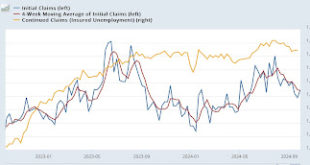

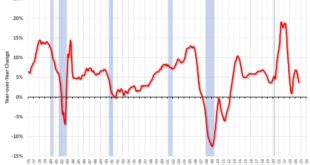

– by New Deal democrat Initial jobless claims will be up against some very challenging comparisons for the next 6 months or so, due to some unresolved post-COVID seasonality. Which means that the headline numbers this week, which look very benign at the surface, are not quite so good as they have been for the past year. For the week, initial claims rose 6,000 to 225,000. The four week moving average declined -750 to 224,250. Continuing claims,...

Read More »Briefly, All the Toilet Paper has Been Sold and Dockworkers Went Back to Work

Somewhere, there is a correlation between the two . . . The Atlantic and the Gulf of Mexico dockworker strikes are over. The strike by tens of thousands of dockworkers on the East and Gulf coasts has been called off, after the International Longshoremen’s Association and the U.S. Maritime Alliance, representing ocean carriers and port operators, reached a tentative agreement on wages. The two sides also agreed to extend the existing contract...

Read More »Are manufacturing and construction in a synchronous downturn? If so, that’s Trouble

– by New Deal democrat I wanted to follow up on a point I made yesterday: although manufacturing is no longer a big enough slice of the US economy to bring about an economic downturn on its own – unless for some reason the manufacturing downturn were unusually severe – when it is paired with a downturn in construction, that historically has been a reliable (but of course not perfect!) harbinger of recession. And while yesterday’s construction...

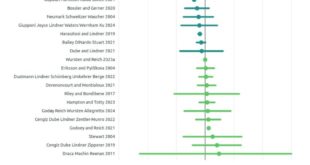

Read More »Evidence Shows Minimum Wage Increases Will Cause Job Losses is Largely Wrong-Headed

Largely speaking direct labor is not the issue of costs have I have presented in another post. It is the overhead such as healthcare insurance which can better handled in another manner. Inflation grows and minimum wage income is stagnant. Studies have found little or no job loss due to Minimum Wage Laws, Economic Policy Institute There is always political heat around minimum wage increases, largely driven by concerns about job losses. The...

Read More »Manufacturing remains in contraction, with construction on the brink

– by New Deal democrat This month we started the month with not just the usual two important reports on the leading sectors of manufacturing and construction, but the JOLTS report for August as well (which I will summarize separately). In the big picture, I do not see the US economy falling into recession unless either both construction and manufacturing are in synchronous decline, or else at least one of them contracts very sharply. ...

Read More »Freddie Mac House Price Index Increased Slightly in August; Up 3.7% Year-over-year

Over the last 6 months, the seasonal adjusted index has increased at a 1.5% annual rate. by Bill McBride @ Calculated Risk Note: The Freddie Mac index is a repeat sales index using only loans purchased by Fannie and Freddie and includes appraisals. See FAQs here. Freddie has data for all states and many cities. For house prices, I’m currently following Case-Shiller, FHFA, CoreLogic, ICE, the NAR median prices, and this Freddie Mac index....

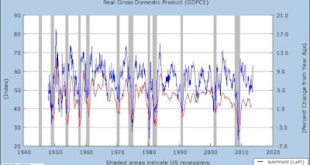

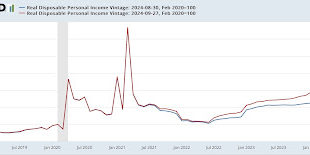

Read More »The real nowcast for the economy as of the end of Q3

– by New Deal democrat On Friday I highlighted the sharp positive revision to the personal saving rate. That was a byproduct of a similar sharply higher revision to real personal income over the past two years. Here is what those revisions, to real personal disposable income, look like: Instead of being up 6.8% since just before the pandemic, real disposable income is up 10.6%. A historical look at the most salient economic indicators...

Read More »FTC Taking Action Against Rental Property Companies for Deceiving Home, etc. Renters

I did not know this. In Phoenix, etc. The subject of this commentary, “Invitation Homes” has approximately 7300 available homes for rent at prices which would equal a mortgage payment, property taxes, and the required homeowner’s insurance. I am sitting in the middle of all of this in AZ. The only reason I can think of for not buying is poor credit, bankruptcy, no funds to pay for a realtor, closing, etc. Even so, why would you mess with rental...

Read More »John Deere Maintains Profits and Shareholder Value by Whacking Labor

Nothing new under the sun here. Maintaining profits has been a matter of fact for decades. It became more popular under Pres. Reagan. Deere Reports Strong Profits Amid Layoffs of Workers Across Iowa, Des Moines Register August 13, 2024 and Kevin Baskins at the Des Moines Register reports on the Deere & Company layoffs across the state of Iowa. Layoffs happen when the economy turns down, companies make mistakes, or when a new competitor...

Read More »EV fueling ports vs gas station nozzles

Kevin Drum has a post up about the present and future of EV charging stalls in the US. As of 2023, the number was 184,000, with public charging stalls outnumbering Tesla stalls 6:1. Is that a lot or a little? Well, lots of people say that they’re holding off buying EVs because of the range, which is still less than most ICE cars. One way to mitigate that concern is to have more charging stalls than gas station nozzles*. So how many gasoline...

Read More » Heterodox

Heterodox