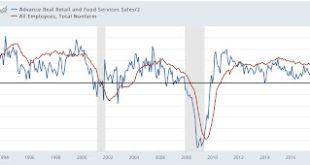

JOLTS report for June amplifies likelihood of substantial downturn in job growth, upturn in unemployment Before we get to the JOLTS report for June, which was released this morning, I wanted to make a point about the overall trend in employment. Because, the two best short leading indicators for employment and unemployment are both pointing South. First, as I have written dozens of times over the past 10+ years, consumption leads employment,...

Read More »July mfg. and June constr. spending: leading components of both are negative

Quick note; “ISM metric strongly suggests that it is likely that the economy will enter recession no later than Q1 of next year, and possibly much sooner (but probably not now). more detail below July manufacturing and June construction spending: leading components of both are negative – by New Deal democrat As usual, the new month’s first data is for manufacturing and construction. Here’s a look at each. The ISM manufacturing index,...

Read More »The Bonddad Blog: Weekly Indicators for July 25 – 29 at Seeking Alpha

Weekly Indicators for July 25 – 29 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. There have been some interesting counter-trend movements in the indicators. For example, interest rates on mortgages have declined by more than 1% since their peak one month ago. Gas prices have declined by about $0.80/gallon, or almost half of their increase that coincided with Russia’s invasion of Ukraine invasion...

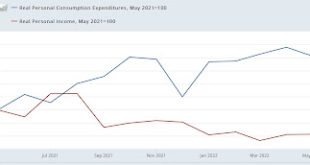

Read More »Real income continued to fall in June, while consumers dug deeper to spend

Real income continued to fall in June, while consumers dug deeper to spend – by New Deal democrat In June personal income rose 0.6% nominally, and nominal spending rose 1.1%. The personal consumption deflator, i.e., the relevant measure of inflation, clocked in at 1.0%, meaning real income fell -0.4%, while real personal spending rose 0.1%. I have been comparing both real personal income and spending with that with their level after early...

Read More »How Changes In Changes In Inventories Have Brought US The “Recession” That Is Probably Not A Recession

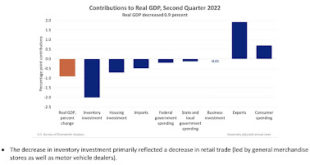

How Changes In Changes In Inventories Have Brought US The “Recession” That Is Probably Not A Recession by Barkley Rosser, Econospeak Based on just announced preliminary results, it looks like the US will have experiences negative GDP growth for the first two quarters of 2022. Based on a “rule of thumb” introduced in a New York Times column in 1974 by then BLS Commissioner, Julius Shishkin, this could be an indicator of a recession happening....

Read More »Long leading indicators embedded in Q2 GDP suggest a recession is near at hand

Long leading indicators embedded in Q2 GDP suggest a recession is near at hand – by New Deal democrat Where does the economy go from here? If it’s not in recession, it isn’t doing much better. There are two components of GDP which are helpful in finding out what lies ahead: real residential fixed investment (housing) and proprietors income (a proxy for business profits). Both of these have long and good track records as helping forecast the...

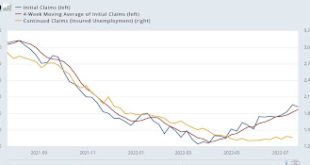

Read More »Increasing trend in initial claims continues; on track to signal recession in November

Increasing trend in initial claims continues; on track to signal recession in November – by New Deal democrat Initial jobless claims declined 5,000 to 256,000 last week. But hold your celebrations, because that was because last week’s 251,000 was revised 10,000 higher! The 4 week average rose another 6,250 to 249,250, a nearly 8 month high. On the positive side, continuing claims declined 25,000 to 1,359,000: Typically, but not always,...

Read More »First comments on Q2 GDP, no Recession Yet

First comments on Q2 GDP: no, we’re not in a recession (yet) – by New Deal democrat When the negative print on Q1 GDP first came out three months ago, I wrote: “yes, it was a negative GDP print. No, it doesn’t necessarily mean recession…. But the big culprits were non-core items. Personal consumption expenditures, even adjusted for inflation, were positive. The three big negatives were a big decline in exports vs. imports, followed in about...

Read More »The Increasing Debtor Status of the U.S.

by Joseph Joyce The Increasing Debtor Status of the U.S. The Net International Investment Position (NIIP) of a country reflects the difference between foreign assets owned by domestic residents and domestic liabilities held by foreign residents. The difference, positive or negative, determines a country’s status as an international creditor or debtor. The U.S. position, which has been negative for many years, has deteriorated sharply in recent...

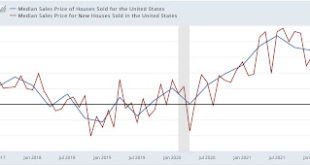

Read More »New home prices may have peaked after all

New home prices may have peaked after all – by New Deal democrat Yesterday I wrote, “The median price of a new home increased 1.7% in June (not seasonally adjusted), and remained sharply higher YoY at 15.1%.” That’s true, but it wasn’t complete. The 15.1% figure is from the quarterly average. On a monthly basis, the YoY% change was 7.4%. Here are the monthly and quarterly figures together: The monthly change is not seasonally adjusted, so...

Read More » Heterodox

Heterodox