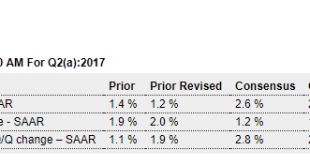

Up as expected though way down from initial forecasts as data deteriorated, and q1 was revised lower. More q2 data will be released over the next month when the first revision will be released. Consumer spending up vs prior quarter (but down year over year) even as consumer credit numbers decelerate, with ‘goods’ contributing over 1% to growth. Residential investment fell, in line with the deceleration in real estate lending, as did auto related spending, in line with...

Read More »When ignorance is bliss

from Lars Syll The production function has been a powerful instrument of miseducation. The student of economic theory is taught to write Q = f(L, K) where L is a quantity of labor, K a quantity of capital and Q a rate of output of commodities. He is instructed to assume all workers alike, and to measure L in man-hours of labor; he is told something about the index-number problem in choosing a unit of output; and then he is hurried on to the next question, in the hope that he will forget...

Read More »Myth of “the market”

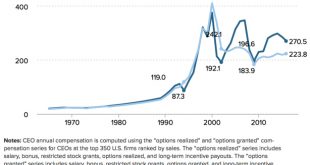

from David Ruccio We’ve all heard it at one time or another. Why is the price of gasoline so high? Mainstream economists respond, “it’s the market.” Or if you think you deserve a pay raise, the answer again is, “go get another offer and we’ll see if you’re worth it according to ‘the market’.” And then there’s CEO pay, which last year was 271 times the average pay of workers. Ah, it’s what “the market” has determined the appropriate compensation to be. “The market” explains...

Read More »What so many critiques of economics gets right

from Lars Syll Yours truly had a post up the other day on John Rapley’s Twilight of the Money Gods. In the main I think Rapley is right in his attack on contemporary economics and its ‘priesthood,’ although he often seems to forget that there are — yes, it’s true — more than one approach in economics, and that his critique mainly pertains to mainstream neoclassical economics. Noah Smith, however, is not too happy about the book: There are certainly some grains of truth in this standard...

Read More »Open thread July 28, 2017

Globalizers and global liars

from Dean Baker As president, Donald Trump has continued to use the same protectionist rhetoric he used during the campaign, even though he has not done much to date to follow through with protectionist policies. Nonetheless, his comments have prompted outrage among most of the media, which is committed to supporting the trade policies of recent administrations. In this respect it is striking how the media slavishly follow the major features of recent trade agreements as the definition of...

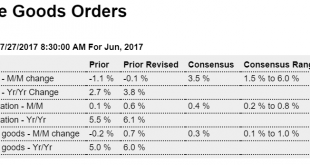

Read More »Durable goods orders, Inventories, Trade, Consumer charge offs, Euro lending

The theme of today’s data seems to be higher q2 gdp than otherwise, but for the wrong reason- over production- as spending weakened and unwanted inventories rose. Nice headline number for durable goods orders but most of the gain was in civilian aircraft which happens every year about this time. However, as previously discussed, the manufacturing sector is chugging along at modest levels after the large dip from the drop in oil related capital expenditures about 2.5 years...

Read More »Redefining economics in terms of multidimensional analysis and democracy

from Peter Söderbaum, “Do we need a new economics for sustainable development?”, real-world economics review, issue no. 80, 26 June 2017, pp. 32-44. A proposed new theoretical perspective starts with a partly different definition of economics: “Economics is multidimensional management of (limited) resources in a democratic society” Why “multidimensional” management? Multidimensional goes against the one-dimensional analysis of neoclassical theory and method. “Monetary reductionism” is no...

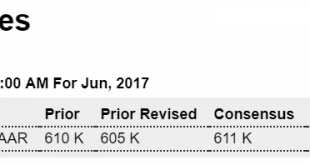

Read More »New home sales, CAB, house prices

New homes aren’t built without permits, which have flattened as well, and are therefore not adding as much to growth: Highlights New home sales are steady near the best levels of the expansion, at a 610,000 annualized rate in June. The 3-month average is 597,000 which is, however, noticeably below the first-quarter cycle peak of 617,000. This is a negative for second-quarter residential investment in Friday’s GDP report. But the upshot of today’s report is mostly positive....

Read More »Three Methodologies

from Asad Zaman This is a summary of the introduction/motivation part of Lecture 15 on Advanced Microeconomics II, delivered at PIDE in Spring Semester 2017. The lecture is about 19th Century European History, and how it is deeply entangled with Modern Economic Theory. We cannot understand one without the other. 19th Century European Economic Ideas In Historical Context. “… the race is not always to the swift, nor the battle to the strong …” Ecclesiastes 9:11 In the late 19th century, a...

Read More » Heterodox

Heterodox