from David Ruccio It is extraordinary that the hegemonic economic theory in the world today—neoclassical economics—still lacks an adequate theory of the firm. It beggars belief both because neoclassical economics is the predominant theory that is taught to hundreds of thousands of students every year and used to make sense of the world and formulate policy in countless think thanks and government agencies and because the firm (or enterprise or corporation) is one of the central...

Read More »NAFTA has harmed Mexico a lot more than any wall could do

from Mark Weisbrot President Trump is unlikely to fulfill his dream of forcing Mexico to pay for his proposed wall along the United States’ southern border. If it is built, it would almost certainly be US taxpayers footing the bill, with some estimates as high as $50 billion. But it’s worth taking a step back to look at the economics of US-Mexican relations, to see how immigration from Mexico even became an issue in US politics that someone like Trump could try to use to his advantage....

Read More »Gas prices and likely January inflation to continue the stall in real wage growth

- by New Deal democrat Gas prices and likely January inflation to continue the stall in real wage growth A big relatively unnoticed concern over the last year has been the end of deflation due to the end of the decline in gas prices. Coupled with really tepid wage growth, this is going to affect consumers, who are 70% of the US economy. Gas prices aren’t a headwind yet. They have increased about 25% YoY. In the past, it has taken a 40% or more spike YoY to...

Read More »The Swedish model is dying

from Lars Syll The 2017 OECD Economic Survey of Sweden — presented today in Stockholm by OECD Secretary-General Angel Gurría and Sweden’s Minister of Finance Magdalena Andersson — points out that income inequality in Sweden has been rising since the 1990s. I would say that what we see happen in Sweden is deeply disturbing. The rising inequality is outrageous – not the least since it has to a large extent to do with income and wealth increasingly being concentrated in the hands of a very...

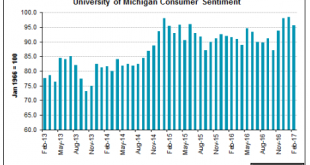

Read More »Consumer sentiment, China policy, Iran

Trumped up expectations fading: No telling why our new President changed his mind on this one. Might have something to do with a kosher house being a two china policy… ;) White House confirms Trump’s agreement to honor ‘One China’ policy By Everett Rosenfeld Feb 10 (CNBC) — A White House statement confirmed a Thursday night report that President Donald Trump had agreed to honor China’s “One China” policy in his first call with the country’s president.“President Donald J....

Read More »Not Friedman!

from Peter Radford While I was checking the inner debates the Republicans are having about health care I came across this quote [in an article written by Tierney Sneed in TPM] from Representative David Brat, an extreme right winger: “When it comes to how much you want to park in the HSAs for providing catastrophic care, that, when it comes, to the safety net, we have to find the Milton Friedman way of doing that,” Brat said. “The Price bill would do tax credits. I am not a fan of those...

Read More »Open thread Feb. 10, 2017

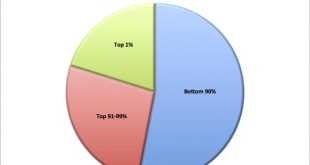

What about that pie?

from David Ruccio The U.S. economic pie couldn’t be carved up much more unequally. The top 10 percent manages to capture about 47 percent of total pre-tax income, while the bottom 90 gets the rest. The top 1 percent alone walks away with 20 percent of national income. And, of course, the distribution of wealth is even more unequal: the bottom 90 percent owns only 28 percent of total household wealth, while those in the top 1 percent own more than 37 percent. As Justin Fox explains, the...

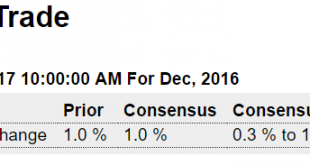

Read More »Wholesale inventories and sales, Trump comments

Highlights Inventories have been on the climb raising the risk of unwanted overhang. But overhang isn’t the story of the December wholesale trade report where a large 1.0 percent build is far outmatched by a 2.6 percent surge in sales. The results pull the stock-to-sales ratio down sharply to 1.29 from 1.31. Wholesale auto inventories rose 2.0 percent in December, a month that proved very strong for retail auto sales and was also very strong for wholesale sales where autos...

Read More »The Econocracy review – how three students caused a global crisis in economics

from today’s Guardian In the autumn of 2011, as the world’s financial system lurched from crash to crisis, the authors of this book began, as undergraduates, to study economics. While their lectures took place at the University of Manchester the eurozone was in flames. The students’ first term would last longer than the Greek government. Banks across the west were still on life support. And David Cameron was imposing on Britons year on year of swingeing spending cuts. Without us...

Read More » Heterodox

Heterodox