Industrial production rebounds; another message of slowdown, no recession Industrial Production is the King of Coincident Indicators. When industrial production peaks and troughs coincides more often than any other indicator to NBER’s recession dating. Let’s take a look at the report for August, which was pretty darn good, which was released this morning. Production as a whole increased 0.6%, and last month’s report was revised upward by +0.1%. The...

Read More »Weekly Indicators for September 9 – 13 at Seeking Alpha

by New Deal democrat Weekly Indicators for September 9 – 13 at Seeking Alpha I realized that I neglected to post a link to this Saturday’s Weekly Indicators post, which was up at Seeking Alpha. So here it is. The theme over the past few months has been that, despite worsening conditions in manufacturing, and almost singular forecaster attention to the yield curve, many of the short and long term indicators have been improving, or are starting to...

Read More »Would Trump Try to Manipulate Economic Data Before the Election?

Dean Baker considers whether Trump’s group of supporters would be able to manipulate the bureacracies of the federal government to alter the economic outlook of the nation in a more expansive way than Larry Kudlow and others, but the data itself ( if that is even needed?) He says not likely, but how creative would one need to be? Dean Baker wonders out loud… Would Trump Try to Manipulate Economic Data Before the Election? I talked to a reporter last week...

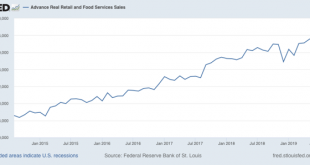

Read More »August retail sales confirm healthy consumer sector

August retail sales confirm healthy consumer sector Retail sales are one of my favorite indicators, because in real terms they can tell us so much about the present, near term forecast, and longer term forecast for the economy. This morning retail sales for August were reported up +0.4%, and July, which was already very good at +0.7%, was revised upward by another +0.1% as well. Since consumer inflation increased by +0.4% over that two month period,...

Read More »The Crushing Burden of Household Debt

If there is one thing that Presidential candidates, pundits, and bloggers agree on, it’s that Americans suffer under a heavy burden of debt. We have passed from alarm over predatory credit card lending, to underwater and deliquent mortgages to student debt, but in any case, we agree that debt is a huge problem. There are those who aim to save us from ruthless bankers and those who scold us for living beyond our means and eating avocado toast (personally I...

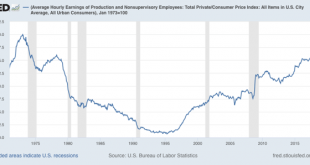

Read More »Real average and aggregate wage growth for August

Real average and aggregate wage growth for August Now that we have the August inflation reading, let’s take a look at real wage growth. First of all, nominal average hourly wages in June increased a strong +0.5%, while consumer prices increased +0.1%, meaning real average hourly wages for non-managerial personnel increased +0.4%. This translates into real wages of 97.5% of their all time high in January 1973, a new high following revisions to prior...

Read More »Whither Ukraine?

Whither Ukraine? Or “wither Ukraine?” some might suggest? But no, after nearly 30 years of serious economic stagnation and massive corruption, along with losing territory to neighboring Russia with whom it has on ongoing military conflict, things are looking up there. GDP grew at 4 percent annually last quarter. The hryvnia currency has been the second most rapidly rising currency in the world during 2019. There has even been a prisoner exchange...

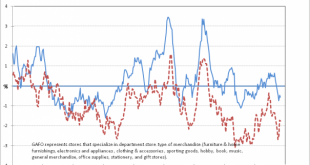

Read More »Tariffs and Price Changes

I have been looking at the data recently to find economic series that would quickly reflect the impact of rising tariffs on the consumer. One is Retail Sales: GAFO. Think of it as department store type merchandise — goods excluding autos, food and energy. It is reported every month in both the Census retail sales press release and in the BEA measures of retail sales they compile in putting together personal spending and GDP. I have long preferred the...

Read More »Scenes from the August jobs report

Scenes from the August jobs report The August jobs report was the mirror image of most earlier reports this year: a lackluster Establishment report but a strong Household report. Let’s take a look. By now the fact that there has been a jobs slowdown is pretty well established. In the last 7 months, only 964,000 jobs have been added, an average of 138,000 per month. If we subtract this month’s temporary census hiring of 25,000, those numbers drop to...

Read More »MbS Consolidates Immediate Family Control Of Saudi Oil Industry

MbS Consolidates Immediate Family Control Of Saudi Oil Industry Saudi Oil Minister al Falih, who also ran ARAMCO, has been replaced by Abdulaziz bin Salman bin Abdulaziz al Sa’ud, half brother of Crown Prince Mohammed bin Salman bin Abdulaziz al Sa’ud, (MbS),who was Ambassodor to the US untile the Khahoggi murder got hot between USA and KSA. The New York Times claims that this is part of an effort by MbS to modernize the Saudi economy, an ongoing line...

Read More » Heterodox

Heterodox