Let Dan and I know please.

Read More »Ricardo’s trade paradigm — a formerly true theory

from Lars Syll Two hundred years ago, on 19 April 1817, David Ricardo’s Principles was published. In it he presented a theory that was meant to explain why countries trade and, based on the concept of opportunity cost, how the pattern of export and import is ruled by countries exporting goods in which they have comparative advantage and importing goods in which they have a comparative disadvantage. Although a great accomplishment per se, Ricardo’s theory of comparative advantage, however,...

Read More »Consumer confidence, Euro zone comments

Consumer confidence (soft data) up for the month but retail sales (hard data) continue to decelerate:No one talking about how this reduced what would have been private sector income and net financial assets by exactly that much, as the savings on interest was not spent by the governments but instead went towards deficit reduction: Euro zone budget savings could complicate ECB rate hikes: Bundesbank By Balazs Koranyi Jul 24 (Reuters) — Euro zone countries have saved nearly a...

Read More »Open thread July 25. 2017

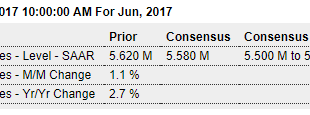

Existing home sales, Services pmi

Mirrors the deceleration in mortgage lending: Highlights The slip in pending home sales was no false signal as existing home sales fell 1.8 percent in June to a lower-than-expected annualized rate of 5.520 million. Year-on-year, sales are still in the plus column but not by much, at 0.7 percent which is the lowest reading since February. Compared to sales, prices are rich with the median of $263,800 up 6.5 percent from a year ago. Another negative for sales is supply which...

Read More »Globalization—how did they get it so wrong?

from David Ruccio There is perhaps no more cherished an idea within mainstream economics than that everyone benefits from free trade and, more generally, globalization. They represent the solution to the problem of scarcity for the world as a whole, much as free markets are celebrated as the best way of allocating scarce resources within nations. And any exceptions to free markets, whether national or international, need to be criticized and opposed at every turn. That celebration of...

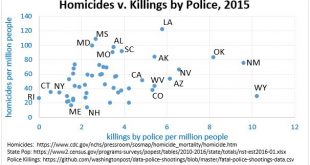

Read More »More on Police Shootings and Race

In my last post, I linked to a post by Peter Moskos noting that: People, all people, are 1.6 times more likely, per capita, to be shot and killed by police in states that are less than 10 percent black compared to states more than 10 percent African American. Blacks are still more likely than whites, per capita to be shot overall. But this ratio (2.6:1) doesn’t change significantly based on how black a state is. For both whites and blacks, the likelihood of...

Read More »The balanced budget paradox

from Lars Syll The balanced budget paradox is probably one of the most devastating phenomena haunting our economies. The harder politicians — usually on the advise of establishment economists — try to achieve balanced budgets for the public sector, the less likely they are to succeed in their endeavour. And the more the citizens have to pay for the concomitant austerity policies these wrong-headed politicians and economists recommend as “the sole solution.” One of the most effective ways...

Read More »Digital banks and fintechs

from Maria Alejandra Madi Bank transactions by internet and mobile banking have sharply increased since the 2008 global financial crisis. In this digital environment, new technologies – such as advanced analytics and big data, in addition to the use of robotics, artificial intelligence, besides new forms of encryption and biometrics – have been enabling changes in the provision of financial products and services. The current wave of financial innovations is being increasingly oriented to...

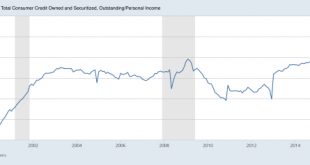

Read More »‘Til debt do us part

from David Ruccio Sometimes you just have to sit back and admire capitalism’s ingenuity. It’s able to make profits twice over. First, capitalists know that, when they keep workers’ wages down—even when there’s “full employment”—they can make spectacular profits. And, second, they can make additional profits by loaning money to those same workers, who are desperate to purchase goods and services and send their children to college, thereby financing the demand for the goods and services...

Read More » Heterodox

Heterodox