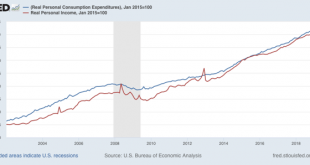

Personal spending shows consumers OK; durable goods shows producers still struggling This morning’s reports on personal income and spending continue to show a consumer that is doing alright. Meanwhile durable goods orders continue to show a production sector that is struggling. First, real personal income (red in the graph below) rose +0.4% in August, while real personal spending rose +0.1%. Since July spending (blue) was revised down -0.1%, the result...

Read More »Initial jobless claims continue near expansion lows

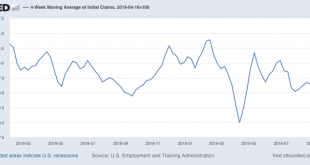

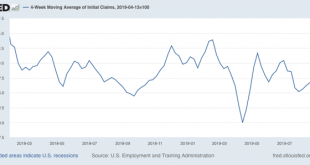

Initial jobless claims continue near expansion lows I’ve been monitoring initial jobless claims closely for the past several months, to see if there are any signs of stress. This is because the long leading indicators were negative one year ago, and many – but not a majority – of the short leading indicators have recently turned negative as well. So I have been on “recession watch.” But no recession is going to begin unless and until layoffs increase. To...

Read More »August new home sales continue rebounding trend

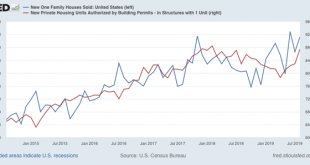

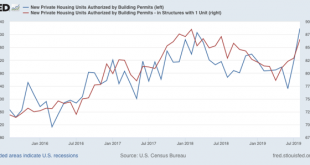

August new home sales continue rebounding trend Let me start out my look at this morning’s August new home sales report with my typical housing mantra: Interest rates lead sales Sales lead prices Prices lead inventory We saw all of that in this morning’s report. First, the trend of rising single family sales continues, and the three month average of this very volatile series (blue), shown in comparison with single family housing permits was the...

Read More »The incipient housing choke collar: July prices update

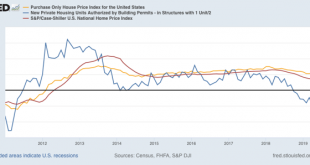

The incipient housing choke collar: July prices update Three months ago I first wrote about the concept of a “housing choke collar” constraining economic growth, to wit: The FHFA and Case-Shiller price indexes have only decelerated to a point where they roughly match median household income growth. This makes me wonder if prices for new homes will shoot back up again quickly as demand returns. If so, we could wind up in a “choke collar” situation...

Read More »Tame inflation —-> “soft landing”?

by New Deal democrat Tame inflation —-> “soft landing”? I have a new post up at Seeking Alpha. So long as inflation remains tame, the Fed has scope to bring about a “soft landing” to the slowdown, without there necessarily being a recession (so long as the Toddler in the White House doesn’t tip over the whole apple cart). As usual, clicking over and reading puts a penny or two in my pocket. ...

Read More »Take Your Pick of Left Wing Climate Change Narratives: Green Abundance or Righteous Austerity

Take Your Pick of Left Wing Climate Change Narratives: Green Abundance or Righteous Austerity While I was preoccupied with other things, the US left settled on a pair of competing climate change narratives. By the time I looked, the choice was down to just these two, and no other views could be considered. View #1, Green Abundance, is that combating climate change means unleashing the power of renewable energy. Fortunately, according to this story,...

Read More »Weekly Indicators for September 16 – 20 at Seeking Alpha

by New Deal democrat Weekly Indicators for September 16 – 20 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. For all of the discussion about various iterations of the treasury bond yield curve, it is little noted that right now it is sending a different message than virtually every other long leading indicator for the economy. As usual, clicking over and reading should bring you up to the moment on the economy, and bring me a penny or...

Read More »A closer look at the housing rebound

A closer look at the housing rebound On Wednesday we got some excellent new residential construction numbers. I went into a lot more detail, showing how – exactly as I forecast – the turn in interest rates led the turn in housing sales by about six months, over at Seeking Alpha. As usual, clicking over and reading helps reward me with a penny or two for my efforts. While I am at it, on the subject of housing, here is a chart I am working on (not...

Read More »Initial claims increasingly foreclose 2019-early 2020 downturn

Initial claims increasingly foreclose 2019-early 2020 downturn I’ve been monitoring initial jobless claims closely for the past several months, to see if there are any signs of stress. This is because the long leading indicators were negative one year ago, and many – but not a majority – of the short leading indicators have recently turned negative as well. So I have been on “recession watch.” But no recession is going to begin unless and until layoffs...

Read More »Housing: BOOM!

Housing: BOOM! Well, this is an easy post. This morning’s report (Wed.) on housing permits and starts showed new expansion highs in both overall permits and starts. The less volatile single family segment also recovered, with both single family permits and starts at one year highs, although slightly below their expansion peaks. Here are total and single family permits: And here are total and single family starts: The housing downturn is over. As...

Read More » Heterodox

Heterodox