by New Deal democrat The long leading forecast up to 12 months Last week I posted my short term forecast through midyear. This morning my long term forecast through the 2nd half of 2020 was also posted at Seeking Alpha. As usual, clicking through and reading will help you see the longer term trends, and also rewards me a little bit for my efforts.

Read More »December 2019 real personal income and spending

December 2019 real personal income and spending Real personal income and spending are both coincident indicators. They don’t tell us where the economy is going, but they do give us a snapshot of how ordinary Americans are doing. In December, real income declined by less than -0.1%. Real spending rose by less than +0.1%: Figure 1 Real personal spending excluding government transfer payments is one of the four indicators used by the NBER to determine if the...

Read More »The U.S. Position in the World Economy

by Joseph Joyce The U.S. Position in the World Economy The election of 2016 in the U.S. saw the popularity of campaigning against international trade, foreign investments and immigration. Under the Trump administration the U.S. has implemented policies that mark a retreat from the globalization that was engineered during the 1990s and 2000s. What role has the U.S. played in the integration of global markets, and what happens if we withdraw? Anthony...

Read More »Other Immigration Issues Here and Elsewhere

From SWI, Swiss news: Switzerland’s House of Representatives has rejected an initiative by the right-wing Swiss “People’s Party” to limit immigration and cancel a deal with the European Union on the free movement of people. Albert Rösti, head of the Swiss People’s Party warns that “uncontrolled” immigration could increase the current 8.5 million Swiss population to ten million and place additional pressure on infrastructure and the environment. It also...

Read More »Weekly Indicators for January 20 – 24 at Seeking Alpha

by New Deal democrat Weekly Indicators for January 20 – 24 at Seeking Alpha I neglected to post this yesterday…. My Weekly Indicators post is up at Seeking Alpha. The forecasts remain as they have been recently, but there are several developments in the long leading range. As usual, clicking over and reading brings you fully up to date, and rewards me a little bit for my efforts.

Read More »On the road

On the road Today (Dan here….Jan. 23) is a traveling day, so no detailed posting. This morning’s initial jobless claims were in line with the range over the past two years. There has been virtually no change YoY. This negatives any imminent recession fears. Yesterday’s existing home sales, though touted as “the best in nearly two years,” just continue the baseline that this metric has been in since late 2015, with the exception of the 2018 decline. Of...

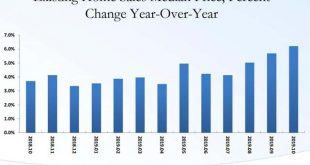

Read More »The producer vs. consumer sectors of the economy: a comparison

by New Deal democrat The producer vs. consumer sectors of the economy: a comparison I have a post up at Seeking Alpha, comparing current conditions on the producer side of the economy vs. the consumer side. As usual, clicking over and reading should bring you up to date on the “nowcast,” and helps put a $ or two in my pocket.

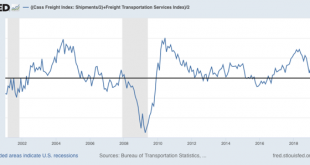

Read More »Why negative transportation indexes don’t support a recession call

Why negative transportation indexes don’t support a recession call Every month for at least the past half year there is a spate of bearish economic commentary that relies upon one or both of two metrics: AAR rail carloads and/or the Cass Freight Index. I have a post up at Seeking Alpha showing why the first measure is not a representative slice of transport as a whole, and the second has a history of being very volatile and with a slew of negative...

Read More »A Stock Market Boom is Not the Basis of Shared Prosperity

(Dan here,,,at lunch the other day a friend asked about the great prices for stocks. This post by Thomas Palley caught my attention as a well written post on the nuances between stocks and finance and the 80% who do not own many stocks and the economy of losers and winners. ) by Thomas Palley (re-posted) A Stock Market Boom is Not the Basis of Shared Prosperity The US is currently enjoying another stock market boom which, if history is any guide,...

Read More »Bloomberg’s Plan for Addressing Economic Inequality: not a wealth tax

Bloomberg’s Plan for Addressing Economic Inequality: not a wealth tax A bit ago (Jan 8, 2020), the New York Times described Michael Bloomberg’s plan1 for addressing the income and wealth inequality in the United States that has been a constant topic of discussion by Democratic candidates. Briefly, as with the robber barons of Teddy Roosevelt’s age, the wealth of the global commerce titans and particularly the private equity fund buyers and sellers of...

Read More » Heterodox

Heterodox