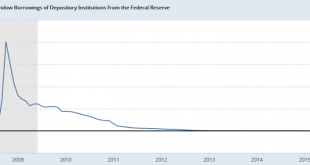

Note that there was little or no demand from member banks to borrow from the regional reserve banks, yet they decided the rate needed to be higher…;) All but one bank requested to raise an interest rate the U.S. central bank places on its loans to commercial banks for the month of December, according to Federal Reserve Board discount rate minutes released on Tuesday. The Federal Reserve Bank of Minneapolis asked to leave the discount rate unchanged, according to Fed minutes....

Read More »Small business index, Redbook retail sales, Jolts, Consumer credit, Retail sales forecast

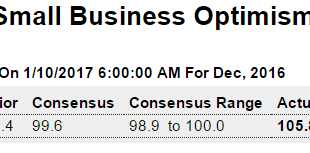

Still Trumped up expectations: Highlights The small business optimism index soared 7.4 points in December to 105.8, the highest reading since December 2004. The outsized increase far exceeds expectations and follows a robust 3.5-point rise in November. NFIB said business owners who expect better economic conditions accounted for about half of the overall increase, with a net 50 percent of respondents expecting that the economy will improve, a 38 point leap up from November....

Read More »Labor market conditions index

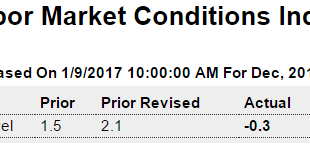

From the Fed’s research: Highlights The economy may be at full employment but it’s not helping the labor market conditions index which remains flat. For the first negative score since May, December’s index comes in at minus 0.3. Based on this report, there may be more slack than suspected and less risk perhaps of wage inflation. Considered experimental, the labor market conditions index, published by the Federal Reserve, is a composite of 19 separate indicators. ...

Read More »More evidence of early US involvement in Indian demonetisation

from Norbert Haering When Prime minister Narendra Modi took the bulk of Indian cash out of circulation, he caused great hardship for many Indians, while a disruption-loving tech elite and political establishment asked for optimism and patience. In an earlier piece I have provided some indications for US involvement in that scheme. In this piece, I am adding some more, including earlier, evidence, summarize the evidence and ask if this evidence is reasonably compatible with the...

Read More »European inflation is NOT soaring

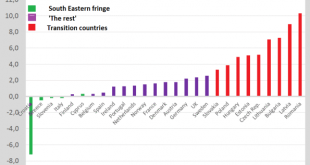

Predictably (as energy prices can’t fall forever) consumer price inflation in the EU recently increased. The present level is 1,1% which is, in a historical perspective, outright low. Also, ‘core’ inflation (which, unlike consumer price inflation, has never been negative) remained subdued and even below 1%. Predictably, however, people already start to scream that inflation is soaring and we should be afraid about worthless money. They are wrong. Four reasons: Inflation does not measure...

Read More »Links: dowries are paid in cash. And disruptive technology.

Very cool webpage which maps CO2 content of electricity in different European countries in real time (i.e.: German content drops when sun start to shine in Germany), as well as international flows. Blackest country: Poland. Greenest: Norway (hydro), France (nuclear). I’ve been tweeting a bit with global warming deniers. They are soooooo conservative, at least when it comes to their (lack of) believe in the power of technology. The transition is taking place already. Here, a real life zero...

Read More »Keynesian Complexity

from Asad Zaman This continues the sequence of posts on re-reading Keynes. The fundamental point about the labor market which is made in Chapter 2 is that the micro level negotiations on wages between firms and laborers do not determine the real wage in the macro-economy. Before explaining this point in detail, we want to show how it is just a special case of the general idea that the economy is a complex system which cannot be understood by looking at simple sub-systems. The idea of...

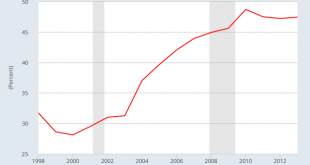

Read More »Charts of the year – 28

from David Ruccio As regular readers of this blog know, I try to make available and critically interpret charts of data—both to challenge others’ arguments and to provide a foundation for my own. Last year, I spent much more time using publicly available data to make my own charts, which readers are free to use for their own purposes. Here are some of those charts (just click on each chart to go to the post in which it originally appeared).

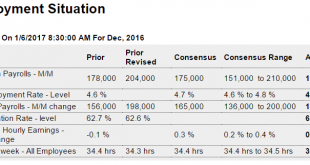

Read More »Payrolls, Factory orders, Foreign trade, Retailers, Boston rents

The year over year chart continues its 2 year deceleration unabated. No telling where it ends but the end will coincide with increased deficit spending, private or public: Highlights Job growth may be the new economic policy but wage inflation may be the risk. Nonfarm payrolls rose a lower-than-expected 156,000 in December but, in an offset, revisions added a net 19,000 to the two prior months (November now at 204,000 and October at 135,000). But the big story is another...

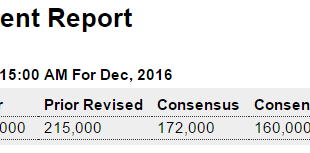

Read More »ADP, ISM non manufacturing

While surveys remain Trumped up, at least so far when it comes to actual numbers the deceleration continues, and can’t reverse without a commensurate increase in deficit spending, public or private: Highlights ADP is pointing to a softer-than-expected employment report on Friday. ADP’s estimate for private payrolls is 153,000, a still respectable level of growth but noticeably below the Econoday consensus for 172,000. Private payroll growth in Friday’s December employment...

Read More » Heterodox

Heterodox