Last time in Denver and some observations. My youngest son and I took off to the Little Big Horn to see where Custer made a fool of himself. He died for it and took a whole bunch of others with him. We spent the night in Hardin, Montana in a cheap, yet clean hotel, in a small room with double beds. There was not much to the town of 3600 people. It was not a dangerous place to be either. I felt more danger in Mesa AZ. We the gray-hairs, are viewed...

Read More »Consumer inflation lessens in December

Consumer inflation lessens in December; real wages increase, but a consumer slowdown remains likely Consumer prices increased 0.5% in December, a deceleration from the past several months. But this is still well above the typical monthly increase in prices pre-pandemic: On a YoY basis, at 7.1% consumer inflation is the highest since the big Reagan recession of 1981-82. My favorite measure, CPI ex energy, is also up 5.6% YoY, and tied for...

Read More »One Man’s Toilet Water is Another Man’s Organic Farm

One Man’s Toilet Water is Another Man’s Organic Farm, Michael Smith, Agricultural Economist and Farmer In my search to find sustainable sources of organic material to turn into viable soil modification vectors, I had been struggling to source material to add to the Padina sands that are in abundance in our lands. See, in late 2020 we had five tons of compost brought in all at once and we scattered it here and there. Before that we had brought...

Read More »December jobs report

December jobs report: more signs of real tightness, while new jobs added are (seasonally?) disappointing There were three big questions I had going into this jobs report: 1. whether the big decrease in new jobless claims to a half century low would translate to another big top line number in the jobs report 2. is wage growth holding up? Is it accelerating? 3. Would last month’s “poor” 210,000 number of new jobs be revised higher? The...

Read More »More signs of real tightness, while new jobs added are (seasonally?) disappointing

December jobs report: more signs of real tightness, while new jobs added are (seasonally?) disappointing There were three big questions I had going into this jobs report: 1. whether the big decrease in new jobless claims to a half-century low would translate to another big top-line number in the jobs report2. is wage growth holding up? Is it accelerating?3. Would last month’s “poor” 210,000 number of new jobs be revised higher? The answers...

Read More »First post on Angry Bear 2003

(Dan here…just a ‘for example’ of the econ blogosphere for your curiosity) February 14, 2003 3:20 am Income and Consumption by Angry Bear So here’s the bit of information that lead me to finally decide to put my two cents on the web. Dave Neiwert reports that the 2003 Economic Report of the President contains language referring to plans to eliminate or reduce the income tax and replace it with a consumption (i.e., sales) tax. This is an...

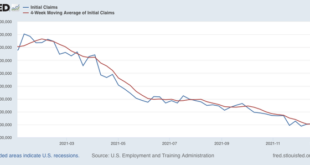

Read More »Initial and continuing jobless claims: 2022 starts out where 2021 left off

Initial and continuing jobless claims: 2022 starts out where 2021 left off The labor market in 2022 started out where it left off in 2021, as new claims increased slightly, by 7,000, to 207,000. The 4 week average of new claims increased 4.750 to 204,500: Readings this low haven’t been seen in half a century. Continuing claims for jobless benefits also rose slightly, by 36,000, to 1,754,000: Except for 2018-19, we haven’t seen continuing...

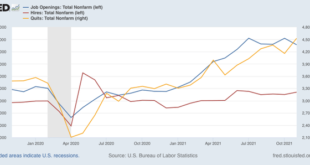

Read More »Imagine, if you will, a game of musical chairs

November JOLTS report: imagine, if you will, a game of musical chairs, New Deal democrat Imagine a game like musical chairs, except that some players are the chairs (employers) as well as people who want to sit in the chairs (potential employees), and players, both sitters and chairs, are continually entering and exiting the game. The game would be in equilibrium if the number of sitters and chairs are always equal. If there are more...

Read More »Sherman Act, Part 2: The Small Farmer Pitchfork Army

Agricultual Economist and Farmer Michael Smith, Sherman Act, Part 2: The Small Farmer Pitchfork Army Most are now aware of the Biden Administrations recent announcement and press briefing for a plan to combat prices in the meat industry. If not, you can find a bit of information here: Readout of President Joe Biden’s Event with Farmers, “Ranchers on his Action Plan for a More Competitive Meat and Poultry Supply Chain“ And you can also see...

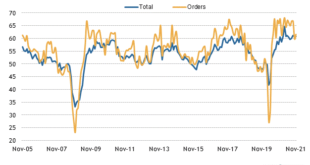

Read More »First data releases of 2022 confirm manufacturing strength, construction slowdown

First data releases of 2022 confirm manufacturing strength, construction slowdown The first December data, the forward-looking ISM manufacturing report, has been released. Yesterday construction spending for November was also released. Let’s take a look at both. The ISM index, especially its new orders subindex, is an important short leading indicator for the production sector. In December the index declined from 61.1 to 58.7, as did the...

Read More » Heterodox

Heterodox