It is standard analysis to see real and nominal imports as a share of GDP quoted to estimate the importance of imports in the economy. Currently that shows nominal imports are about 15% of GDP and real imports are some 18% of real GDP. But I suspect that this comparison understates the role of imports in the economy because services are some 45% of GDP but only about 16% of imports. As my high school algebra teacher was fond of saying, you are adding...

Read More »Industrial production, jobless claims, and retail sales

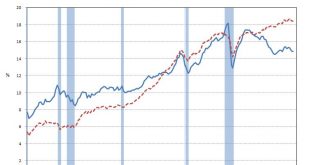

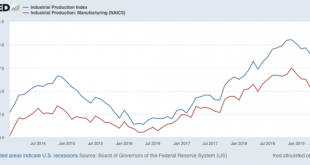

Industrial production, jobless claims, and retail sales As I noted this morning, a slew of important data was released. Let me deal with the “normal” weekly and monthly data in this post. First, industrial production continues to languish, down significantly from the end of last year, whether measured in total or just as to manufacturing: The saving grace here is that it has not declined as much as it did during the 2015-16 “shallow industrial...

Read More »Quick hits on a major Thursday economic news blitz

Quick hits on a major Thursday economic news blitz There has been a ton of significant economic news this morning. I’m not going to be able to get to all or even most of it in depth. So I am going to leave a quick rundown here. Starting with the positive: -nominal retail sales up +0.6%, up +0.3% in real terms, up +0.2% Per Capita. This is another new high and suggests the US consumer continues to be in good shape (relatively speaking). Note that much of...

Read More »Quality Spreads

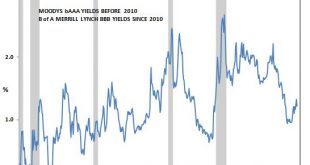

While the yield curve turning negative is getting a lot of attention and seems to be the main excuse for yesterdays stock market drop, there are other financial indicators that are also signaling weaker economic growth ahead. The primary one is quality spreads as the yield on corporate bonds are rising relative to treasuries. This is driven by investors fear that in a weak economy, recession environment the risk of corporate defaults rises and bond...

Read More »Traffic Jam in Shenzhen, China

” The long line of trucks is a traffic jam of military trucks. Shenzhen (China), to state the obvious, is across the border and located just north of Hong Kong (see map). This show of force could still be a well poised threat to Hong Kong warning them to discontinue their protests or else. Shenzhen is an approximate 20 miles from Hong Kong and can be traveled by rail, bus, or limo. Click on the images to enlarge. On a business trip, I was scheduled to...

Read More »Real average and aggregate wage growth for July 2019: yellow flag for aggregate wages

Real average and aggregate wage growth for July 2019: yellow flag for aggregate wages Now that we have the July inflation reading, let’s take a look at real wages. First of all, nominal average hourly wages in June increased +0.2%, while consumer prices increased +0.3%, meaning real average hourly wages for non-managerial personnel decreased -0.1%. This results in a slight decline of real wages to 97.0% of their all time high in January 1973: On a...

Read More »My preliminary long leading forecast through midyear 2020

by New Deal democrat My preliminary long leading forecast through midyear 2020 This post is up at Seeking Alpha. This is my first look at economic conditions into next summer. I suspect that it is contrary to most punditry that you will read. In any event, as usual clicking over and reading helps reward me for the effort I put in to this endeavor.

Read More »Goats and Dogs, Eco-Fascism and Liberal Taboos

When remembered at all, Edward Abbey is mostly thought of as an environmentalist and anarchist but there is no gainsaying the racism and xenophobia on display in his 1983 essay, “Immigration and Liberal Taboos.” The opinion piece was originally solicited by the New York Times, which ultimately declined to publish it — or to pay him the customary kill fee. It was subsequently rejected by Harper’s, The Atlantic, The New Republic, Rolling Stone, Newsweek,...

Read More »Q2 Credit conditions were decidedly mixed

by New Deal democrat Q2 Credit conditions were decidedly mixed Credit conditions are one of my categories of long leading indicators. I track the Chicago indexes weekly, but the more comprehensive Senior Loan Officer Survey only comes out once per quarter. The 2nd Quarter Survey was published earlier this week. I have a post describing what it shows up at Seeking Alpha. As usual, clicking on the link at reading should give you good information, and...

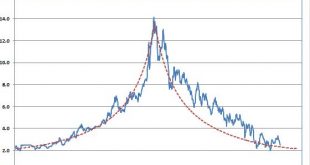

Read More »Long Treasuries vs The Long Wave

Since the early 1990s, I published this chart every month on the back cover of my publication until I retired a couple of years ago. I thought it was a great piece of marketing to remind readers that I was a long run bull on interest rates. Readers might not pay much attention or remember claims that I was bullish, but they would pay attention to and remember this. I even had bond managers walk out over this chart in the middle of my presentation. Now...

Read More » Heterodox

Heterodox