Engel Criticizes Trump On Soleimani Assassination Juan Cole reports that House Foreign Affairs Committee Chair, Eliot Engel (D-NY) has criticized the administration for its assassination of Iranian General Qasem Soleimani in response to a report fresh out of the DOD that said the attack was for past activities by Iran in attacking tankers and oil facilities in Saudi Arabia without any mention of a threat against US personnel in Iraq, the ostensible...

Read More »Have we reached “full employment”? An update

Have we reached “full employment”? An update As an initial matter, this morning’s initial and continuing jobless claims report were positive as to all metrics by which I judge them. They are near the bottom of their recent ranges and/or are lower YoY (lower being good). I’ll add a graph once the info is available at FRED. UPDATE: Here it is: Here is something I haven’t updated in a couple of months: given recent gains in labor force participation...

Read More »What to Do about Amazon

What to Do about Amazon I think Farhad Manjoo gets it right about Amazon: while the company’s sheer size, not to mention its often shady business practices, call out for public intervention, “Amazon is pushing a level of speed, convenience, and selection in shopping that millions of customers are integrating into their daily lives.” Breaking it up would be wrong, since the essence of what Amazon offers is its potential universality. For me, shopping on...

Read More »December JOLTS report continues the trend of confusing jobs data

December JOLTS report continues the trend of confusing jobs data The December JOLTS report came out this morning, and it continues the streak of confusing employment data. To recapitulate, the JOLTS report decomposes the jobs numbers into openings, hires, quits, layoffs and discharges, and total separations. Since the series is only 20 years old, however, it only covers one full business cycle, so is of limited forecasting use. The order in which the...

Read More »Why I expect further declines in manufacturing jobs

Why I expect further declines in manufacturing jobs This is the week I highlight further information from last Friday’s jobs report. One thing that struck me is that we’ve now had two months of declines in manufacturing jobs. This is something I have been anticipating since about the middle of last year, because the manufacturing work week had been declining significantly, and it has a reliable 80+ year history of leading manufacturing jobs. Here’s the...

Read More »Weekly Indicators for February 3 – 7 at Seeking Alpha

by New Deal democrat Weekly Indicators for February 3 – 7 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. There were some changes in all of the timeframes this week. Of particular note, the coincident indicators of rail and steel, which were negative for almost all of 2019, have switched over to positive. As usual, clicking over and reading helps reward me a little bit for my efforts, as well as bringing you up to date about the...

Read More »January jobs report: why I am discounting the headline strong jobs number

January jobs report: why I am discounting the headline strong jobs number HEADLINES: +225,000 jobs added U3 unemployment rate up +0.1% to 3.6% U6 underemployment rate up +0.2% from 6.7% to 6.9% Leading employment indicators of a slowdown or recession I am highlighting these because many leading indicators overall have strongly suggested that an employment slowdown is here. The following more leading numbers in the report tell us about where the economy...

Read More »Is Iraq About To Switch From US to Russia?

Is Iraq About To Switch From US to Russia? Today Juan Cole reports from a newspaper in Iraq that since Mohammed al-Allawi has become the new prime minister in Iraq, there has been a meeting in Baghdad between the Russian ambassador and the Iraqi milirary Chief of Staff, and the Iraqi president, Saleh, will be visiting Moscow shortly. A variety of issues and possible areas of cooperation apparently are being discussed, but the biggie apparently is that...

Read More »Jobless claims continue to show a healthy economy

Jobless claims continue to show a healthy economy I’ll keep this brief. This morning’s weekly report on initial jobless claims continues to show no danger of any imminent downturn. The weekly number was 202,000, close to its 50 year lows last year. The 4 week average was 211,750, also close to its recent 50 year lows. Below are the monthly (blue) and moving 4 week averages (red): Figure 1 The less leading but also less noisy 4 week average of...

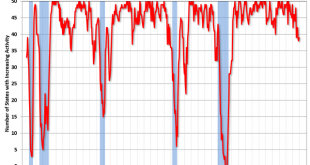

Read More »The Philly Fed state-by-state diffusion index of economic expansion

The Philly Fed state-by-state diffusion index of economic expansion This comes from the Philly Fed’s state-by-state coincident index, via Bill McBride. The graph below shows the number of states showing increasing economic activity: In December the number of states in expansion was 39. Historically over the past 40 years, that number dropping to 35 or below has (with the exception of one month in 1986) been the marker of the onset of a recession....

Read More » Heterodox

Heterodox