Scenes from the December jobs report: leading jobs sectors and wages Let’s take a more detailed look at last Friday’s December jobs report. First, as usual for the past few months, let’s look at the more leading jobs sectors. This month, let’s also take a more detailed look at wage growth and why it may have suddenly decelerated. As an initial note, revisions going back to late 2017 are going to be available next month, and preliminarily it was already...

Read More »Weekly Indicators for January 6 – 10 at Seeking Alpha

by New Deal democrat Weekly Indicators for January 6 – 10 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. How week – or not – the next six months are going to be remains the primary issue. As usual, clicking over and reading should bring you right up to date, as well as rewarding me a little bit for the effort I put in.

Read More »Small Town Support for Trump and “The Working Class”

Small Town Support for Trump and “The Working Class” Much has been written about voters, sometimes labeled the “white working class”, who live in small towns, have low incomes and supported Trump in 2016. There are various hypotheses—not, despite the rhetoric, mutually exclusive—that have been proposed to explain this: never-ending latent racism galvanized by the experience of having a black president, a vote of despair in the face of economic decline,...

Read More »Are We Living In The “Capitalocene”?

Are We Living In The “Capitalocene”? I also attended the last session listed in the program at the ASSA at 2:30 on Sunday, an URPE session on “Ecology, the Environment, and Energy,” chaired by Paul Cooney. He presented on “Marxism and Ecological Economics: An Assessment of the Past, Present, and Future.” Lynne Chester presented on “Energy and Social Ontology: Can Social Ontology Provide Insight?” Finally Ann Davis presented on “”‘Home on the Range:’...

Read More »January’s reports start out with a decidedly mixed picture for 2020

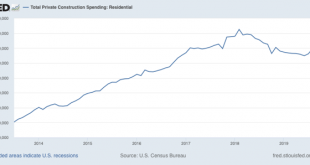

January’s reports start out with a decidedly mixed picture for 2020 We have our first bits of forward-looking data for the year: November residential construction, December ISM manufacturing, and December light vehicle sales. They paint a decidedly mixed picture. Let’s take a look in order. Residential construction spending improved by a strong 1.9% in November. Further, October, which had originally been reported as a decline, was revised to a 0.7%...

Read More »Might We Be On The Verge Of An “Upswing”?

Might We Be On The Verge Of An “Upswing”? One of the more dramatic sessions at the just-completed ASSA meetings in San Diego was an AEA panel on “Deaths from Despair and the Future of Capitalism” on Saturday at 2:30. Chaired by Angus Deaton, it focused on the book by him and his wife/coauthor Anne Case with the same title as the panel session. Case spoke on their book. This was followed by Robert Putnam, who spoke on his forthcoming (in about six...

Read More »Weekly Indicators for December 30 – January 3 at Seeking Alpha

by New Deal democrat Weekly Indicators for December 30 – January 3 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. There were marginal moves to the downside on both the producer and consumer sides of the ledger this past week. As usual, clicking over and reading rewards me with just a little bit of $$$ for my efforts.

Read More »Is The Chinese Economic System the “Mandarin Growth Model” or the “Chinese-Style Keiretsu System”?

Is The Chinese Economic System the “Mandarin Growth Model” or the “Chinese-Style Keiretsu System”? The first term in this choice was the title of a paper presented this morning (1/4/20) at the ACES/ASSA session at 8 AM in San Diego by Wei Xiong of Princeton University. It was a highly mathematical model I shall describe shortly, but which drew heavily on the paper presented before it by Chenggan Xu of Cheng Kong Graduate School of Business in Beijing,...

Read More »Killing Abu Mahdi Al-Muhandis

Killing Abu Mahdi Al-Muhandis Most of the attention in this recent attack by a US drone at the Baghdad Airport has been on it killing Iranian Quds Force commander, Qasim (Qassem) Solmaini (Suleimani), supposedly plotting an “imminent” attack on Americans as he flew a commercial airliner to Iraq at the invitation of its government and passed through passport control. But much less attention has been paid to the killing in that attack of Abu Mahdi...

Read More »Initial jobless claims still negative, but no recession signal

Initial jobless claims still negative, but no recession signal As you know, I’ve been monitoring initial jobless claims closely for the past several months, to see if there are any signs of a slowdown turning into something worse. Simply put, if businesses aren’t laying employees off, those same people are consumers who are going to continue to spend, which is 70% of the total economy. So the lack of any such increase has been the best argument that no...

Read More » Heterodox

Heterodox