It seems highly likely that the Republican Party will win control of the US House of Representatives, and possibly also the Senate, next week. Unless the margin is so narrow that a handful of believers in democracy can tip the balance, that will mean the end of electoral democracy in the US for the foreseeable future. Most House Republicans voted to overturn the 2020 election. All (except a few who were on the way out) voted against the Electoral Count Act which is supposed to make...

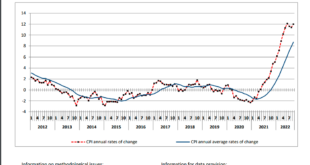

Read More »Inflation and wages in Greece

Consumer price inflation in Greece is, at the moment, 12% (graph 1). This is high and surely bankrupting quite some families. The high level of inflation is surprising, as Greek inflation was quite low and often even negative in the 2012-2022 period. The questions are: (A) what caused this sudden increase? An overheated labour market and runaway wages increases? And: (B) how can we get inflation down again? Does the ECB have to tank the economy to crush wages? Below we will investigate...

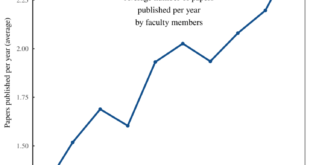

Read More »Weekend read – How to be an Academic Hyper-Producer

from Blair Fix Are you an aspiring academic? If so, this manual will reveal the secret to maximizing your scholarly output. Follow my advice, and you too can become an academic hyper-producer. The golden rule: Don’t do research Newcomers to the academy typically think that the recipe for success is to ‘do high-quality research’. Nothing could be more false. ‘Doing research’ (and writing papers about your ‘results’) is a tedious waste of time. It is no way to be hyper-productive. Savvy...

Read More »Open thread November 4,2022

Endometriosis

endometriosis is a pain. Tissue like the lining of the uterus grows elsewhere, so that menstruation is not just unpleasant but extremely painful. As a reckless pretend expert on everything, I speculated that it happens because during menstruation some of the tissue (which is not just blood) doesn’t exit the vagina as it should but floats somewhere and starts over. I think every menstruation implies a small risk of development of endometriosis...

Read More »Η μισθολογική κατάσταση των εργαζομένων στον Δημόσιο τομέα – Παρασκευή 4/11, 3μμ Υπουργείο Εργασίας

Εν όψει της κρίσιμης γενικής απεργίας στις 9 Νοέμβρη, ο ΑΝΤΙΛΟΓΟΣ (Συλλογικότητα εργαζομένων στο Υπουργείο Εργασίας και στην Επιθεώρηση Εργασίας) διοργανώνει εκδήλωση την Παρασκευή 4/11, 3μμ, στον 4ο όροφο της ΚΥ του Υπουργείου (Σταδίου 29). Στην εκδήλωση θα παρουσιαστεί από τον Σταύρο Μαυρουδέα, καθηγητή Πολιτικής Οικονομίας στο Πάντειο Πανεπιστήμιο, η μελέτη του Κοινωνικού Πολύκεντρου της ΑΔΕΔΥ σχετικά με το επίπεδο και την εξέλιξη των αμοιβών στο Δημόσιο Παρεμβαίνουν στη...

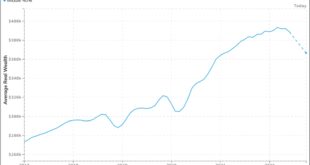

Read More »The world according to Bloomberg

from David Ruccio The story currently being peddle by the folks at Bloomberg [ht: ja] is that the American middle-class is currently suffering, as the enormous wealth they managed to accumulate during the past few years is now dwindling. And that crisis—the end of their “once-in-a-generation wealth boom”—is what they will take into the midterm elections. There is a kernel of truth in that story but it is overshadowed by all that it leaves out. The small sliver of truth? Yes, as we can see...

Read More »Leontief and the sorry state of economics

from Lars Syll Page after page of professional economic journals are filled with mathematical formulas leading the reader from sets of more or less plausible but entirely arbitrary assumptions to precisely stated but irrelevant theoretical conclusions … Year after year economic theorists continue to produce scores of mathematical models and to explore in great detail their formal properties; and the econometricians fit algebraic functions of all possible shapes to essentially the same...

Read More »Open thread Nov. 1, 2022

“Open thread October 28, 2022,” – Angry Bear, angry bear blog Tags: Open Thread November 1 2022

Read More »Herman Daly has passed away

Herman Daly (1938-2022) was an early supporter of and a frequent contributor to the Real-World Economics Review, and the week before last, eleven days before he died age 84, he submitted an essay to RWER with this email. Dear Edward, I hope that you are well and surviving still in our disintegrating world. RWER continues as a voice of sanity. I am still kicking, but slowly, which has its benefits. Attached is an article that I am submitting to RWER. Suggestions welcome. All good...

Read More » Heterodox

Heterodox