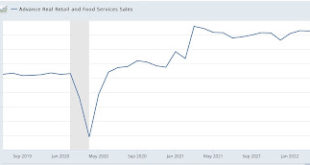

Real retail sales decline again slightly – by New Deal democrat Nominal retail sales for the month of June rose 1.0%, and May was revised up by 0.2% from -0.3% to -0.1%. But since inflation was 1.3% in June and 1.0% in May, this makes the combined downturn in real retail sales -1.4% for the two months: YoY real retail sales is down -0.5%. In the past 75 years, a decline in real retail sales YoY has frequently – but not always – indicated a...

Read More »Weekly Indicators for July 11 – 15 at Seeking Alpha

Weekly Indicators for July 11 – 15 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. We are at the point where I suspect that after the Q2 quarterly economic reports come out, and the Fed’s next meeting/rate hike, literally *all* of the long leading indicators will be negative. But, wait! There is a ray of sunshine still. Oil prices went back down under $100/barrel yesterday, equivalent to where...

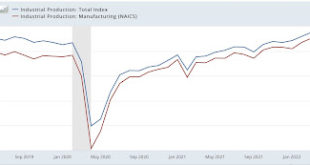

Read More »June industrial production: second sharp monthly decline in manufacturing

June industrial production: second sharp monthly decline in manufacturing – by New Deal democrat Industrial production declined -0.2% in June, and May was revised downward to unchanged. Even worse, manufacturing production declined -0.5% in June, and May was revised downward to -0.5% as well: This corresponds to the sharp deterioration in the regional Fed new orders indexes, and the ISM manufacturing new orders index we have seen during...

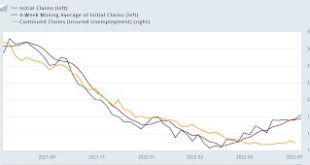

Read More »Jobless claims continue to trend higher, but no recession signal yet

Jobless claims continue to trend higher, but no recession signal yet – by New Deal democrat Initial jobless claims rose 9,000 to 244,000 last week, a 7.5 month high. The 4 week average rose 3,250 to 235,750, a 7 month high. But the news wasn’t all negative, as continuing claims declined 41,000 to 1,331,000, which is only 25,000 above their 50 year low set on May 21: Two weeks ago I noted that reviewing the entire 50+ year history of...

Read More »Capture

Wikipedia offers an excellent synopsis of Regulatory Capture. In her book, Media Capture, Anya Schiffrin does so for Media Capture. In 1971, soon-to-be Associate Justice Lewis Powell Jr., then a corporate lawyer, wrote a memorandum to his friend Eugene B. Sydnor, Jr., Chair of the Education Committee of the U.S. Chamber of Commerce titled Attack On American Free Enterprise System. To his mind, the status quo, which he called The American Free...

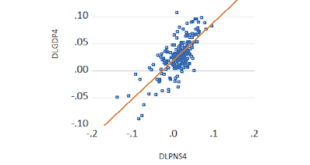

Read More »Aggregate hours and payrolls of nonsupervisory workers and the onset of recessions

Aggregate hours and payrolls of nonsupervisory workers and the onset of recessions An important reason I focus on whether or not the economy is heading into recession is that during recessions income and jobs both decline for the middle and working classes as a whole. In that regard, Jared Bernstein, a member of Biden’s Council of Economic Advisors, posted two graphs over the weekend contra the panic about a potential negative Q2 GDP reading. ...

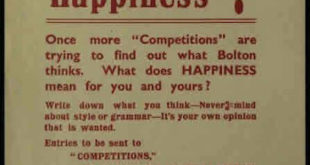

Read More »What is Happiness?

What is Happiness? Post your entries in the comments. Sandwichman WILL JUDGE THEM. Tags: happiness

Read More »Weekly Indicators for July 4 – 8 at Seeking Alpha

[unable to retrieve full-text content]Weekly Indicators for July 4 – 8 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. The 10-2 year Treasury yield inverted again, with very little fanfare. And several other leading indicators deteriorated a little further as well. But as the jobs report showed, the nowcast is still positive. As usual, clicking over […] The post Weekly Indicators for July 4 – 8 at Seeking Alpha appeared first on Angry Bear.

Read More »Inflation, tariffs, and Iran

(Dan here…lifted from comments) Barkley Rosser writes: There are two things Trump did that added to inflation that Biden has somehow not undone yet. One of them is reversing the Trump tariffs, which he clearly fears doing because of opposition by Organized Labor and many white working-class voters in the crucial Rust Belt states. Some of them even support tariffs that hurt them personally, such as the autoworkers who lost their jobs at the...

Read More »June jobs report: strong headline numbers

June jobs report: strong headline numbers, betraying numerous signs of rougher times Consumption leads employment. That’s true at bottoms, and it’s true at peaks as well. Since February, when consumption growth started to flag, I have been waiting for it to show up decisively in jobs numbers. In March through May, average growth decelerated from over 500,000/month to 400,000/month. So in this jobs report, I have been most interested to see if...

Read More » Heterodox

Heterodox