Remdesivir and Transfer Pricing Gilead Sciences is conducting phase III trials to explore whether this treatment – which did not turn out to be effective against Ebola – might be effective in treating COVID-19. We all hope it will be and if it does pass phase III trials, national income tax authorities will later have to address the transfer pricing implications of any profits Gilead Sciences generates. This blog post is the first of two with this one...

Read More »The Mankiw CV Plan

The Mankiw CV Plan Greg Mankiw has posted a suggestion for delivering money to people that targets the benefit to those who need it the most. The idea is clever: 1. Pay people the benefit B. (This could be spread over many weeks or months.) Everyone gets the same B. 2. Next year at tax time, compute the ratio r Y(2020)/Y(2019), the ratio of each filer’s 2020 income, net of B, to their 2019 income and capped at 1. Impose a surcharge of rB on tax...

Read More »A Dog that Didn’t Bark

The USA is about to experience the largest fiscal policy shift since World War II. The House is debating whether to add $ 2,200,000,000,000 to the Federal Budget Deficit (counting loans as if they were expenses because that’s what they do). There appears to be a near consensus as all are speaking in favor. It is just possible to guess which are Republicans I’m sure there is a similar near consensus that Rep Thomas Masie of Kentucky, who made them fly to...

Read More »Notes on the economy and coronavirus issues

Notes on the economy and coronavirus issues As is obvious, I have stopped reporting on almost all incoming economic data, as anything older than last week is out of date. But once the last important February data is reported tomorrow, I will take one last fond look back at our pre- Coronavirus Recession economy. How close to recession was it? I also want to write a few more detailed posts on several points. But for now, let me leave a quick note about...

Read More »Rome Update

For 3 days from an abundance of caution, 4 hours a day of online teaching responsibilities and extreme laziness, I have stayed in an apartment usuaally in a bed. Rome is a bit different than was I went into hibernation. There are people walking around without dogs on a leash. Some cars. There was a guard outside the supermarket absolutely waiting for someone to come out bfore letting someone in. No crowds: no line at cashier. The Deli lady (who I thanked...

Read More »AFL-CIO has a Plan

AFL-CIO has a Plan From the AFL-CIO website: PRIORITIES OF THE LABOR MOVEMENT TO ADDRESS THE CORONAVIRUS: PROTECT FRONT-LINE WORKERS Streamline approaches for allocating and distributing personal protective equipment to working people in greatest need. Issue a workplace safety standard to protect front-line workers and other at-risk workers from infectious diseases. Provide workplace controls, protocols, training and personal protective equipment....

Read More »The Oil Price War

The Oil Price War One consequence of the emerging global Covid-19 recession has been that it has helped push world oil prices down from the $60.77 per barrel range near the beginning of 2020 to $23.12 for West Texas Crude and $29.00 for Brent Crude, levels not seen since the end of 2008. But part of why that decline has been so sharp and deep has been thet Saudi Arabia has increased production while Russia has kept up production, despite the Saudis...

Read More »This is what exponential growth looks like: 2,500,000 infected in the next 15 days, 50,000 deaths

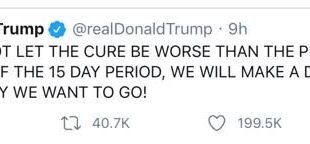

This is what exponential growth looks like: 2,500,000 infected in the next 15 days, 50,000 deaths I had originally planned on limiting this post to the next 10 days. But then the Buffoon-in-Chief tweeted this: So let’s look at the number of diagnosed infections and deaths in the US by the time Trump gets around to deciding what to do. Bottom line: about 2.5 million *diagnosed* infections, and about 50,000 deaths baked in the cake at a 2% mortality...

Read More »The True Owners of Foreign Capital

by Joseph Joyce The True Owners of Foreign Capital Explaining the sources and destinations of capital flows is a key focus of research in international finance. But capital flows between countries can flow through financial centers before they arrive at their ultimate destination, and these intermediary flows distort the record of the actual ownership of investments. Two recent papers seek to provide a more accurate picture of the true sources of...

Read More »For a Universal Debt and Rental Moratorium

For a Universal Debt and Rental Moratorium Incomes are collapsing throughout the economy, and both businesses and individuals face a crisis in meeting fixed payments they can’t control. The most direct step we can take is to temporarily suspend these payment obligations. Suppose the government were to announce that, starting immediately, all stipulated debt and real estate rental payments were to be suspended for all borrowers and renters. This...

Read More » Heterodox

Heterodox