from Lars Syll Back in 1991, when yours truly earned his first PhD with a dissertation on decision making and rationality in social choice theory and game theory, I concluded that “repeatedly it seems as though mathematical tractability and elegance — rather than realism and relevance — have been the most applied guidelines for the behavioural assumptions being made. On a political and social level, it is doubtful if the methodological individualism, ahistoricity and formalism they are...

Read More »The Indian Economy: 70 years after Independence

from C. P. Chandrasekhar The defining feature of the economic programme of independent India’s first government was to accelerate the transition to a modern economy dominated by industry. Agriculture and related activities at that time accounted for around half of GDP and modern industry in the form of factory establishments for just above 6 per cent. Thus, colonial rule had made India the victim of the barriers to productivity increase typical of predominantly agrarian economies. These...

Read More »Crime and Punishment

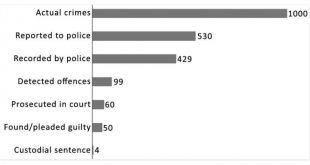

I stumbled on a blog post by Jerry Ratcliffe, who is a Professor of Criminal Justice and Director of the Center for Security and Crime Science at Temple University, Philadelphia, and a former police officer with London’s Metropolitan Police (UK). From one of this posts: Graph no. 2 is another image from my Intelligence-Led Policing book. The crime funnel represents what happens to a random selection of 1,000 crimes that affect the public (top bar). It...

Read More »Trading in Myths

from Lars Syll Pretending that the distribution of income and wealth that results from a long set of policy decisions is somehow the natural workings of the market is not a serious position. It might be politically convenient for conservatives who want to lock inequality in place. It is a more politically compelling position to argue that we should not interfere with market outcomes than to argue for a system that is deliberately structured to make some people very rich while leaving...

Read More »Trade, SUV’s, Redbook retail sales, Trump and Harvey

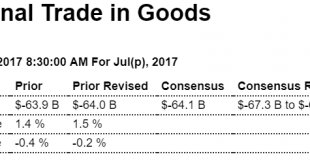

No ‘improvement’ here: Highlights Third-quarter GDP is off to a slow start, at least for international trade in goods where the July trade gap widened more than $1 billion to $65.1 billion. Exports fell 1.3 percent and were pulled down by a sharp fall in vehicles and also consumer goods which are two weak categories for the US. Helping to ease the effect of exports was a 0.3 percent decline in imports where foreign vehicles, which are usually in strong demand, fell 2.8...

Read More »Open thread Aug. 29. 2017

Slick maneuvers

from David Ruccio Corporate duplicity, it seems, knows no bounds. First, ExxonMobil misled the public about climate change for years, even as its research echoed the growing scientific consensus that global warming is real and caused by human activity. Then, while various states attorneys-general launched investigations of whether Exxon deceived shareholders and the public to protect its profits, the Wall Street Journal published 21 opinion pieces about current or potential Exxon...

Read More »Baltimore Trade-off

I’ve been following the situation in Baltimore since the death of Freddie Gray because my wife hails from that city. Here is what is happening now according to the Baltimore Sun: Baltimore’s top law enforcement leaders say they are working closely together to fight crime — but the community should not expect a turnaround soon. State’s Attorney Marilyn J. Mosby and Police Commissioner Kevin Davis, in an exclusive joint interview with The Baltimore Sun,...

Read More »Durable goods orders, Vehicle sales, Credit check

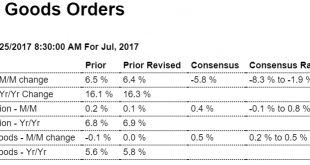

Nothing impressing me here, as per the chart: Highlights Durable goods orders came in as billed with a steep aircraft-related decline for the headline, at minus 6.8 percent, contrasting with solid gains for ex-transportation at 0.5 percent and core capital goods (nondefense ex-aircraft) at 0.4 percent. A special plus in the report, and one that will lift GDP, is a sharp pickup in shipments of core capital goods, up 1.0 percent in July with June revised 2 tenths higher to 0.6...

Read More »Media’s biased reporting on China serves only the rich and powerful

from Dean Baker This month, a leading newspaper ran a column bashing China by two former U.S. intelligence officials. The piece claimed that the United States loses $600 billion a year due to “intellectual property theft” and that “China accounts for most of that loss.” This was striking for two reasons. First, the number is obviously absurd. Reputable news outlets usually make writers provide some backup for the numbers they use. That doesn’t seem to have been the case here. Second, if...

Read More » Heterodox

Heterodox