Weekly Indicators for June 13 – 17 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. My paradigm is: first the long leading indicators turn. Then the short leading indicators turn. Then the coincident indicators turn. Finally the lagging indicators turn. For months I have been documenting the downturn among the long leading indicators. In the past few weeks, that deterioration has been gradually...

Read More »Positive Production Points to Continued Economic Expansion in May

Positive production print points to continued economic expansion in May The usual suspects are out, claiming that a recession has either already started or is imminent. Well, the big reason I call industrial production the King of Coincident Indicators is because empirically is the one whose peaks and troughs coincide most definitively with NBER recession dates. And unless there is a significant downward revision, in May the King of Coincident...

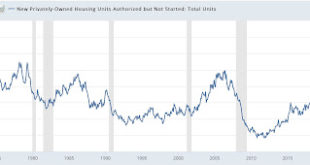

Read More »Downturn in housing permits and starts in May

An across the board downturn for housing permits and starts in May Housing permits and starts declined across the board in May. In the past year there has been a unique divergence between permits and starts due to construction supply shortages. This has been reflected in the number of housing units authorized but not started increasing to a near-50 year records of 298.4 in March. In May that number increased from April by 1.5 million...

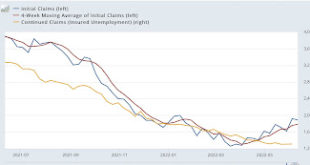

Read More »The increasing trend in new jobless claims continues

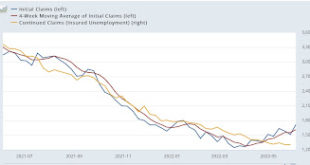

The increasing trend in new jobless claims continues Initial jobless claims declined -3,000 to 229,000 last week, vs. the 50+ year low of 166,000 set in March. The 4 week average also rose 2,750 to 218,500, compared with the all-time low of 170,500 ten weeks ago. Continuing claims rose 3,000 to 1,312,000, or 6,000 above their 50 year low of 2 weeks ago: It’s now clear that initial claims have been in an uptrend over the past 2.5 months. If...

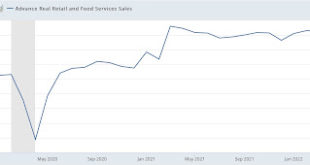

Read More »Negative May and YoY real retail sales add to the foreboding signals of a recession next year

Negative May and YoY real retail sales add to the foreboding signals of a recession next year Nominal retail sales for the month of May declined -0.3%, and April was revised down by -0.2% to +0.7%. This reduces April’s number, after inflation to +0.4%, followed by a “real” decline in May of -1.2% after rounding. YoY real retail sales were up 8.1%, but because inflation in the past 12 months has been 8.5%, real retail sales YoY is down -0.4%. Here...

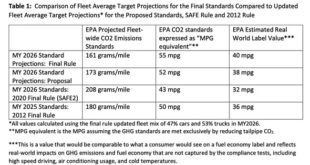

Read More »Auto and Light Truck Emission Rules are Still Problematic

“New Auto Emissions Rules Have a Loophole You Can Drive a Light-Duty Truck Through” (treehugger.com), Lloyd Alter, December 2021 ~~~~~~~~ President Biden and the U.S. Environmental Protection Agency (EPA) have revised the existing greenhouse gas emissions standards for passenger cars and light-duty trucks. Rolling back in four years the rollbacks the Trump administration implemented to change the standards set in place by the Obama...

Read More »Missing all the fun on Wall Street . . .

On the road, and missing all the fun on Wall Street . . . I’m still on the road, and there is no important economic statistic to report, but I will make a brief market comment. YoY stocks are now down 10%. Except for the very bad 1982 and 2008 recessions, and the 2000 Nasdaq bubble and the 1987 crash (which were prolonged bear markets), that has typically been close to their YoY lows: And with rare exception that level has only been hit...

Read More »Weekly Indicators for June 6 – 10 and a comment on COVID

by New Deal democrat Weekly Indicators for June 6 – 10 and a comment on COVID I’m still traveling, so light posting for a couple days more. In fact, I neglected to post a link to my Weekly Indicators on Saturday. A bit tardy, here it is. Conditions across all time frames do not look so good, and with Friday’s poor inflation report, I expect the Fed to continue stomping on the brakes – especially since we know that the YoY change in rents...

Read More »Consumer prices rise 1% in May alone; owners’ equivalent rent at 30 year high

Consumer prices rise 1% in May alone; owners’ equivalent rent at 30 year high; expect the Fed to keep stomping on the brakes Today is a travel day for me, so I’ll keep this relatively brief. People who were hoping inflation would abate did not get the news they wanted from the May CPI. Consumer prices rose 1.0% in that month alone. Inflation less energy rose 0.7%, and “core” inflation less food and energy rose 0.6%. On a YoY basis, prices are...

Read More »Initial jobless claims now in a clear uptrend, and other economic notes for the week

Initial jobless claims now in a clear uptrend, and other economic notes for the week First, a note on other economic news from earlier this week. The housing market is getting absolutely crushed by 10 year+ high mortgage rates. Mortgage applications fell to levels not seen since 2017 (except for a few weeks during the 2020 Covid lockdowns). Refinancing is at 20 year lows. The next questions are when prices will peak, and what will happen with...

Read More » Heterodox

Heterodox