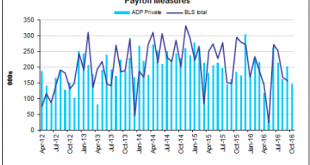

Weakening further ever since the collapse in oil capex: speaks for itself:

Read More »Greece, Russia and all that…

During the first Putin presidency, the Russian government gave a very high priority to paying back Russian international debt and used quite a lot of the income from oil to do this. Jeffrey Sachs answers why (also read the last paragraph): The lack of Western assistance The lack of Western assistance was grim and was my greatest frustration[32] during late 1991 and 1992. The early days were inauspicious to say the least. When the G-7 deputies came to Moscow in late November 1991, just...

Read More »The editor has gone to Zanzibar

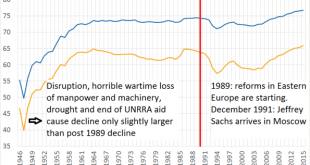

For the first time since 1964 Russian male life expectancy reached a new record

For a kind of prediction of the 1947 mortality crisis you will find a march 1947 article by Ernest Germain published by the fourth international here (I love the internet). Basically, the exhaustion of war time stocks (during the war partly provided by the 1943 United Nations Relief and Rehabiliation Administration), the horrible losses of people manpower suffered during the war, the dislocation and loss of production capacity caused by the war and a terrible drought in 1946 caused a...

Read More »Where did all the Ukrainian refugees go…?

The population of Russia is growing again – because Russia accepts millions of Ukrainian refugees. Russia is supposed to be a world-class bully again – but if so (and it is indeed making things in Syria even more vicious than ‘we’ already did…) it is clearly playing outside its league. It is a country with a dwindling population and a dwindling GDP. But while preparing the graph above, I wondered why, after the post 1990 demographic catastrophe (look here for a The Lancet article about...

Read More »Wages not commensurate with labor productivity in the USA

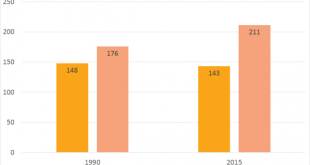

Since 1975 workers have received almost none of the gains of increased productivity, which has increased by 143% since around 1975 (figure 14). In other words, productivity has more than doubled, while workers received none of the gains. This can be explained by the deindustrialization of the US economy, as heavy industries followed by manufacturing in general were exported to Asia. Due to this trend there was a huge decrease in unionization which went from 39% in 1940 to around 10% in...

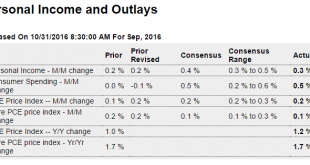

Read More »Personal Income and Spending, Chicago PMI, Dallas Fed

Personal income a bit below expectations, spending met expectations but last month revised down a bit. And the GDP report already had consumer spending way down and less than expected and we already know auto sales are falling behind last year’s totals: Highlights Personal income rose a solid but slightly lower-than-expected 0.3 percent in September with the wages & salaries component, which weakened in August, also at plus 0.3 percent. Consumer spending was especially...

Read More »The oddity of a Brexit odyssey

By Jamie Morgan Globalizations is a leading inter-disciplinary journal with an interest in political economy. It has notably published on exploitative work practices, the Arab Spring, land grabs, climate change, and the power asymmetries and future prospects of governance processes. The journal recently organized a special forum on Brexit. The forum includes contributions from many points of view: British history, the history of European integration, the role of class, the rise of the...

Read More »James Tobin

James Tobin was a leading - perhaps the leading - American neo-Keynesian macroeconomist in the era of Keynesian dominance after World War II that extended through to the early 1970s. Along with growth theorist Robert Solow and micro and trade theorist Paul Samuelson, the three substantially shaped what became known as the neoclassical synthesis which [...]

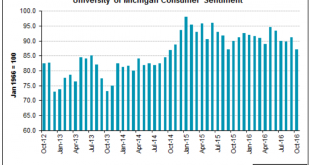

Read More »Consumer sentiment, GDP comments and charts

Doesn’t look like ‘improvement’ the way I see it? Looks like others are seeing it my way as well this time: Sorry, but the economy’s growth spurt isn’t going to last By Jeff Cox Oct 28 (CNBC) — Excluding “transitory” effects, the actual growth rate would have been closer to the 1.5 percent rate of the past four quarters. Still decelerating since the collapse of oil capex (and the presumed windfall for the consumer…): This is a relatively new series. so don’t know if it...

Read More » Heterodox

Heterodox