Read More »

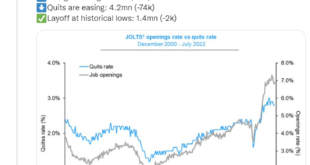

JOLTS, ISM manufacturing, fed funds rate

No recession yet, at least partially due to the increased federal deficit spending on interest payments as the Fed hikes rates: With debt/GDP the rate hikes have had the effect of about $500 billion/year of additional (highly regressive) federal deficit spending:

Read More »How the West betrayed Mikhail Gorbachev and seeded the Ukraine conflict

Mikhail Gorbachev died on August 30, 2022. Since then, praises have flowed from Western leaders. Those praises obscure how the West betrayed Gorbachev after he fell from power, and how that betrayal seeded the Ukraine conflict. The story is complicated because Gorbachev’s fall was triggered by Communist Party hardliners, so the troubles which befell Russia […]

Read More »Open thread August 30, 2022

Economics as ideology

from Lars Syll Tax cuts for the wealthy were supposed to stimulate growth and make everyone better off. There was dispute about this within the profession, but there were also many economists who provided intellectual support for the claim that tax cuts will create growth and widespread prosperity. The evidence from the Bush and Reagan tax cuts does not support this claim, but it is still made by some economists and this gives those who are serving wealthy interests or who want to force...

Read More »The end of the Bitcoin Monster?

For a few years now, I and others been banging on about the environmental cost of Bitcoin, and similar cryptocurrencies. This cost from the electricity wasted on the pointless calculations used to ‘mine’ Bitcoins, under the ‘proof of work’ protocol used to ensure the validity of entries in the Bitcoin blockchain. The cost is huge, about the same as the energy use of a medium size country. For almost as long, we’ve been promised an alternative ‘proof of stake’, in which the integrity...

Read More »Car sales, Dallas Fed, Gasoline supplied

Maybe stabilizing? Post-Covid bounce followed by a dip from the post-Covid cuts in fiscal spending, but no recession yet: A bit of a slowdown but no recession here yet:

Read More »Rosa Luxemburg on Czarist Russia

After reading her contemporary Alfred Marshall, reading Rosa Luxemburg (born in Poland, 1871-1919) is a joy. The clarity of the prose, the consistence of the arguments, the sheer knowledge of events and facts. She backed an anti-imperialist socialist agenda coupled with – no, based upon – differences of view and discussion in combination with cultural and linguistic diversity. In my view, she would have backed the growth of international food supply chains binding Ukraine, Russia, Turkey...

Read More »Open thread August 26, 2022

GDP, Jobless claims, personal income and consumption

No recession yet: Income and consumption not yet indicating recession:

Read More » Heterodox

Heterodox