Read More »

Let the Punishment Fit the Crime, Even if the Crime is Imaginary

This can’t be healthy: Matthew Halls was removed as artistic director of the Oregon Bach Festival following an incident in which he imitated a southern American accent while talking to his longstanding friend, the African-American classical singer Reginald Mobley. It is understood a white woman who overheard the joke reported it to officials at the University of Oregon, which runs the festival, claiming it amounted to a racial slur. Here are the mechanics...

Read More »Who’s working for Facebook?

from David Ruccio There are plenty of reasons to be interested in—and, even more, concerned about—Facebook. Many of them are raised in the recent review of Facebook-related books by John Lanchester [ht: db]: the fragmentation of the polity (via the targeting of posts), the dissemination of “fake news” (which played an important role in the 2016 U.S. presidential election), the undermining of other livelihoods (such as journalism and music), the level of surveillance of users (much more...

Read More »Time for critics of economics critics to move on!

from David Orrell and WEA Commentaries There is a growing trend for economists to write articles criticising the critics of economics. These articles follow a similar pattern. They start by saying that the criticisms are “both repetitive and increasingly misdirected” as economist Diane Coyle wrote, and might complain that they don’t want to hear one more time Queen Elizabeth’s question, on a 2008 visit to the London School of Economics: “Why did nobody see it coming?” Economist Noah Smith...

Read More »Modern society

from Lars Syll

Read More »Everyone can create money

from Merijn Knibbe “Everyone can create money; the problem is to get it accepted.“ Hyman Minsky Summary. Central banks the world over publish sophisticated Flow of Funds data which shows who and how and, to an extent, why all kinds of money are created and used and if stocks and flows of debt and money are becoming a threat to stability. Institutional analysis of these data, which looks at different kinds of credit as well as at different kinds of money and using a grid which enables the...

Read More »Open thread Sept. 8, 2017

ACT Scores and Achievement Gaps

The Washington Post has a story on ACT scores: New results from the nation’s most widely used college admission test highlight in detailed fashion the persistent achievement gaps between students who face disadvantages and those who don’t. Scores from the ACT show that just 9 percent of students in the class of 2017 who came from low-income families, whose parents did not go to college, and who identify as black, Hispanic, American Indian or Pacific...

Read More »Beyond the trinity formula

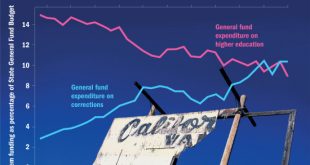

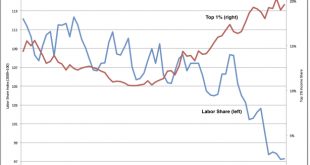

from David Ruccio John Hatgioannides, Marika Karanassou, and Hector Sala are absolutely right: mainstream macroeconomists and policymakers never venture beyond the “holy trinity” of economic growth, inflation, and unemployment.* Everything else, including the distribution of income and wealth, is relegated to the fringes. This problem, while always serious, has been magnified in recent decades as inequality has grown to obscene levels, particularly in the United States. The labor share...

Read More »The Othering of “Economic Illiteracy”

Noah Smith has written a column at BloombergView, “Don’t Believe What Jeff Sessions Said About Jobs,” which scolds Attorney General Jeff Sessions for “terrible economics.” That may be a bit like carping about Charles Manson’s hairstyle or critiquing David Duke’s academic integrity. But there is something far more dangerous going on with Smith’s knee-jerk invocation of the lump-of-labor fallacy to rebuke Sessions and, presumably, those who might find...

Read More » Heterodox

Heterodox