentially, more output in the economy. That’s a parent or...

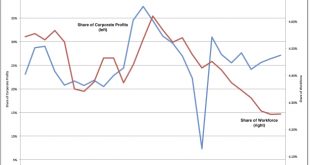

Read More »Golden Age for American workers?!

from David Ruccio We’ve been hearing this since the recovery from the Second Great Depression began: it’s going to be a Golden Age for workers! The idea is that the decades of wage stagnation are finally over, as the United States enters a new period of labor shortage and workers will be able to recoup what they’ve lost. The latest to try to tell this story is Eduardo Porter: the wage picture is looking decidedly brighter. In 2008, in the midst of the recession, the average hourly pay...

Read More »Vehicle sales, Homebuyer affordability, Bank loans, FX reserves, Growth index, Rail traffic

Looking like an uptick here, some of it weather related? From WardsAuto: Forecast: SAAR Expected to Surpass 17 Million in September A WardsAuto forecast calls for U.S. light-vehicle sales to reach a 17.5 million-unit seasonally adjusted annual rate in September, following August’s 16.0 million SAAR and ending a 6-month streak of sub-17 million figures. In same-month 2016, the SAAR reached 17.6 million. Preliminary assumptions pointed to October, rather than September, as...

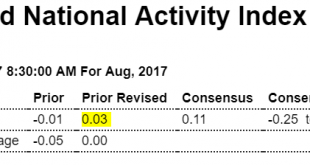

Read More »Chicago Fed, Small business optimism, NY Fed comments

Note the shift: From NY Fed’s Dudley. I added a chart after several of his statements so you can seewhat he sees as support for his statements. Looks a lot to me like he’s trying to manage expectations? “The fundamentals supporting continued expansion are generally quite favorable. Low unemployment, sturdy job gains, and rising wages—even at a pace below previous expansions— are lifting personal income. Household wealth has been boosted by rising home and equity...

Read More » Heterodox

Heterodox