United States Code Title 18 § 227 #TakeAKnee

Read More »Protest this!

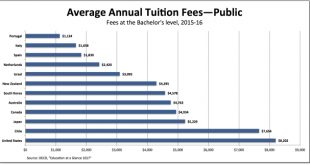

from David Ruccio Back in 2011, thousands of Chilean students participated in protests against the high cost of higher education. The most famous took place in front of La Moneda, the president’s palace, dancing to Michael Jackson’s “Thriller.” According to the latest statistics from the OECD report, “Education at a Glance 2017,” the costs of a college education in Chile were still very high in 2015-16. But they’re still not as high as in the United States, where it costs more to go to...

Read More »Open thread Sept. 22, 2017

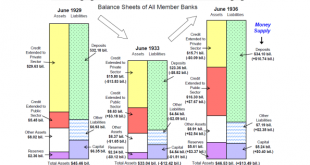

Why, to the detriment of the economics profession, MiltonFriedman ignored Hyman Minsky’s advice

Weird: fifty years after Schumpeter and one hundred years after John Stuart Mill they did not mention ‘credit’. Let alone ‘private credit’. Mill’s idea that private credit creation often decisively contributes to bubbles, and bursts, is absent from the whole thing. The Schumpeterian idea that credit financed investments lead to economic growth (and monetary changes) is alien to their concept. Even the Irving Fisher idea that there are different kinds of money with different kinds of...

Read More »Habit Formation

There’s a fascinating but barely-accessible-to-a-non-neurologist article about habit formation. Here is a pretty good summary, albeit with an un-helpful title: A single kind of neuron deep within the brain serves as a “master controller” of habits, new research in mice indicates. Some habits are helpful, such as automatically washing your hands before a meal or driving the same route to work every day. They accomplish an important task while freeing up...

Read More »Putting predictions to the test

from Lars Syll It is the somewhat gratifying lesson of Philip Tetlock’s new book that people who make prediction their business — people who appear as experts on television, get quoted in newspaper articles, advise governments and businesses, and participate in punditry roundtables — are no better than the rest of us. When they’re wrong, they’re rarely held accountable, and they rarely admit it, either. They insist that they were just off on timing, or blindsided by an improbable event,...

Read More »Justice Denied

From the Daily Mirror: None of the 400 citizens returning here after fighting for Islamic State in Syria and Iraq have been charged with war crimes. Yet the Council of Europe’s legal affairs committee recently ruled membership of the terror group, also known as Daesh, is enough for prosecution at the Hague’s International Criminal Court. Labour Shadow Minister Liam Byrne, representing Britain, backed the decision. He said: “We know British citizens were...

Read More »Water, health and wealth

Nava Ashraf, Edward Glaeser, Abraham Holland, Bryce Millett Steinberg NBER Working Paper No. 23807 Providing clean water requires maintenance, as well as the initial connections that are typically measured. Frequently, the water supply fails in the developing world, especially when users don’t pay the marginal cost of water. This paper uses the timing of frequent, unexpected water service outages in Lusaka, Zambia to identify the short-term impacts of piped water access on contagious...

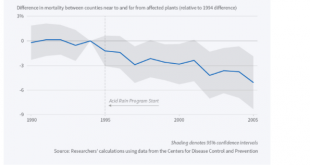

Read More »Acid rain, health and government policy

A recent meme of the fact free right in my country (the Netherlands) is the idea that the Acid Rain problem spontaneously disappeared. It didn’t. It was the government, stupids! And it is a really serious problem which did and does require attention. Source

Read More »Break this!

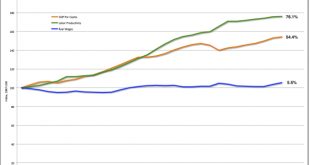

from David Ruccio David Brooks should have left well enough alone. Middle-class wage stagnation is the biggest economic fact driving American politics. Over the past many years, so the common argument goes, capitalism has developed structural flaws. Economic gains are not being shared fairly with the middle class. Wages have become decoupled from productivity. Even when the economy grows, everything goes to the rich. But then Brooks spends the rest of his column trying to convince us...

Read More » Heterodox

Heterodox