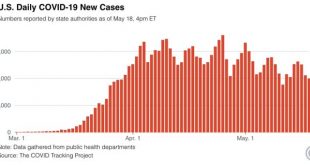

Abbreviated coronavirus dashboard for May 19: testing improvement continues Here is the update through yesterday (May 18). As usual, significant developments are in italics. The downward trend in new infections and deaths has continued. An important issue is whether we are beginning to see an increase in new infections in States which irresponsibly “reopened.” I will look at that separately from this post. I will restart giving the daily increase in...

Read More »Who Ordered This Stuff?

I am reading this on Bloomberg entitled “Saudi oil rush threatens to disrupt stabilizing U.S. oil market.” These shipments are planned, Saudis are not sending this over out of the goodness of their hearts. Furthermore, the shipments themselves take roughly 21 days to get to the US. The orders were placed over 3 weeks ago. When you have a lot of US capacity which produces at a higher price and we are seeking to become oil independent and we are seeking to...

Read More »The Comic Stylings of FRED, Employment Edition

I’m back to playing with data, so there will probably be more posts coming soon. (Sorry.) Meanwhile, this one was irresistible. FRED® has a “Natural Rate of Unemployment” data series. Apparently, the evil of the United States is that—except for the second half of the Clinton Administration where it was worth people’s while—Americans Just Don’t Work Enough, Same graphic, excluding last month and with the monthly employment data averaged to match the...

Read More »Economics Doesn’t Have to Be Amoral

Steve Roth, publisher of Evonomics and at Angry Bear, sends this note and thematic list: Economics Doesn’t Have to Be Amoral The complexity economist Eric Beinhocker writes “economics has painted itself as a detached amoral science, but humans are moral creatures. We must bring morality back into the center of economics in order for people to relate to and trust it. All of the science shows that deeply ingrained, reciprocal moral behaviors are the...

Read More »Weekly Indicators for May 11 – 15 at Seeking Alpha

by New Deal democrat Weekly Indicators for May 11 – 15 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. Noteworthy this week is that mortgage rates have fallen to new all-time lows, and mortgage applications, not coincidentally, have rebounded sharply. This is good news since housing normally leads the way in economic recoveries. This is an important positive for whenever the time comes that more normal life is able to safely resume. As...

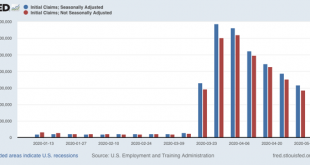

Read More »Jobless claims show new damage ongoing, but some damage repaired

Jobless claims show new damage ongoing, but some damage repaired Now that we have more than one month of data from initial and continuing jobless claims since the coronavirus lockdowns started, we can finally begin to trace whether the economic impacts of the virus are being contained, or are continuing to spread out into further damage. Eight weeks in, the answer is mixed. First, let’s look at initial jobless claims both seasonally adjusted (blue) and...

Read More »Coronavirus dashboard: updating the 52 Petri Dishes of democracy

Coronavirus dashboard: updating the 52 Petri Dishes of democracy [Note: There is no significant economic data today (Dan here…May 13) Thursday we’ll get initial claims, and on Friday retail sales and industrial production for April, both of which will be important] Here is the update through yesterday (May 12). I will restart giving the daily increase in infections if States that have “reopened” start to increase significantly again. The preliminary...

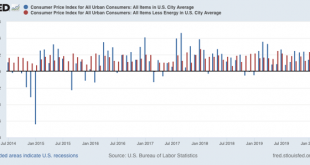

Read More »April deflation follows a typical recessionary pattern

April deflation follows a typical recessionary pattern This morning’s consumer price index for April gives us our first indication of what the coronavirus recession has done to inflation. Overall consumer prices declined by -0.8% (blue), while consumer prices excluding energy (gas) declined -0.2% (red). Note that in 2015 when gas prices collapsed, prices otherwise continued to increase, showing the underlying strength of the economy. But in March and...

Read More »Reopening Isn’t Reopening—It’s Cutting Off Unemployment

Reopening Isn’t Reopening—It’s Cutting Off Unemployment Donald Trump, cheering on his “warriors” who demand that states lift their lockdown and distancing orders (where they have them), would have you believe this is about bringing the economy back to life so ordinary people can get their jobs and normal lives back. Elitist liberals who work from home and have country estates to retreat to don’t care, but “real” people do. The reality is different. ...

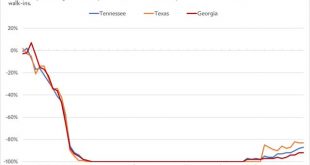

Read More »If you open it, they still won’t come: restaurant edition

If you open it, they still won’t come: restaurant edition In case you haven’t already seen it, here is the OpenTable restaurant reservation data from 3 Confederate States that “reopened” their economy at the end of April: Even though restaurants were open again, reservations were still down over 80% from a year ago. This highlights an important behavioral aspect of the pandemic: people did not wait for their State governments to order lockdowns in...

Read More » Heterodox

Heterodox