from Norbert Häring The Council for Inclusive Capitalism with the Vatican turns two. After his famous verdict “This economy kills,” Pope Francis seems to now be offering big capitalists a spiritual platform for polishing their public image. Unless, the commitments that corporate CEOs post on this platform are seriously intended to make the world a better place? Let’s take a look. It’s a contrast that could hardly be greater: In late 2013, Pope Francis condemned predatory capitalism and...

Read More »Open thread October 28, 2022

Open thread October 25, 2022 – Angry Bear (angrybearblog.com)

Read More »Labor’s love lost:the tide is turning on private ownership of electricity grids

I’m not a fan of the convention that newspaper and magazine editors choose the headline for articles, but I liked this one in The Conversation. The heading is neat and the sub-heading gives you the tl;dr version. The promise by the Andrews government to reintroduce public enterprise to Victoria’s electricity industry, through a revived State Electricity Commission, is something of a shock. The process of electricity privatisation in Australia began with Labor in Victoria,...

Read More »What’s wealth got to do with it?

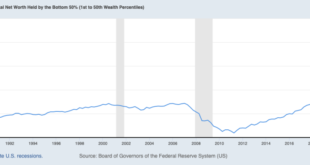

from David Ruccio In a recent article in The Intercept, Jon Schwarz [ht: db] arrives at a perfectly reasonable conclusion—but, unfortunately, he makes a real hash of the data concerning changes in wealth ownership in the United States. Schwarz starts with the fact that the total amount of wealth owned by the bottom 50 percent of the U.S. population has doubled since the first quarter of 2020 (in other words, during the pandemic). He then takes issue with the idea that economic growth...

Read More »Macroeconomic aspirations

from Lars Syll Some economists seem to be überjoyed by the fact that they are using the same ‘language’ as real business cycles macroeconomists and that they therefore somehow can learn something from them. James Tobin obviously did not find any need to speak the RBC ‘language’: They try to explain business cycles solely as problems of information, such as asymmetries and imperfections in the information agents have. Those assumptions are just as arbitrary as the institutional rigidities...

Read More »Open thread October 25, 2022

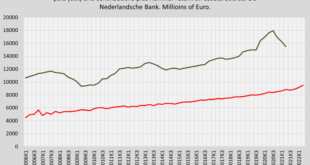

Neoclassical induced financial fragility. Central bank pension fund regulation edition.

Financial wizardry recently caused massive problems for UK pension funds and the Bank of England. The Bank of England forces pension funds to take part in ‘LDI’ contracts which aim to insure possible future liquidity problems. These contracts however lead to real liquidity problems, which forced the Bank of England to intervene to prevent a market melt down. The solution became the problem. Deputy Governor John Cunliff of the Bank of England stated: ...

Read More »Seminar on mental fitness

I’ll be giving a talk on Tuesday (1pm ADST) to the ANU seminar on health service research and policy. Topic:Mental health and mental fitness in an age of disaster. The Zoom link is https://anu.zoom.us/j/81262299147?pwd=eWRJNDJFSC9JbHh4dDd0a0IvTUFvdz09 Share this:Like this:Like Loading...

Read More »A ‘no first use’ U.S. nuclear policy could save the world

My latest piece in Independent Australia THE RISKS of nuclear war are greater than at any time since the Cuban Missile Crisis. Not only is Vladimir Putin threatening to use nuclear weapons to stave off defeat in Ukraine, but the North Korean Government has continued to develop and test both missiles and nuclear warheads. U.S. President Joe Biden has responded to Putin’s threats with admirable calm so far, playing down the risk that Putin will use nuclear weapons and avoiding any...

Read More » Heterodox

Heterodox