March jobs report: good nowcast, concerning forecast HEADLINES: +196,000 jobs added U3 unemployment rate unchanged at 3.8% U6 underemployment rate unchanged at 7.3% Leading employment indicators of a slowdown or recession I am highlighting these because many leading indicators overall strongly suggest that an employment slowdown is coming. The following more leading numbers in the report tell us about where the economy is likely to be a few months...

Read More »March news good so far; the Fed has plenty of scope to cut rates

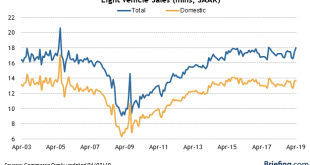

March news good so far; the Fed has plenty of scope to cut rates While we are waiting for tomorrow’s jobs report, let’s step back for a moment and look at where we are in the big picture of the economic cycle. So far, March data is running pretty positive. In addition to the decent ISM manufacturing report I discussed the other day, motor vehicle sales turned out to be excellent, topping 18 million annualized: The ISM services index, like the...

Read More »Watch for temp jobs weakness in Friday’s employment report

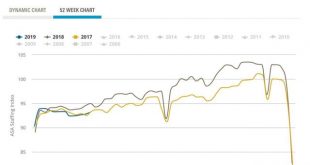

Watch for temp jobs weakness in Friday’s employment report Yesterday I looked at manufacturing jobs, and goods-producing jobs generally, as two what to look for in Friday’s jobs report. Today let’s follow up with temporary jobs, an acknowledged leading indicator for jobs as a whole. As I wrote about a couple of months ago, the American Staffing Association’s Staffing Index does a good job forecasting the trend in temporary jobs in the monthly employment...

Read More »Manufacturing slowdown apparent, but no contraction

Manufacturing slowdown apparent, but no contraction With yesterday’s ISM report for manufacturing in March, let’s take an updated look at this sector, with a particular emphasis on what to look for in this Friday’s jobs report. The ISM manufacturing index, and its more leading new orders sub-index, both continued positive in March, with the former at 55.3 and the latter at 57.4. Both of these are good, solid, positive numbers. Here’s the updated graph...

Read More »Effective Tax Rates

Along with fourth quarter GDP, corporate profits for the the fourth quarter was also reported. Profits growth was either quite strong or very weak depending on how you looked at them. On a year over year basis, after tax profits growth was 11% and appeared to be accelerating. However, on a quarter to quarter basis after tax profits actually fell -6.73% (SAAR) in the fourth quarter and that is after a third quarter annual growth rate of only ...

Read More »Real personal income and spending sag

Real personal income and spending sag Along with jobs and wages, household and personal income and spending are my main focus on how average Americans are doing in the economy. We’ll get the next jobs report a week from now, but today we got – almost updated to the present – January personal income and February personal spending. First of all, in my rubric of long leading, short leading, and coincident indicators, both of these are coincident. They tend...

Read More »The last long leading indicator, corporate profits, declined in Q4 2018

The last long leading indicator, corporate profits, declined in Q4 2018 Three months after the quarter ended, corporate profits for Q4 of 2018 were reported this morning, and they were down slightly (-0.1%). Here’s the quote from the BEA: Corporate profits deflated by unit labor costs are a long leading indicator. Since these costs were already reported at +1.6% q/q, that means that adjusted corporate profits were down about the same percentage....

Read More »Here’s a model that didn’t pan out in 2018

Here’s a model that didn’t pan out in 2018 A little over a year ago, I proposed A simple model of interest rates and the jobs market. As I explained at the time, “during the past such era of [low interest rates in] 1930-1955 several recessions including the very bad 1938 recession occurred without a yield curve inversion, I have been looking at alternative measures.” What I found was that “a YoY increase in the Fed funds rate equal to the YoY% change in...

Read More »Capital Flows in a World of Low Interest Rates

by Joseph Joyce Capital Flows in a World of Low Interest Rates Interest rates in advanced economies continue to persist at historically low levels. This trend is due not only to the response of central banks to slow growth, but also fundamental factors. If these interest rates continue close to their current levels, what are the consequences for international capital flows? The decline in rates in the advanced economies has been widely documented and...

Read More »February housing data indicates slump not over UPDATED

by New Deal democrat February housing data indicates slump not over UPDATED Housing data, in the form of February permits and starts, finally caught up after the government shutdown. Two sources of house price data were also released this morning. The bottom line is that, depending on how you measure, housing construction is likely either at or just slightly above a short term bottom. Price growth, meanwhile, continues to decelerate. I have a more...

Read More » Heterodox

Heterodox