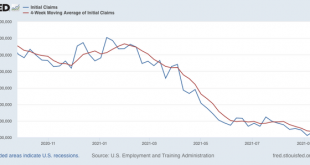

New jobless claims increase: exit Delta, enter supply chain chokepoints? This week jobless claims were higher for the third week in a row, and the 4-week average also rose slightly. Initial claims rose 11,000 to 362,000, and the 4-week average rose 4,250 to 340,000, from last week’s pandemic low: Meanwhile, continuing claims declined 18,000 to 2,802,000, but remain above the pandemic low of 2,715,000 of two weeks ago: It appears...

Read More »Real spending increases, real income declines in August

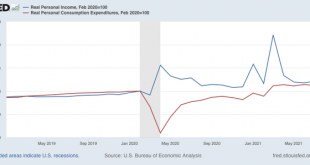

Real spending increases, real income declines in August (Note: I’ll report separately on construction spending and the ISM manufacturing index later.) Real personal income and spending held up well throughout the pandemic, due to a vigorous government response. This morning these were reported for the last full month of any assistance. In nominal terms, personal income rose 0.2%, and spending rose 0.8% (but with a downward revision of -0.4%...

Read More »House prices continue to surge. But maybe . . .

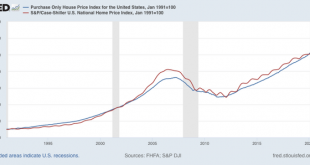

House prices continue to surge. But maybe . . . Both the FHFA and Case-Shiller house price indexes for July were released this morning. Both showed a continued surge in house prices, with one difference that may be of importance. First, here are both indexes normed to 100 as of January 1991, when the FHFA index began: Both are currently within 2% of an identical 250% increase since then. Further, YoY gains in both continued to...

Read More »Climate change and insurance markets: let’s focus on real solutions, not finger-wagging

I don’t know why I’m writing about this when our democracy is on fire. Maybe I need to focus on something cheery, like climate change. The American Prospect has a couple of pieces up on insurance and climate change. One identifies a genuine issue, the other misses the mark. In this piece, Alexander Sammon asks why insurance companies aren’t taking steps to fight climate change, given that catastrophes like wildfires and hurricanes cost...

Read More »Joe Manchin believes Income Inequality is not a problem

Does Joe Manchin Believe That Income Inequality Is a Problem?, Horizons, Nancy LeTourneau’s big picture looks at politics and life Nancy was one of the regular writers at Washington Monthly. She had well – written fun reads, some of which I disagreed with in my numerical way. I am a numbers guy. The editors of Washington Monthly decided to change the format and brought in a cadre of writers who replaced Nancy, the Longmans, Atkins and others....

Read More »Fed’s Powell Sees Agriculture Inflation Continuing

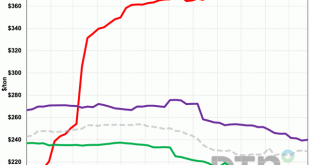

Agri-Economist and farmer Michael Smith talking inflationary impacting crops and farmers. Higher inflation rates “will likely remain so in the coming months,” Federal Reserve Chairman Jerome Powell acknowledged today in testimony before the Senate Banking Committee. Powell has been in meeting this week discussing the persistent inflation going into next year. Powell noted the effects of inflation on the economy “have been larger and...

Read More »The producer portion of the economy continues to do well

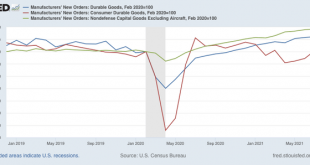

The producer portion of the economy continues to do well First, a little blogging note. This week is light on data. House prices tomorrow, jobless claims Thursday, then a bunch of month end/beginning data on Friday. In other words, don’t be surprised if I take a day off. This morning the report on durable goods orders for August was released. Manufacturing is a leading sector of the economy, and new orders both for manufacturing and...

Read More »Means-testing the Child Tax Credit

Matt Yglesias has published an interesting essay at his substack by Simon Bazelon and David Shor arguing that Democrats should introduce stricter means testing into the Child Tax Credit. Their key points are as follows: The current CTC design already has means-testing for very high incomes, which means that the administrative burdens associated with means-testing (making low-income people file tax returns, etc.) are already being...

Read More »Job Growth Twice as Fast in States Retaining UI

August Job Growth Was Twice as Fast in States That Retained UI – “People’s Policy Project,” Matt Bruenig, September 21, 2021 I ran across this author and his site while reading a commentary (referencing Matt Bruenig’s story) on McDonalds experience in Denmark at Yves Smith’s Naked Capitalism. Since my background over 40 odd years has been in manufacturing and the impact of direct Labor on it, I was drawn to that article and visited Matt’s site....

Read More »Returning to work and unemployment benefits

Diane Lim writes an analysis of the economic theory of the marginal incentives people have to go back to work at her blog EconomistMom. Worth a visit: Quote: “Get ready to see lots of press on the ending of pandemic unemployment benefits in some parts of the country and what it shows about how much those benefits are to blame for keeping people from getting back to work. See, for example, this Wall Street Journal story which offers this...

Read More » Heterodox

Heterodox