If I was going to guess, and I do not have to do so, it appears the US is retooling to update capabilities. Maybe they will put forth a plan to minimize inventory too. The source of all this retooling? Probably using up the money made during the pandemic and also government funds invested in infrastructure. And maybe, they are creating minimal setups to handle a variety of product like we did for one supplier of hoods to Chrysler. Automotive still...

Read More »Identifying the policy levers generating wage suppression and wage inequality

Lawrence Mishel and Josh Bivens at Economic Policy Institute take a look at why wages have been relatively flat compared to productivity gains in the US economy, inequality of compensation, and declining share of income between labor and capital. Broad strokes but helps with context and suggesting ideas for current government actions. Inequalities abound in the U.S. economy, and a central driver in recent decades is the widening gap...

Read More »On Labor Day 2022, how well is labor doing?

On Labor Day 2022, how well is labor doing? This is Labor Day, so let’s take a look at a few metrics of how labor is doing. As an initial aside, occasionally I get asked why I write about expansions and recessions. An important reason is, pretty much by definition during recessions jobs and income decline. During expansions they, well, expand. So forecasting whether the period ahead will feature better or worse conditions for job-holding and...

Read More »Pride, Chaos, and Kegs on Labor’s First ‘Day’

A bit of history leading up to the creation of Labor Day as a holiday, the first day of celebration, the politics, how it came to be, and the politics as told by Prof. Heather. That first celebration being held September 5, 1882; at noon that day, when the marchers arrived at Reservoir Park, the termination point of the parade. While some returned to work, most continued on to the post-parade party at Wendel’s Elm Park at 92nd Street and Ninth...

Read More »Weekly Indicators for August 29 – September 2 at Seeking Alpha

[unable to retrieve full-text content]Weekly Indicators for August 29 – September 2 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. The consumer portion of the economy continues to benefit from lower gas prices, while the producer side continues to suffer from higher interest rates. As usual, clicking over and reading will bring you up to the […] The post Weekly Indicators for August 29 – September 2 at Seeking Alpha appeared first on Angry Bear.

Read More »August jobs report: despite a good headline number, the decelerating trend resumes

August jobs report: despite a good headline number, the decelerating trend resumes I have written a number of times since February that the short leading indicators have signaled that we should expect weaker monthly employment reports, with both fewer new jobs and a higher unemployment rate. That was completely *not* the case in July, In August, would the decelerating trend kick in again? That it did. Since February the 3 month average in new...

Read More »A respite in manufacturing in August, continued decline in construction in July

A respite in manufacturing in August, continued decline in construction in July As usual, the new month’s first data is for manufacturing and construction. Here’s a look at each. The ISM manufacturing index, and especially its new orders subindex, is an important short leading indicator for the production sector. In August, after two months of showing slight contraction, the leading new orders subindex improved to 51.3, indicating expansion....

Read More »June house price indexes show no peak yet; no respite likely in the “official” consumer housing measure

June house price indexes show no peak yet; no respite likely in the “official” consumer housing measure Yesterday the Case Shiller and FHFA house price indexes were updated through June (technically, the average of April through June. Because the Case Shiller index is not seasonally adjusted, the best way to show them is YoY. Here are YoY% changes for the last 2 years of each (although the FHFA *is* seasonally adjusted, and increased only +0.1%...

Read More »What News was in My In-Box

Some pretty interesting articles this week. I like the one about Alito. With trump, I can not figure out what was in his mind when he walked off with boxes of classifies documents. You are I would be in jail right now. Usual stuff about student loans. The $10,000 on many of these loans will go to pay fee, interest, penalties and consolidation fees. What will me left is more of the same and few dollars will get to relieve the original loan amounts. No...

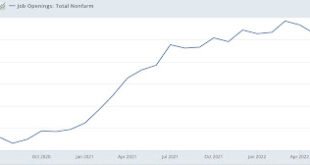

Read More »July JOLTS report: the broad deceleration in the game of reverse musical chairs (generally) continues

I have been writing since early this year that, because of the pandemic, there have been several million fewer persons looking for work, leaving a huge number of unfilled job vacancies, particularly in the face of a roughly 10% higher jump in demand. This gives employees the upper hand, as there are almost always higher paying jobs on offer for which they can apply. I‘ve also posited that the dynamic would only slow down once some employers...

Read More » Heterodox

Heterodox