Mixed Bag Today. Police Actions are making the news. Not just on the street. Major story is police beating a man to death. It was very discouraging to read this. Cop City being built and one protestor dead. Oklahoma prison murdering imprisoned prisoners. Talked with a Police Captain the other day. He was insisting he be called captain. Should I have angered him and insist I be called Sergeant USMC. I had a Communications platoon reporting to me....

Read More »California waits as Other states submit Colorado River plan

California holds out as Arizona, other states submit Colorado River plan, ktar.com, KTAR FLAGSTAFF, Ariz. (AP) — Six Western states that rely on water from the Colorado River have agreed on a model to dramatically cut water use in the basin, months after the federal government called for action and an initial deadline passed. With the largest allocation of water from the river, California is the lone holdout. Officials said the state would...

Read More »House price indexes for November: up like a rocket, down like a feather

House price indexes for November: up like a rocket, down like a feather – by New Deal democrat As I’ve repeated many times in the past 10 years, in housing prices follow sales with a lag. Housing permits peaked at the beginning of 2022, and starts followed several months later. This morning the FHFA and Case Shiller house price indexes for November showed continued declines from their seasonally adjusted June 2022 peak, and also continued...

Read More »From Deficit to Debt

In the real world, if someone spends more money than they make, they run a deficit. Income – Spending = Deficit. Accumulatively, deficits become debt. In order to avoid the accumulation of debt; they need to either reduce spending, increase income, or both; a lessening of income would require a reduction in spending, an increase in spending would beg an increase in income, and so forth. Governmentally, spending stays spending and income becomes...

Read More »What to watch most for in this Friday’s jobs report

What to watch most for in this Friday’s jobs report – by New Deal democrat After a two week drought, this week a plethora of economic stats get reported. Most importantly for my purposes that includes house prices, construction spending, the ISM manufacturing report, and of course on Friday nonfarm payrolls. Speaking of which, 3 of the 5 short leading indicators that haven’t rolled over yet are included in the jobs report – construction and...

Read More »No More Noma

No More Noma Eating is a necessity and can be a great pleasure. It also has a symbolic dimension in every culture. In the long history of European civilization, going back at least to the Romans, it has been a form of status distinction, allowing the elites at the top to display their separation from the masses below. For many centuries elite food was set apart by its ingredients, like caviar, choice cuts of meat, difficult to procure spices...

Read More »Oh The Cost Of It

The 2nd that is. If there was ever anything that cried out for a cost-benefit analysis it is surely the more recent Supreme Court interpretations of our ‘Second Amendment Rights’. On The Benefit Side: The right to protect our family and selves at all times and in all places from all dangers both real and imagined with deadly force. The right to experience any pleasure one might get from firing automatic and semi-automatic weapons...

Read More »New Deal democrat’s weekly indicators for January 23 – 27

Weekly Indicators for January 23 – 27 at Seeking Alpha – by New Deal democrat “Slowly I turn. Step by step . . .” That old Vaudeville bit comes to mind in watching the coincident indicators creep towards a recessionary downturn on a weekly basis. Also, some of the long leading indicators are also creeping in the direction of no longer being negative. Which is a longer way to say, my Weekly Indicators post is up at Seeking Alpha. As...

Read More »Rail Workers Are Fighting On After Biden Blocked a National Strike

Politicians may have headed off their strike, but rail workers haven’t stopped organizing for paid sick leave, safe staffing, and time off. AFL-CIO Transportation Trades Department: “The American people should know that while this round of collective bargaining is over, the underlying issues facing the workforce and rail customers remain,” As take from: “Here’s How Rail Workers Are Fighting On After Biden Blocked a National Strike,” In...

Read More »Good news and bad news on personal income and spending

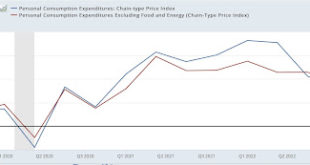

Good news and bad news on personal income and spending – by New Deal democrat December personal income and spending had some material for both optimists and pessimists. Let’s look at the good news first, mainly having to do with inflation. Both the total and core personal consumption deflator continued their overall deceleration in December, with the former up +0.3% for the month, and the latter, said to be much beloved by the Fed, up just...

Read More » Heterodox

Heterodox