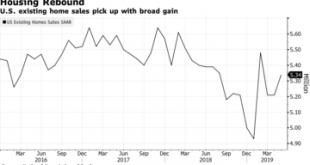

A tale of two timeframes No data today Monday, so while we are waiting for new home sales tomorrow, let me step back a little and give you an updated overview of my thinking. It boils down to: the short term forecast — over the next 4 to 8 months — looks flat at best, and could develop into an actual downturn. The longer term — over one year out — looks more positive. Let me start with the positive long term forecast first. Long term interest rates...

Read More »Two articles to think about, one on opioids, the other billing for hospital care

Via Naked Capitalism: Place based economic conditions and the geography of the opioid overdose crisis By Shannon Monnat, Associate Professor, Syracuse University. Originally published at the Institute for New Economic Thinking website Over 400,000 people in the U.S. have died from opioid overdoses since 2000. However, there is widespread geographic variation in fatal opioid overdose rates, and the contributions of prescription opioids, heroin, and...

Read More »Social Security and the NYT

(Dan here….) Via the New York Times comes an article on the Social Security shortfall. No explanations given for what the shortfall context is, and not till the end was a fix suggested. In comments calling SS a ponzi scheme (with no explanation) was common, or with the fix mostly was about lifting the cap. Only one commenter referred readers to a Bruce Bartlett article from 2013 on the matter, From an e-mail by Dale Coberly Forgive me, I have...

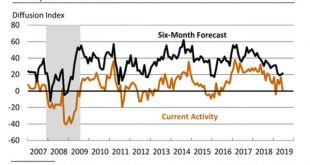

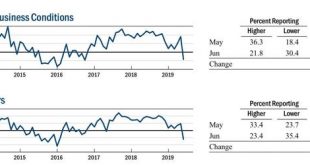

Read More »Regional Fed indexes confirm that manufacturing is flat

Regional Fed indexes confirm that manufacturing is flat [A reminder: this week I’m on vacation, so light posting is the rule.] Earlier this week the Empire State Manufacturing Index went negative. This morning the Philly Index just barely avoided the same, reported at up +0.3 for June: The more leading new orders index declined to +8.3. This means the average of NY and Philly is a little below -1, while the average of all five regional Fed indexes as of...

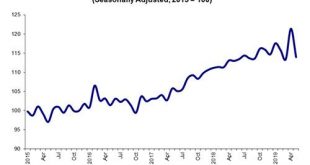

Read More »Trucking suggests transport slowing, but has not rolled over

Trucking suggests transport slowing, but has not rolled over I have been paying particular attention to the monthly report of the American Trucking Association, to compare its performance with rail, which has been sagging since the beginning of this year. A few other people are relying on the Cass Freight Index, but since that includes international shipping and air transport, it does not exclusively measure the US economy. In April this index rose...

Read More »Will Libra Destroy Cryptocurrencies Or Vice Versa?

Will Libra Destroy Cryptocurrenciees Or Vice Versa? Yesterday, Facebook released a White Paper on their planned supposed cryptocurrency, Libra, which has apparently long been under development. This triggered two stories in the New York Times, as well as lots of commentary by lots of people, including several posts by Tyler Cowen at Marginal Revolution, who is moderately favorable to the proposal. This is supposed to become an international currency...

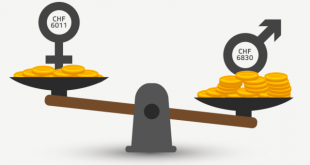

Read More »Women Strike in Switzerland for Equal Pay

Interesting there is not a peep on this in the US and literally hundreds of thousands of women gathered in the streets of the Swiss cities. 40,000 in front of parliament in Bern and the same was repeated in the cities of Lausanne, Geneva, and other places. It is said the turnout is greater in numbers than the protest in 1991. Much of the same inequalities are recognized in Switzerland as they are in the US. Women lose is salary if they take time off. This...

Read More »May real retail sales positive, but industrial production remains in a shallow recession

May real retail sales positive, but industrial production remains in a shallow recession Retail sales are one of my favorite indicators, because in real terms they can tell us so much about the present, near term forecast, and longer term forecast for the economy. This morning retail sales for May were reported up +0.5%, and April was revised upward by a net +0.5% as well. Since consumer inflation increased by +0.4% over that two month period, real...

Read More »Empire State Manufacturing: OUCH!

Empire State Manufacturing: OUCH! I’m on vacation this week, so fair warning that there is probably going to be light posting! The only economic news of note today was the Empire State Manufacturing Index. Only one district, only one survey, in a noisy series, but just the same, the overall index fell to -8.6 and the new orders component fell to -12: This brings the average of all five regional Fed Indexes down to +1. If the Philly Index simply declines...

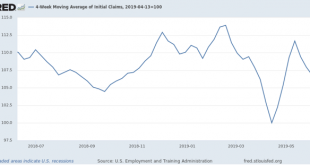

Read More »Initial jobless claims for week ending June 10 – no concern yet

Initial jobless claims for week ending June 10 – no concern yet I have started to monitor initial jobless claims to see if there are any signs of stress. My two thresholds are: 1. If the four week average on claims is more than 10% above its expansion low. 2. If the YoY% change in the monthly average turns higher. Here’s this week’s update. Initial claims last week were 222,000. The four week moving average was 217,750. First, the four week average is...

Read More » Heterodox

Heterodox