“Social Security and Medicare finances bolstered by growing economy,” (axios.com), Neil Irwin. Two different pieces of information going on here. The pie chart below shows were we were in 2021 for Medicare. I have not compared the pieces of information to see if they conflict. I do not have charts for Social Security, I can only imagine in my head the outcome. A million people died so the funds go to the living. The trustees of the programs...

Read More »Existing home sales decline to recessionary levels

Existing home sales decline to recessionary levels; prices have clearly turned down; low inventory still a problem – by New Deal democrat As I wrote earlier this morning, my primary interest in existing home sales at this point is prices. [Note: graphs below for sales and prices does not include October] For the record, existing home sales fell to a new 2.5 year low (i.e., since the teeth of the pandemic lockdowns) of 4.430 million...

Read More »Core inflation using house permits

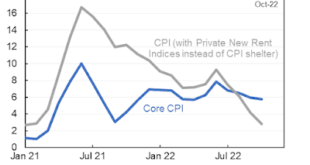

Core inflation using house prices rather than imputed rents – by New Deal democrat Later this morning existing home sales will be reported for October, which will mainly be of interest to me only for what happened with prices, and secondarily whether the problem of low inventory which has existed for 3 years is moving in the direction of resolution. In the meantime, yesterday Jason Furman got some traction, and amplification by Paul...

Read More »Housing; permits and starts falling, under construction continues slow rise

Housing permits and starts continue to fall, but housing under construction continues to (slowly) rise – by New Deal democrat The monthly numbers for housing permits, starts, and single family permits all declined this month. Permits (red in the graph below) declined -38,000 annualized to 1.526 million annualized, and starts (blue) declined -62,000 annualized to 1.425 million, both the lowest since summer 2020. Single family permits...

Read More »America’s Missing Workers, Who Are They?

Before you start chattering at me about this and that detail, let’s get an understanding. I am supply chain and manufacturing or manufacturing and supply chain. If there was a job opening in either and with appropriate pay, I was more than likely in. Companies hiring me usually did so because they had a problem. When I solved it in a couple of years, I was also expendable after 2 more years. Usually a recession would roll around, the company was...

Read More »October retail sales: consumers: “We’re not dead yet!”

October retail sales: consumers: “We’re not dead yet!” – by New Deal democrat Retail sales, my favorite consumer indicator, was reported this morning for October. And it was a good number, up +1.3% nominally, and up +0.5% after adjusting for inflation: On the bright side, this was the highest absolute number since April. On the down side, retail sales have still gone essentially nowhere for the last 18 months. As a result, YoY retail...

Read More »The Audition Commodity

The Audition Commodity Richard Serra and Carlotta Fay Schoolman produced the video, “Television Delivers People” in 1973. It manifests a critique of television mass media that was subsequently defined by communications scholar, Dallas Smythe as the “audience commodity” but the outline of which had already been presented by him in 1951 in the Quarterly of Film, Radio and Television: The troublesome fact is that under our uneasy...

Read More »October industrial production: consistent with a very slow expansion

– by New Deal democrat I call industrial production the King of Coincident Indicators, because more often than any other metric it coincides with the peaks and troughs of economic activity as determined by the NBER, the official arbiter of recessions. Unlike retail sales, the news this morning for October was not so good. While manufacturing production did increase +0.2% to a new post-pandemic high, overall production declined -0.1% for...

Read More »Supply Chain pressures have eased

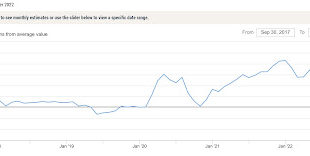

October producer prices: more evidence that supply chain pressures have eased – by New Deal democrat Let me start this discussion of October’s producer price index by pointing to the NY Fed’s “Global Supply Chain Pressure Index” for the past 5 years through October: Before Trump’s tariff’s in 2018, most often this index was slightly below zero. It zoomed higher when the pandemic, and with the exception of a few months, stayed there until...

Read More »Foreboding Economic Signs Coming from consumption and employment data

Some foreboding signs and portents from consumption and employment data – by New Deal democrat I have a special post up at Seeking Alpha, looking at some very troubling signs from several of the high frequency indicators I track weekly as to consumption and employment. Click over and read the whole article, but here is a little taste: the below is what the YoY% change in the 20-day total of payroll tax withholding has been in has been as of...

Read More » Heterodox

Heterodox