The government shutdown may have caused a mini-recession Aside from being a monumentally poor policy outcome, and aside from the hardship it caused nearly a million workers, the government shutdown may also have caused a general contraction in production, sales, and income, and a slowdown in employment, that if it were longer would qualify as a recession. Because the affected three months straddle Q4 2018 and Q1 2019, both quarters will likely show...

Read More »Interview with Andrew Yang

Now that Andrew Yang has made it into the first debate by meeting the fundraising threshold, and being on Morning Joe this morning, it is time to post this interview of him via Freakonomics. I was impressed by his thought approach. He is the first person who is talking about the economy as a ecosystem of society. That is, it’s not just about making money. He does not come out and say it as I would but I think he is thinking about a question I have...

Read More »Preventing Presidential autocracy: thoughts on reining in Executive power

Preventing Presidential autocracy: thoughts on reining in Executive power Matt Yglesias posted a jarring tweet this past week when he wrote: He elaborated by linking to a long-form article he wrote four years ago, explaining his position, where in relevant part, he wrote: America’s constitutional democracy is going to collapse. Some day … there is going to be a collapse of the legal and political order and its replacement by something else. If we’re...

Read More »Lawrence Ferlinghetti Turns 100 Years Old

Lawrence Ferlinghetti Turns 100 Years Old On the forthcoming March 24. This last of the Beat Poets, who founded and still owns both the City Lights bookstore and the associated City Lights press, which legally overcame an effort in 1956 to prevent him from publishing Allen Ginsberg’s poem, _Howl_, he is not only alive and well by current reports, and looking forward to his centennial birthday party, but his bookstore on Columbus Avenue in San Francisco...

Read More »The Real Reason Stock Buybacks Are a Problem

By Steve Roth (reposted from Evonomics) The Real Reason Stock Buybacks Are a Problem Buybacks are a massive tax dodge for shareholders Bernie Sanders and Chuck Schumer’s New York Times op-ed, “Limit Corporate Stock Buybacks,” has thrown internet gasoline on the buyback debate. The left is waving the flag, and the right is trying to tear it down. The core Sanders/Schumer argument: buybacks extract money from firms, money that could be used to pay workers...

Read More »Leading scenes from the February jobs report

Leading scenes from the February jobs report Let me catch up with some details from last Friday’s employment report. As a preliminary matter, the overwhelming take was that the poor +20,000 gain was “nothing to see here, just an outlier.” The problem with that take is that, for all of 2018, the average monthly gain in jobs was just over +200,000 a month. January came in more than 100,000 above that, at +311,000 jobs, and yet I don’t recall anyone taking...

Read More »More evidence for a Q4 “Recession Watch”

by New Deal democrat More evidence for a Q4 “Recession Watch” About a month ago, based on those Q4 2018 reports that had not been delayed by the government shutdown, plus workarounds for those that were missing, I went of “Recession Watch” for Q4 of this year. Now all of the missing pieces have been reported, and they add to the evidence justifying the call. This post is up at Seeking Alpha. My base case remains slowdown vs. recession. But I see a...

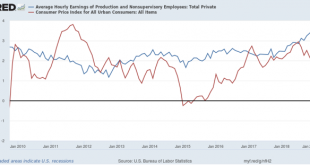

Read More »Real wage growth continued to improve in February

Real wage growth continued to improve in February Now that we have February’s CPI (up +0.2%), let’s update nominal and real wage growth. First, here is a graph of nominal wage growth YoY vs. consumer inflation YoY since the beginning of this expansion almost 10 years ago: First of all, why do I bother with nominal wages? Because employers don’t give out inflation-adjusted salary and wage increases. If they give you a 3% raise, it’s a 3% raise...

Read More »Is Russia Becoming A Neo-Socialist NEP Economy?

Is Russia Becoming A Neo-Socialist NEP Economy? Probbly not, but there has been some movement in that direction. The New Economic Policy (NEP) was the Socviet system in the 1920s after the WarCommunism period and before Stalin imposed command central planning as well ass full state ownership of the means of production, classsic socialism. The War Communism period was a command economy, but without central planning. Famine appeared as authorities...

Read More »Neoliberals Passing the Baton

Brad DeLong got a huge amount of attention by saying it was time for neoliberals such as Brad DeLong to pass the baton to those to their left. Alarmingly, he seems to have written this first on twitter. Zach Beuchamp rescued it from tawdry twitter to now very respectable blogosphere with an interview. One interesting aspect is that Brad has very little criticism of 90s era Brad’s policy proposals. Basically, the argument is that Democrats must stick...

Read More » Heterodox

Heterodox